All good things must come to a end, AAPl and they Index's have had a parabolic move since December lows but a pullback is inevitable. Weakness in the chips,semis and sections of Big Tech have surfaced and reality has began to set in among investors. Going into tonight's earnings it would be very wise to bank profits in AAPL considering what happened to Alphabet...

From our perspective the GOOGL chart has become more and more positive over the past month and is set up perfectly going into earnings. Our only apprehension is the possibility that Google has a recent history of selling off post earnings seemingly regardless of results. Speculation is rife that Googl will finally start discussing revenue numbers from YOUTUBE...

Twilio has really out performed in the last year with very few pullbacks. It is a fantastic company but is now getting just a bit to risky for traders to be holding into earnings. Earnings are expected to be good but after such a surge in the stock it better be a blowout. Late FOMO money has kept the rally going but will be quick to abandon ship on any sign of...

Fords jump on earnings last week has increased speculation that GM may follow in its footsteps. Looking at the long term chart the trend would be higher but faces strong resistance at $41.50 - $42 , until that level breaks on considerable volume we are not convinced. Ford took some radical moves over the last year to cut costs, reduce inventory and product ranges...

The chart is a thing of beaut,y rarely does such symmetry exist and if it continues we got to be long. The company is also in a area of immense growth with almost guaranteed growth potential as companies , government and individuals are becoming more an more prone to cyber attacks. FireEye, Inc. operates as a intelligence-led security company, which engages in...

Stephen Tusa is regarded as somewhat of a god in the GE analyst community. In 2016 he projected the fall in GE then priced at $30 . Since then he has been pretty flawless in his analysis and his opinion is that GE is still overvalued, his price target of $6 is becoming more and more realistic. Until he changes his views it is very difficult to see how the stock...

Oil has seemed to top of perfectly at the .7 fib level which also is in confluence with previous support, now turned resistance. We think oil will be range bound now between support and resistance, however political influences could alter that very quickly.

Corning is a great company with very diversified income streams but is often just associated with phone screens, which may have hurt its share price given the negative growth in smartphones. The company is currently very close to the analysts price estimate of $36 and from a charting perspective indicators are neutral. Despite good earnings the stock could sell...

Tomorrows earnings from AMD will have an enormous impact on the Chip sector. Intel and Xilinx both reported earnings last week and disappointment resulting in selling within the sector. It is hoped that it will come to light that AMD actually took market share from Intel rather than the market decreasing. Currently the short interest in AMD remains quite high at...

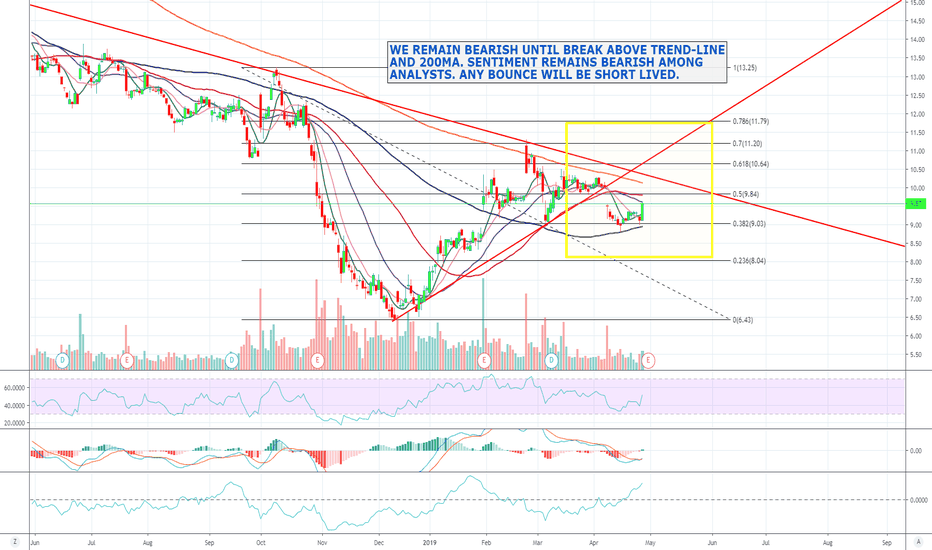

From a charting perspective RIG is really at a critical level, historically it has had a lot of false dawns and ended up falling out from these bearish rising channel, technical indicators are also all turning negative coming into earnings . The analysts covering the name have a average price target of $11.97 and a overweight rating, 20 analysts have a buy rating...

