QuantumFusionWave

EssentialQuantum Computing Race: Who Will Become the “NVIDIA” of the Quantum Era? As the quantum computing sector accelerates, companies like D-Wave Systems, Rigetti Computing, Quantum Computing Inc. (QUBT), and IonQ are emerging as key players—each competing to become the dominant force in what could be the next trillion-dollar tech frontier. The comparison to NVIDIA in...

Rigetti Computing Inc. (RGTI) is a notable company in the quantum computing space, focused on developing superconducting qubit systems. As of late May 2025, the stock is trading around $14.19, marking a sharp rise from its earlier levels this year. The stock has rallied more than 1,200% over the past six months, pushing RGTI toward the upper boundary of its...

Bitcoin is currently trading around $85,500, maintaining short-term bullish momentum within a well-formed ascending structure on the daily chart. The price is now entering a mid-phase rally, with a clear target of $98,000, a key resistance level that coincides with the upper boundary of a rising wedge formation and historical trend extension zones. Key Technical...

Gold Weekly Technical Outlook Gold (XAU/USD) remains in a clear bullish trend on the weekly chart, currently trading around $3,230. After marking a new high, price action suggests a potential pullback—a healthy retracement that could set the stage for further gains. Key Levels to Watch: Current Price: $3,230 Retracement Zone: First support at $3,100, a recent...

The ChinaH Index is currently trading at $8,390, after recently rejecting the key resistance level of $9,200, a historically significant zone last tested in 2021. Despite this rejection, the index remains well-positioned within a strong and intact bullish channel, signaling long-term upward momentum. Current Setup: We are now observing a short-term relief bounce...

Tencent Holdings Limited (TCEHY) is currently trading between $62–$64, maintaining structure within a well-defined ascending channel. After testing the $73 resistance level—a key price from 2020—the stock faced rejection, triggering a retracement phase and a shift into a daily consolidation range. This range now appears to be forming a short-term descending...

NAS100 is currently in a corrective phase, trading at $18,900, with bearish momentum suggesting a potential move toward the $18,300 support level in the coming week. If this level holds, a rebound could push the index back up toward $20,300, creating a temporary recovery phase. However, if the price struggles at $20,300 and fails to sustain bullish momentum, it...

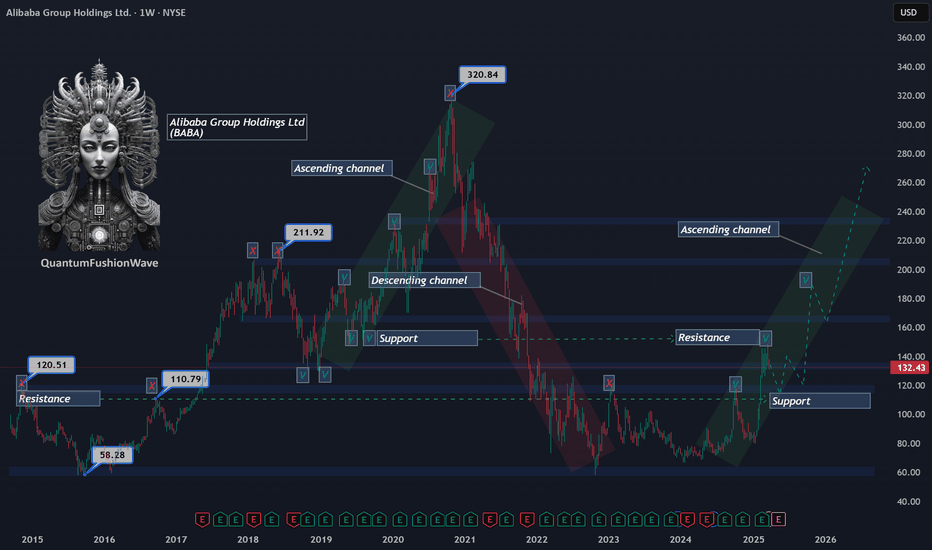

Retracement Within an Ascending Channel Alibaba (BABA) has faced strong supply pressure at $149, a key price level that previously acted as support in 2019 and has now flipped into resistance. The inability to reclaim this level has triggered a retracement, with the stock currently trading around $132, showing signs of continued corrective movement. Despite the...

Rigetti fails to hold the $9.80 support, it could continue its decline toward the $5.50 zone. Till then we can see: Rigetti Computing (RGTI) is at a pivotal moment, currently trading around $8.90 after a 56% drop from its $16 peak to a recent low of $7. The stock failed to hold the critical $9.80 support level, raising concerns about further downside pressure....

Sidus Space is currently trading at $1.71, placing it in a dangerous zone where it risks falling below NASDAQ's $1.00 minimum bid price requirement. The stock is now ranging between $1.10 and $2.00, with $1.10 as the last strong support level. If this level breaks, the company may face delisting risks, forcing management to take further action, possibly another...

Tencent Holdings Limited (TCEHY) is currently trading within a well-defined ascending channel, with price action averaging $68–$69. The key resistance level at $73—a price last seen in 2020—appears weak and could be easily broken, given the company’s strong positioning in China’s expanding economy. With Tencent’s involvement in gaming, artificial intelligence,...

Gold is on a relentless hunt for the $2,720 level, navigating through a well-defined ascending channel where the upper boundary has acted as long-term resistance and the lower boundary as dynamic support. The price has respected this structure, with multiple touches reinforcing its integrity. However, a recent double top near the upper boundary signals potential...

Bitcoin stands at a critical juncture at $80,000, where market participants are engaged in a decisive battle between bullish momentum and bearish resistance. The outcome of this struggle will shape the next major move, with two distinct scenarios emerging. Scenario 1: A Retracement Toward $65,000 If Bitcoin fails to maintain its current momentum, profit-taking...

Atos Confirms Bullish Continuation, Invalidating Consolidation and Bearish Retest Atos has officially invalidated neutral consolidation and a bearish retest, choosing a bullish continuation as it currently trades at $0.0046. Atos Needs a Pullback to $0.0028–$0.0034 After 84% Surge Following a massive 84% rally from $0.0030 to $0.0055, Atos now requires a...

In the current global economic shift, China is emerging as the leading force across multiple sectors, including economy, corporations, artificial intelligence, quantum technologies, and international alliances. With the U.S. facing economic struggles, including growing national debt, loss of investor confidence, and strained alliances, China is solidifying its...

IonQ has seen a massive 59% drop, falling from $45 to $20, stretching the market to an extreme oversold level. This steep decline has created a high-probability buying zone between $18 and $20, where a solid rebound could push the price back toward $25–$31 in the short term. Key Resistance & Confirmation Levels $26 Resistance → This was the January 10 dip level....

Rigetti Computing (RGTI) is currently at a critical price juncture, with a focus on retesting key support levels before determining its next major move. The stock needs to revisit the $9.80 support level, which has historically been a pivotal price point. Key Scenarios for RGTI’s Price Action: Bearish Scenario: Drop to $5.50 Before an Explosive Rally If Rigetti...

Strong Upside Potential Quant (QNT) has officially entered a bullish phase, as the price refused to drop below $84, signaling a strong buying zone and market confidence. Currently trading at $106, QNT is showing momentum to easily break through key resistance levels at $130 and $170 in the coming months. If the bullish trend continues, QNT could be on track to...