Litcoin is leading the way today among the higher cap ALT's , but like all alts it has hit price resistance and also from the weekly 100ma is just above the current price. There is still time to get above that zone before Sundays close but much higher volume is needed, while BTC is advancing so strong it may be difficult to find that extra volume.

Looking at the chart it is clear to see that it is very difficult to catch a bottom. It looked as if they selling had concluded on several occasions in the last 12 months, but it just kept dropping. We will have a close eye on STMP over the coming days as on Friday it actually gave a 10% gain. Small Dollar moves give great percentage gains. Company Description...

The market sentiment towards Chinese stocks is once again very low, restored tariffs can only lead to more pain in these stocks which are often clustered into ETF's. If overall market sentiment was to slip any further in the coming week TME will certainly suffer severe price declines. This is certainly not a stock we would be trading into earnings, but will keep...

Expectations have been rising in TTWO for this earnings season, even analysts are raising targets pre earnings which is positive. Although its competitors have had very erratic responses to good earnings, we believe that TTWO will provide a good return on an investment pre earnings. From the charting perspective it is clear that momentum is back with the bulls and...

Despite posting a loss in the quarter the stock has traded very well today on what has been a difficult session. They main loss was attributed to a decline in dealerships but the company is very upbeat about the drastically improved brand awareness. We think there is a good case for taking a long position above $22.50 Cars.com Inc. (CARS) on Friday reported a...

Copa produced a very clean earnings report in which the highlight was the 4% decline in cost per available seat mile (CASM). Capacity also increased 2% while revenue declined slightly as expected. Air traffic in South America is expected to grow by 5% year on year for at least the next 15 years as emerging nations produce higher disposable income. We believe we...

******BIG BEAT AND PARTNERSHIP DEAL WITH TENCENT********************* EARNINGS DETAILS JD.comreports Q1 beats with 21% Y/Y revenue growth. In-line Q2 guidance has revenue of RMB 145-150B vs. RMB 145.53B. Q1 net service revenue was up 44% Y/Y to $1.9B. Net product revenue was up 19% in the period to $16.2B. Cost of revenue grew 20% to $15.3B. Non-GAAP operating...

In its most recent earnings report, Bookings Holdings company reported adjusted EBITDA fell 10% during the quarter to $718M vs. $713M consensus. Adjusted EBITDA is expected to fall in a range of $1.295B to $1.325B for Q2. Room night sales increased by 10.3% while Car rentals and Flight ticket sales dropped 1.3% and 4.4%. This may be a case of not quite as bad as...

Despite posting a loss of $.33 per share and revenue of $454.1 million , Zillow actually beat the estimates and provided very upbeat expansion plans and revenue growth prospects. Sales figures in their buy and sell program tripled in the quarter, such growth has lead to expansion into six new markets. The one stop shop approach of selling homes and providing the...

3M IS NEAR THE TOP OF THE LIST OF COMPANIES WHO NEEDS A TRADE DEAL WITH CHINA SWIFTLY. THE RECENT EARNINGS REPORT HIGHLIGHTED THE DIFFICULTIES 3M IS HAVING WITH CHINA AND THE IMPACT OF TRADE WORRIES. THE STOCK HAS NOW SOLD OF 20% POST EARNINGS, WITH ANOTHER 20% POSSIBLE IF WE DO NOT GET A DEAL/TRUCE TODAY. POSITIVE NEWS COULD SEND THIS SOARING 20% IN A FEW DAYS...

Education specialist 2U reported a earnings beat but guidance was far from pleasing to investors, leading to a mass exodus resulting in a 30% drop. Despite this, analysts have actually remained somewhat bullish, both Oppenheimer and BMO Capital maintained a Outperform rating with a average price target of $63. We think the selling was overdone and will wait for a...

After a massive run since its IPO, which we missed out on, waiting for a pullback that never came, we are looking to enter a position now as earnings and lock up expiry selling is complete. On Friday or Monday, when we have more clarity on the China trade situation we will hopefully initiate a long if the market turns positive.

Expectations are low in UNITI GROUP and options are pointing to a fall to $10, we are looking for a positive move and buy alerts placed above $13 but also sells below $10, either way volatility is expected and we are biased to the long side. Analysts have a underweight price target of $9. Company Description Uniti Group, Inc. is a real estate investment trust...

GOPRO IS A GOOD CANDIDATE FOR A EARNINGS POP TODAY. OPTIONS ACTIVITY HAS BEEN QUITE POSITIVE AND LOW EXPECTATIONS COULD FUEL QUITE A MOVE AFTER HOURS. WE THINK REVENUE AND EARNINGS MAY JUST NOT BE AS POOR AS EXPECTED, WHILE THE TURNAROUND STORY COULD IGNITE INTEREST. Company Description GoPro, Inc. engages in manufacturing and selling camera and camera...

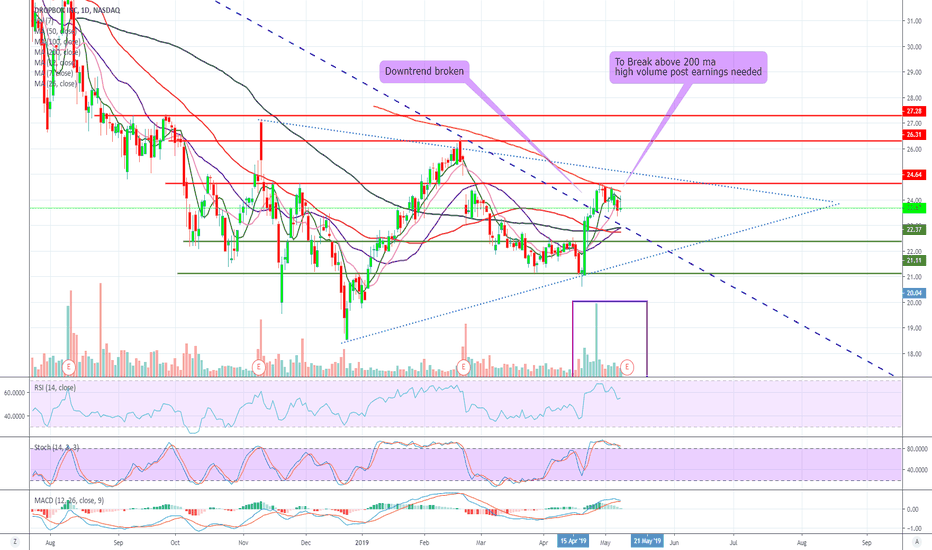

Having MSFT and GOOGL as you competition is not a comfortable market to sit in, but Dropbox has stood up to this challenge. Unfortunately they have done so at the cost of their margins, this has resulted in sell off's on its previous earnings reports. We are hoping for a positive report and margin improvement today which could produce a sizable jump int the stock....

For 2 months $360 has been defended by the bulls since the second plane crash, but now the added uncertainly regarding trade with China and consumer confidence issues with the 737, the price has finally broken below which is crucial. Our bearish target is $295 giving a 17% downside return.

After suffering a 22% lose post earnings, it is time to start nibbling again but possibly not today until the trade talks have a little more clarity, if we do have a positive outcome XLNX will rally hard. We missed out on the original rally but not this time. Company Description Xilinx, Inc. engages in designing and developing programmable devices and...

Symantec had a 40% gain from the December lows and has now started to reverse on decent volume. Earnings approach with little optimism as revenue is expected to have declined. From a charting perspective the RSI has had a drastic correction and is approaching oversold territory,we are of the opinion that the gap to $21 will be filled at a minimum, so we will be...