QuantumEdgeAnalytics

EssentialIWM (iShares Russell 2000 ETF) - Sector: Broad Small-Cap ETF (Russell 2000) Sentiment: --Bearish (softening). Pre-market put volume eased, RSI 44 up from 42, X posts overnight hint at an oversold bounce despite tariff fears, suggesting a less dire tone. Tariff Impact: --Moderate. Industrials/financials exposure persists. News/Catalysts: --Consumer Credit...

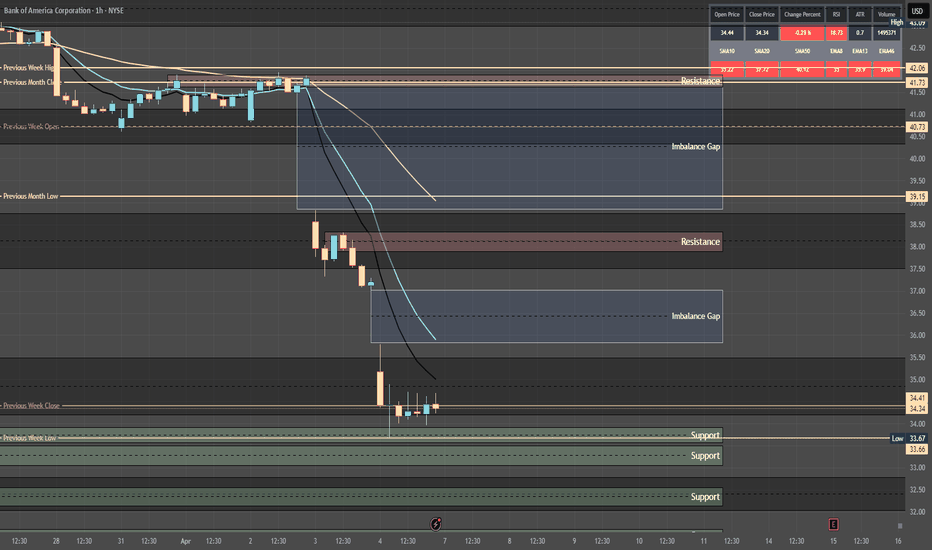

BAC (Bank of America Corporation) - Sector: Financials (Banking) Sentiment: Bearish. Put volume rises, RSI 45 weakens, X posts note banking fears from tariffs/economic uncertainty. Tariff Impact: Moderate. Tariffs may slow growth, impacting loans, but domestic focus softens the blow. Sentiment drives more than fundamentals. News/Catalysts: Banking sentiment...

Sentiment Overall Sentiment: Bearish with potential for reversal. Options Activity: Recent data shows elevated put volume over calls (e.g., 8 puts Ascending Triangle DEX suggests a bearish directional bias. Posts on X indicate traders are eyeing short setups, reinforcing this sentiment. 1 OTM Premiums: 0DTE (April 7 expiration): Call: $182 strike, premium $1.20...

NASDAQ:NVDA Outlook - -GEX and -DEX but +OI This week. NASDAQ:NVDA ’s price action will likely hinge on broader market sentiment rather than company-specific releases, given no major NVIDIA events are slated. Weekly -- 2nd consecutive down week with increasing volume Daily -- Downtrend to next HVL under 106 possible Hourly -- Consolidating at support...

NASDAQ:TSLA Outlook - -GEX and -DEX with put support at 220 which would fill the Earnings gap up from last October. Weekly -- Rejected the EMA Daily -- Closed right above EMA Hourly -- Consolidating 10m -- Consolidating Bias - Neutral until one side breaks. Too much volatility to pick a side. Pivot - 263.5 Upside Targets: *...

Outlook - Last week every bounce was followed by another sell off making it had for bulls to gain any momentum. But Fridays session closed with a strong push to the next HVA and prices refused to break below 5760 the last 4 hours of the session. On open will look for long entries above 5775.5 which is the previous weeks close. If 5775.5 rejects will look for 2nd...

This week’s data and Nvidia earnings (Feb 26) are pivotal. Options Positioning Volume: High, with daily averages ~1.5M contracts (CME data trends). Expect ~1.7M this week due to macro catalysts. Call vs. Put Skew: Call-heavy (1.4:1), reflecting hedging against a pullback and speculative upside bets. Key Strikes: NTM (6,000–6,050): GEX high (+$300M), IV ~25%,...

NASDAQ:ADBE – After gapping down on +ER I think Adobe is at a nice spot. A pullback was expected although not quite this big. If 530 can hold I think it could start gapping back up to at least 565 by weeks end. On the downside, if 530 breaks then it could head down to next support around 500 which is where I would look for longs again.

NASDAQ:ADBE – After gapping down on +ER I think Adobe is at a nice spot. A pullback was expected although not quite this big. If 530 can hold I think it could start gapping back up to at least 565 by weeks end. On the downside, if 530 breaks then it could head down to next support around 500 which is where I would look for longs again.

I'm not a huge marco guy or economist but what I do know is patterns and trends. Gold has seen expansion like never before but has it been due to a massive rotation of money out of crypto? 2500 is my next level down followed by 2470.

NYSE:TGT – After consolidating the last week and ending with an explosive push to the upside the positioning is there to continue that run. Over 1,000 calls were added Friday to the 140 strike making it my key level to watch. I’m looking for longs If 135 holds because Target could explode to +GL levels at 155 & 160

NYSE:F – After breaching 2020 levels can NYSE:F finally make a push higher? Seeing lots of bullish positioning at the 14 and 15 strikes. The last 5 days have made higher lows so bullish structure is trying to form but the 10 and 8.5 strike picked up a significant amount of put volume. A breakthrough the upper imbalance around 10.5 would be needed to confirm my...

NYSE:DELL – Weekly and daily now show bullish structure forming after selling off for the last 5 week. Also, positioning is heavily swayed towards the call side with 30k+ Open Interest on the 160 and 180 strikes. On the downside the 85 strike has 12k Open Interest which is where NYSE:DELL gapped up from 81.9 - 85.4. Ideally would like a gap down on open under...

AAPL technicals looks like its ready to push higher after holding daily support. But with ER on Thursday we have to be careful. Positioning over the next few weeks is bullish with a high gamma level at 220. A gap down on open to test 215 and hold would be ideal to look for longs but 215 is my line in the sand.

The short answer is nobody knows. Bullish structure is forming and I think Bitcoin could reflect market liquidity so we have to pay attentions to not only earning this weeks but the economic releases as well.

NASDAQ:SBUX looks to continue into +GL at 85. Plenty of momentum and as long as premiums hold longs look like a safe play this week.

Seen a lot of talk about $MBLY. It finally broke to the downside after consolidating for 7 days. 26.51 must hold for further upside or 26.11 then 25.6 being next downside targets. Currently in a no trade zone for me.

MU – Fridays close erased all of Wednesday’s gains ending the day down 3.82% (-1 ATR) with the most volume of the week. With 1M in premium on 6/12 132C, 133C & 135C I will look to take longs if 131 can hold. *This is my opinion and is not financial advice. Please use due diligence before placing any trades*