Spotify’s weekly chart shows a peak around the 627–652 range, where price action has failed to break through multiple times. This lack of upward momentum has left NYSE:SPOT vulnerable to potential downside. At the moment, 484 serves as an important support level. If it fails, it could open the door to a deeper pullback, possibly towards the 380–320 zone. Even if...

What Price Action Says: After a sharp decline, IWM has experienced a 15% rebound, signaling the end of the bearish trend. However, this doesn't mean the market is ready to shift upward just yet. For now, the most probable scenario is sideways movement, likely continuing through the end of Q2. A sustained upward move will require confirmation of a clear bottoming...

What Price Action Says: SPY has bottomed, support now at 510, up from 485! Strong resistances at 550 & 585, but AMEX:SPY is likely to break through these levels in the second half of the year. In the short term, it remains within a range. Watch 510/550 closely.

The U.S. dollar approaches key support at 97.4, with strong selling pressure recently. A shift to the upside may not happen quickly, but we could see a potential rebound in Q3.

BTCUSD has broken above 89K, confirming the reversal pattern; momentum builds toward the 105K target.

Something just got clearer: BTCUSD is now above the short-term 10D/20D MAs. It’s broken above bearish trendlines, and it's eyeing 110K.

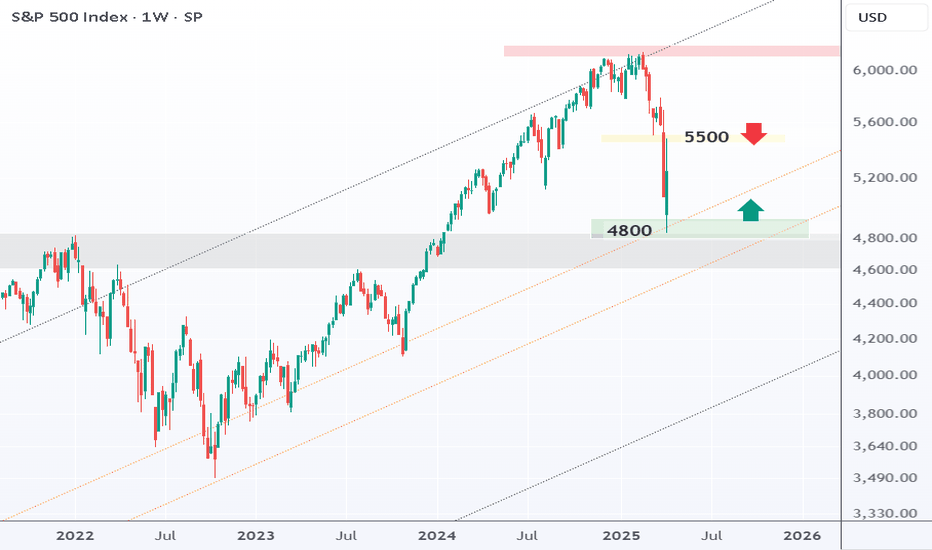

S&P 500's bearish trend that began in February 2025 has ended following a strong 14% rebound from a key level that previously triggered the last sharp down move. This does not mean the market is immune to further downside, but if one still maintains a bearish view, it is important to note that breaking below 485 would likely mark the beginning of a major bear...

First Majestic Silver (AG) has been in a long downtrend, but signs of a bottom have started to form around the $5/$6 level. The recent stabilization and gradual upward pressure suggest that the stock may be building a base. Analysts currently set an average 12-month price target at $7.86. However, if AG manages to break above this base structure, it could trigger...

Important week for BTCUSD. Price is sitting right at the edge of a short-term downward trendline within a larger bullish channel. If it breaks above this structure convincingly, it could open the path toward the upper channel extension, with potential upside reaching the 140,000–150,000 region. On the flip side, if the highlighted support area around 75,000 fails...

Broadcom has rebounded +30% off its March lows, recovering from recent weakness. The stock is currently testing the 200-day moving average ( around 183) but has so far failed to break above it. It now faces a confluence of resistance near $185 — a key level to monitor for potential rejection or breakout.

ALB stock seems to have reached a support around $50. The recent sharp decline has created a setup for a short-term rebound toward the $65-$70 range.

Long-term structure points to upside potential, initially toward $6. Short-term, expect consolidation or a brief dip toward $1 in a worst-case move. Patience may pay.

We’re stuck in a 15% range between 4800 and 5500 — for now. Either: ✅ 4800–5000 builds strong support → leads to breakout above 5500 or ❌ 4800 fails → bigger breakdown ahead The range is the game — for now.

Data Speaks About SPY: 1️⃣ Trading above key support zone (480/495): The stock is holding above critical levels, which suggests a potential for stability or a rebound if these levels hold. 2️⃣ Below 10-day MA: Currently trading below the 10-day moving average, indicating short-term bearish sentiment and lack of upward momentum. 3️⃣ Failed attempt to re-enter...

Tesla's price action in 2024 has shown signs of weakness, casting doubt on the strength of its long-term upward trend. After a sharp decline from its peak, the stock is now at a critical juncture where key levels and momentum are in play. Here’s an in-depth look: Potential Bounce at Key Support: Tesla is currently heading toward the 180/140 support zone, which...

LULU has formed three major peaks resembling a classic top pattern, signaling caution. If the 215 level doesn’t hold, further downside could be ahead.

LCID is still in a long-term bearish trend, but there are signs it could be nearing a shift. Here's the breakdown: ✅ Bearish trend since 2021: LCID’s price dropped from 64.86 to 1.93, a major decline over the past few years. 📉 Substantial declines: After a 280% gain in 2021, LCID has seen significant losses — -82% in 2022 -38% in 2023 -28.3% in 2024 -21% so...

RDDT looks like it's in the late stages of a bearish cycle, but hasn’t confirmed a reversal yet. Here’s what stands out: ✅ Bearish pattern targets completed: This suggests that the technical downside has largely played out, and we might be near exhaustion. 📉 -65% from February highs: That’s a deep correction — often the kind that starts to attract value hunters...