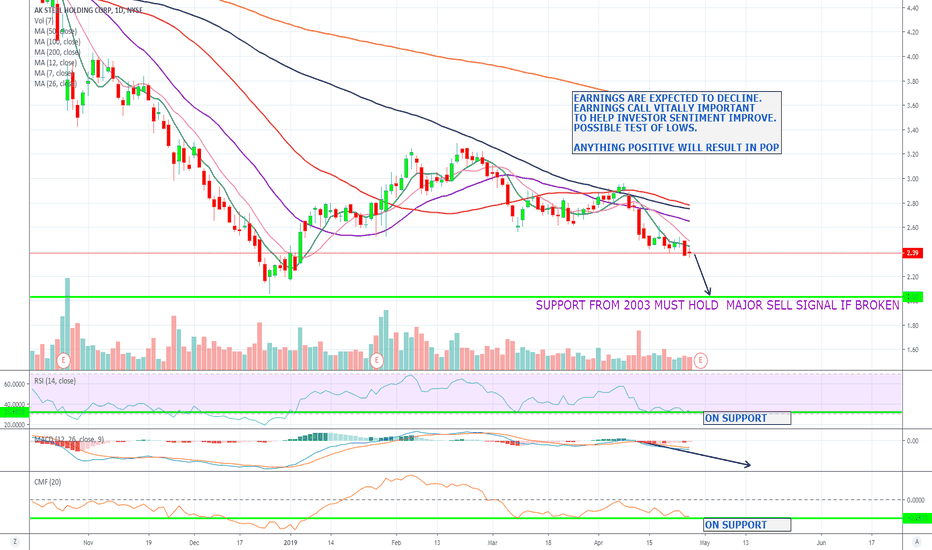

It has almost become a certainty that AKS will disappoint on earnings for the quarter. The stock has been on a terrible run and is now at lows from 2003, and trading at a PE ratio of 4, arguably considerably undervalued. The price in raw materials have spiked and this is a big headwind to AKS steel. Remaining investors will be eagerly hoping for a positive outlook...

======================== UNEQ (Uneeqo Inc.) Alert Price: $0.04 Float: 50M Website | Recent News ======================== Members, Regardless of the public's opinion on the use of bitcoin as a new currency, one thing is for sure.... Blockchain technology is here to stay! Experts agree that Blockchain technology will continue to shape industries...

Amazon and Alphabet becoming your competition is daunting news for any company in any sector. Despite this, sentiment remains bullish on SPOT and the analysts community have a average price target of $165 with 17/30 having a buy rating. Earnings are Monday 29th April and we expect a positive response and break from current formation into EW3. ***GENERAL...

We have not given up hope on WDC even though the recent break above resistance soon reversed as the SMH tumbled due a very weak outlook by INTEL. Monday there is also earnings from NXP, while AMD reports Tuesday so maybe we will find that Intel's weak guidance is company specific, if so the rally will resume. WDC has lagged the sector since December still well...

There is not a great deal to rejoice at AT&T presently, cord cutting and in particular the over payment for Warner Media is dark cloud hanging with no silver lining. Last weeks earnings was no confidence booster either nor the public performance of the CEO whom can often be portrayed as lacking enthusiasm and optimism. The stock price is stuck in a downward...

Cognex is the leading Machine-vision learning provider and has delivered record growth, revenue, income,and earnings per share in the last 3 years. This is not enough for investors lately given the announcement that the CFO will be departing in May 2019. Having only worked at the company for 2 years this will surely be a topic for discussion on the earnings call...

The news that AMZN returns will now be accepted at all Khol's stores nationwide resulted in a spike of 12% in the retailers stock price last Tuesday. "We are thrilled to bring Amazon Returns at Kohl's to all of our stores across the country," said CEO Michelle Gass. "Amazon and Kohl's have a shared passion in providing outstanding customer service, and this...

*****Update******* Our trade has worked out perfectly in MRVL, so we have taken profits and will wait for reentry once the SMH has found some stability. Despite the lovely gains in the last few weeks call buyers have been very active, loading up on calls with a $28 strike. We do find this as a compelling reason to stay long but discipline dictates that profits...