A recent analysts upgrade from Bank of America with a $10 price target alerted out attention to HEXO which is a relativity small cannabis company. Large inflows of buyers have since ensued and we will await a breakout above $7.40 foe a buy signal on continued high volume.

*********Update from our long call. Today's results could propel this stock to much higher levels already up 7% premarket , our price target for the gap fill is $41.50 before continuing to complete long term cup and handle formation. We hold a long and will continue to do so, long term winner.

History had a habit of repeating itself, we see no reason for this earnings report to be any different. The price is at the bottom of a very well respected channel which if it breaks will be a massive short, but wee see a great long opportunity.

Speculation is rife today regarding the acquisition of MX Semi by Sk Hynix. Both companies have refused to comment on this speculation but it has had significant influence on the stock price action today. SK Hynix is the second largest memeory chip maker in the world and its is seen that this acquisition is just another en devour today challenge the number one...

Speculation is rife today regarding SK Hynix is preparing to make a move for the acquisition of a part of MX semi. This is very much a developing story and has given the price a nice pop today. SK Hynix is the second largest memory chip manufacturer in the world, trailing behind Samsung and this is seen as another step to challenge their dominance. It this deal...

When a stock gets this much Analysts attention in the one day we take notice. With the average price target of $24 this has huge upside potential. It is a name that requires much more research but we are very interested by these upgrades.

Lets hope Pepsi Co Inc gave us a induction of a improvement in the fortunes for Coca Cola. From our perspective we are hoping for a nice jump on earnings to a possible price target of $49.50. Coca Cola is probably the most reconcilable brand name in the world and it has endevoured to offer a more diversified range of products to compete for the dollars of the...

United technology reports on the 4/23/19 and is on the back of a monumental run from the December lows, we expect this to continue long term but the chance of a slight pullback is very possible. The company has very strong fundamentals and trades at 17 P/E with a nice stable dividend. Like most industrial's Chinese and USA relations are very important, a trade...

Difficult to call Verizon on earnings, most probably it will be a beat on earnings and revenue, but will it satisfy investors and analysts. The future is very bright for VZ with the roll-out of 5G networks so if you hold the stock its a keeper with the added incentive of a nice dividend. Short term, we think that the retrace may have a little more room to run so...

ZOOM was the "it" word from last week, it even took the shine from the Pinterests IPO. we see reality kicking in this week and any sign of weakness will bring about intense selling in this name. It is unwise to think that this will continue to rocket higher, fundamentals must be take rank over sentiment and FOMO at some stage, smart money has already started to...

Earnings projections are quite mixed among analysts in Zion like many in the banking sector. Zion has invested heavily in modernizing and improving the approach to technology and It is hoped that it reaps rewards, we see this as a nice long term hold which has been oversold unduly. Crossing above the 200ma would be pivotal for the stock so maybe set $49 as a alert...

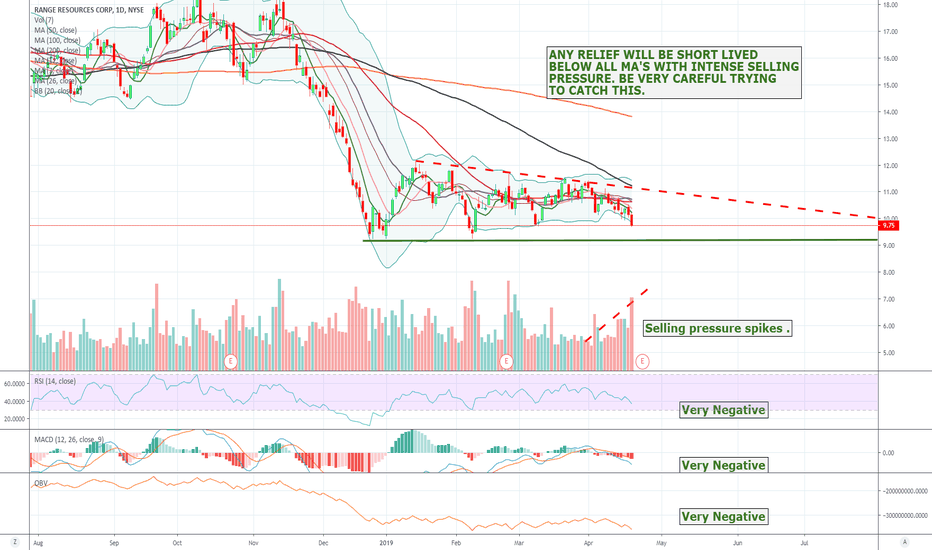

RRC is a no touch zone unless your short, it is losing more and more money and its actual resources are in abundance and also losing value. Income has steadily increased but so has the losses making them very busy fools.

Lockup expiration on the 4/23/19 on all 3 names, this provides investors a opportunity to cash in their chips which can often lead to a fantastic short opportunity. Yeti is a standout name for 2019 rewarding investors with over 100% returns on investment. It is very understandable why selling would ensue tomorrow , we will wait to see what happens and maybe pick...

Despite the fact that the price has reached they average analysts price target we remain confident in the companies continued growth. The company currently holds 4 strong buys and 4 buy ratings from 9 analysts covering the name, thus we expect upside revisions to their price targets very soon, possible coming into earnings or post earnings release. We think any...

It has not been easy for investors in MTW, with the price currently sitting at 1999 levels. Good news has been in short supply but maybe its close to turning the corner. It has fallen so much now there is no real need to jump back in, while fears of global growth still exist. The removal of trade war issues could well be the stimulus needed. We remain neutral but...

Lumber Liquidators seems interesting at these levels, it offers a very good risk reward with a tight stop lose below support. Earnings are approaching and expectations are very low so any positive news could propel it much higher. The 200ma seems like the next resistance on a pop.

Despite everything thrown at Facebook over the last 9 months it has remained resilient and staged quite a comeback from the depths. Investors and advertisers remain to have confidence in the stock and leadership. Everyone is well aware of the data scandals etc but investors are even more aware and becoming more comfortable with the costs increases to help evade...

Difficult to call this into earnings, estimates are for a reduction in earnings but increase in revenue, we will wait for a move before taking a position, high volatility on earnings is more than likely and the risk just seems to high to enter a position prior to getting more information.