RHTrading

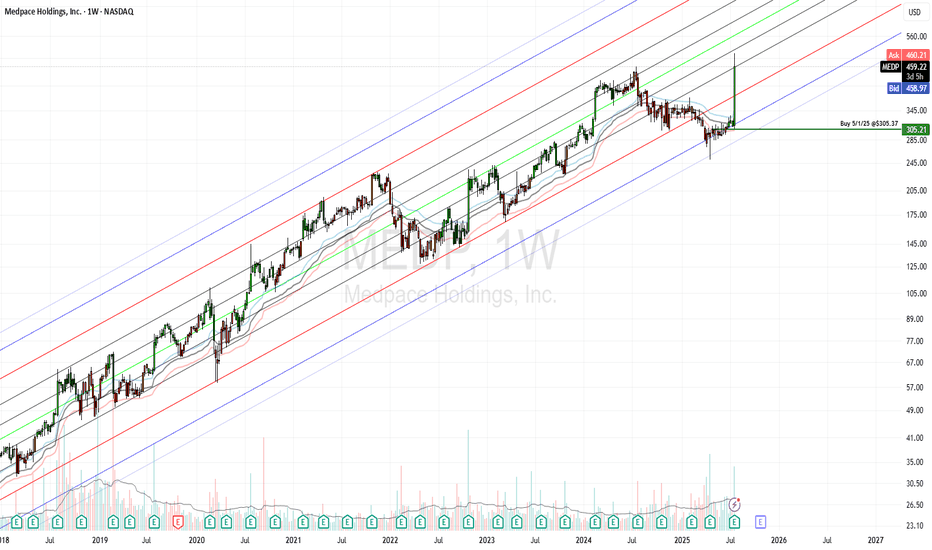

EssentialMedpace is a late-stage contract research organization that provides full-service drug-development and clinical trial services to small and midsize biotechnology, pharmaceutical, and medical-device firms. It also offers ancillary services such as bioanalytical laboratory services and imaging capabilities. The company was founded over 30 years ago and has over...

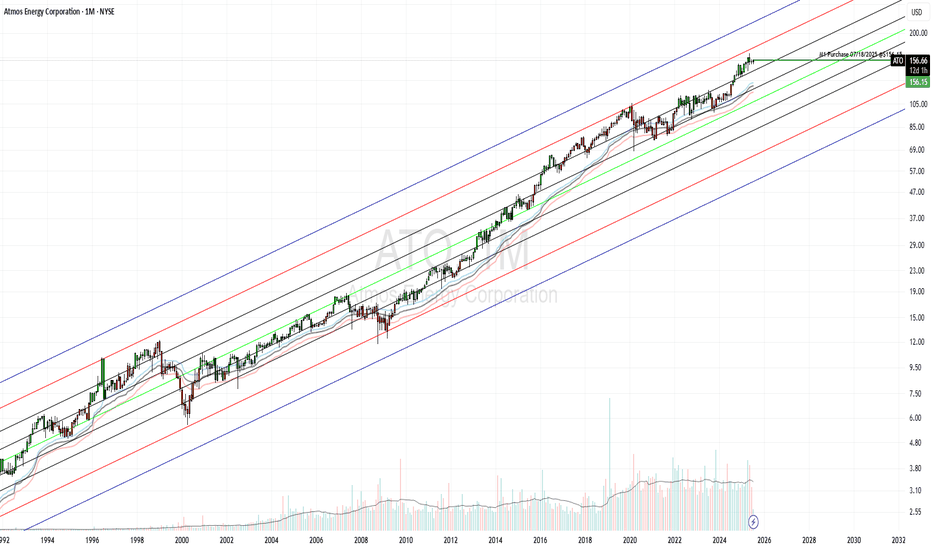

Atmos Energy is one of the largest fully regulated natural gas utilities in the U.S., serving over 3 million customers across 8 states. It operates in a stable, recession-resistant sector with predictable cash flows and strong regulatory relationships. $24B Infrastructure Investment Plan through 2029 to modernize pipelines and expand service 20 New Industrial...

