I remember so clearly in November 2021 when Bitcoin showed bearish divergence on the weekly charts. We might all be suffering from PTSD and fear the same outcome, especially with the potential for a double top. If BTC is able to stay above the 1D 200MA, as well as the RSI remaining above 50, there may be hope... If not, i.e. a weekly close below and retest of...

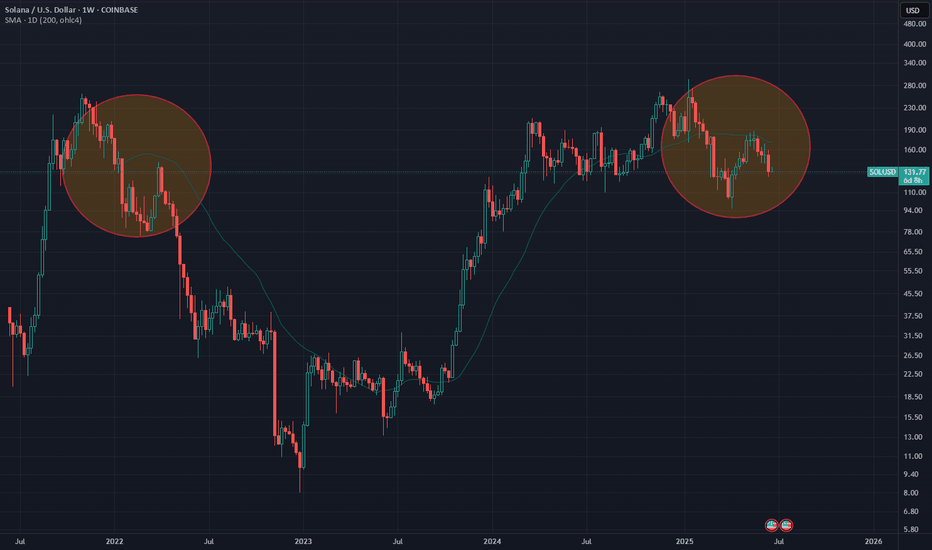

I don't like this rejection from the 1D 200MA. Looking at the the weekly chart, it is very easy to see the similarity to 2022. Maybe we should brace for impact?

After a retest of support around $142, SOL is testing previous support as resistance around $152. A strong break and retest of the $153 area could signal price reclaiming support and heading towards $166. Failing to do so could lead to a retest and confirmation of $140 as support. Of course, losing support would signal further weakness towards $136 before a...

After reaching new highs around $112k, BTC has since retraced to support around $100k. Currently reclaiming support around $105k, continued strength could see price reach ATHs in the coming days or weeks. Losing support around $105k could signal a retest of $100k. Referring to a previous post, my theory that we may not see sub $100k for the rest of the year...

SOL is potentially creating a local low around $150. If buyers step in and price holds these levels, we could see a reversal, reclaiming previous support around $160. A rejection from $160 and breaking this week's lows ($150) could signal a retest of previous levels from $130 - $140. My personal instinct is still weary of the fact that price has been rejected...

BTC has lost local support around $107k and currently testing previous resistance around $104k. If buyers are able to step in between $100k - $104k and reclaim $107k, it will signal strength. If BTC experiences continued weakness, losing $100k as support, I would expect price to test the $95k - $97k region or 1D 200MA before signaling a reversal.

SOL is holding above support around $166, potentially heading for a test of local highs around $185. A strong break and close above could signal a push towards $190 - $200. For the time being, Solana has also yet to reclaim its 1D 200MA which could also be signalling some weakness, or lack of strength rather, in the short-term. Reclaiming $166 on 21 May could've...

Bitcoin is potentially finding support around $107k after making new ATHs last week around $112k. Assuming these levels as S and R, a strong break could signal the direction of price in the coming days. If local support is lost, we can expect price to at least test $104.9k. Assuming the bullish momentum continues, breaking resistance would signal higher...

SOL starts the week trading below local support around $165. Continued weakness could lead to a retest of $155. Failing to hold $155 could signal further weakness and the possibility of entering it's previous range with support around $142. If prices reclaims $155, it could signal strength and potential to turn local resistance around $182 into support,...

If you were like me, you got a little dose of hopium after BTC closed above last week's resistance around $105k. Nonetheless, resistance was expected from $105k - $108k with price starting the week with a bearish engulfing candle, currently trading around $103.1k. We will have to see if last week's support around $101.5k holds. If the price continues with...

BTC continues it bullish momentum supported by the total crypto market cap in bullish territory around $3.31T, well above the 1D 200MA. Starting the week with a continued steady uptrend from last week's push to current levels, reclaiming $102k. Continued momentum could easily lead to a break and close above ATHs. If, for whatever reason, there is weakness,...

After breaking out of last week's range, BTC failed to flip R to S. Currently testing potential support, if price fails to hold it current price range between $93.k, we could see a retest of GETTEX:92K or the 1D 200MA around $90k.

SOL starts the week with bullish momentum from local support around $147. Reclaiming local highs or a solid candle above $155 could signal a push towards $179 or 1D 200MA around $181. A close below $147 could signal short term weakness.

BTC starts the week with a 4H doji, potentially signaling a reversal of the short term retracement from local Hs around $95.4k. Reclaiming those Hs can easily lead to a retest of Feb's resistance around $98.7k - or even surprise us with a test of $102k. A loss of momentum and close below GETTEX:92K could signal weakness.

BTC tests March highs after 2 weeks of bullish price action and a double bottom / reversal pattern on Apr 9. Currently testing significant price levels around FWB:88K and 1D 200MA, a decisive break above could signal a push towards $92k. Failing to reclaim FWB:88K - GETTEX:89K could lead to a retest of $85k - $86k before attempting to reclaim previous R...

SOL is back around $132, failing to stay above $135. Reclaiming 4HR 50MA could signal a recovery, while a continuation of bearish momentum could bring SOL to $120.

ETH is back below support and 4HR 50MA, trading around $2.3k. Reclaiming 50/200MA and $2.4k would signal strength. Bearish target is $2k - $2.1k, if $2.25k is lost.

BTC failed to keep its bullish momentum above GETTEX:59K , now trading just below 4HR 200MA around $58.7k. $56.5k - $58k is the nearest support zone. If lost, $50k could still be expected.