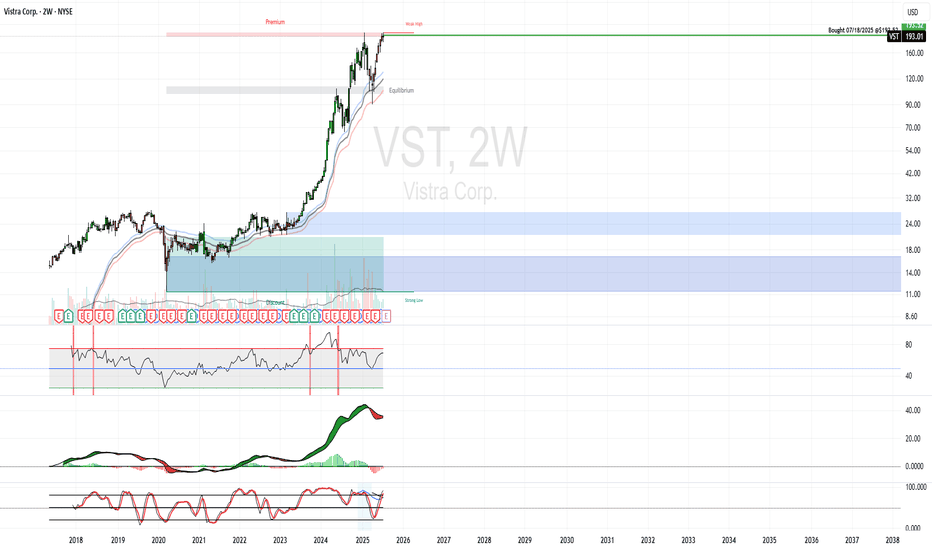

Vistra Corp. (VST) – Cash Flow Machine $4.09B TTM operating cash flow, highest among peers 2. Strong nuclear and renewables mix, with AI data center exposure. Thesis: Balanced growth and income play with upside from AI-driven demand. Purchased CEG earlier. AI megatrend is tied to nuclear. Not stoked about the purchase price, but long term growth should...

Key Rationale: Significantly undervalued tech company with uncorrelated returns that's been on my watchlist. Company Profile: Qualys is a cloud security and compliance solutions provider that helps businesses identify and manage their security risks and compliance requirements. The California-based company has more than 10,000 customers worldwide, the majority...

Key Rationale: Profitable technology firm with a track record of commercializing AI. World leader in two industries primed for significant growth, with a comprehensive suite of products and a treasure trove of historical data for AI training. Solid Growth profile and five-star valuation make it an ideal GARP investment. Company Profile: A tech powerhouse...

Key Rationale: Fundamentals remain intact making this a very attractive time to be contrarian, ignore the pessimism and buy the dip. Always nice to buy what you know and can see around you. Comments: Credited with the development of athleisure. Hasn't yet seized Pickleball market opportunity. Incessant selling due is unwarranted with one executive...

American Water Works Co (AWK) Trade Idea. American Water Works is the largest investor-owned us water and wastewater utility, serving approximately 3.5 million customers in 16 states. It provides water and wastewater services to residential, commercial, and industrial customers and operates predominantly in regulated markets. The company's nonregulated business...

ETSY is trading at a 50% discount to its fair value estimate. Wide moat with Standard capital allocation Down 80% from its all time high. Technicals look very attractive. That said, ETSY currently ranks poorly on my screens, so this is purely a technical/contrarian trade idea. GreenBlue Rank: 1845 Company Description: Etsy operates a top-10 e-commerce...

ResMed Inc. is a leader in digital health and cloud-connected medical devices. ResMed is one of the largest respiratory care device companies globally, primarily developing and supplying flow generators, masks and accessories for the treatment of sleep apnea. Increasing diagnosis of sleep apnea combined with ageing populations and increasing prevalence of obesity...

Valuations are attractive on an absolute and relative basis. Cross-asset breadth for EM assets (stocks/bonds/FX) making a sharp move higher from washed-out levels. EM central banks are collectively pivoting from rate hikes to cuts, which supports EM assets. China is moving towards a larger stimulus as the property downturn deepens and the economy slows...

BDX gapping higher and may be breaking out of this 5-year range it's been trading in. This serial-acquirer is a buy. Over the longer-term, Becton Dickinson has been a solid compounder, and the current valuation represents a reasonable entry point. Becton, Dickinson is a Medical Instruments provider in Healthcare. It has a Narrow Moat, Stable Moat Trend,...

A Great Business | Fund Favorite | Danaher is a stock Mutual and Hedge Funds Love | The company has a stellar high-moat M&A-driven business model with strong pricing power and often anti-cyclical customers | Compounder Starts To Look Attractive Dividend Stock Brilliance | Danaher has a wide-moat business model, strong pricing power, anti-cyclical customers, and...

I recently added new position MKTX to the portfolio. MarketAxess operates the leading platform for the electronic trading of corporate bonds.Recently, we found for an active high-yield bond fund, and on the manager call they mentioned they exclusively use MarketAxess for their trading activity. The company is poised to capture broad-based capital market growth as...

The ISM currently stands at 46.3%, signaling a contraction. Business activity is implying that rising interest rates and growing recession fears are starting to weigh on businesses. The reading pointed to a fifth straight month of contraction in factory activity, as companies continue to slow outputs to better match demand for the first half of 2023 and prepare...