The trend has been to increase spending on defense worldwide. The Pentagon is estimated to spend 1 trillion over the coming 2 decades. NOC is one of the companies that will be a benefactor of such spending. Worldwide countries like Saudi, India and Pakistan have all seen defense as a much needed sector for increased spending.

This is a stock which we really missed out on, it is a cloud and fixed cyber security specialist which is at the epicenter of growth and spending. The stock has created a lovely base and is now breaking out with a minimum 10% upside in our opinion, we are long as of today and will hold for long term upside with $93 as our stop loss level.

There is no need to rush into LEVI, we think sentiment about the brand has taken over from common sense. $21 seems like a good target for us to reassess our stance on the stock. Analysts have pilled into the stock today but with quite a mixed bag of views, which reaffirms our bias to remain on the sidelines.

NIKE could really not have planned it better, it looked like it was scripted, the redemption of TIGER WOODS while wearing everything with that Nike logo blasted across our TV screens. Golf and golf apparel has had a rough time in the last 10 years but TIGER is the man who can turn that around single handed. All if forgiven lets go long.

Fibrocell Science Inc today announced the signing of a deal to commercialize a new skin disease drug with Castle Greek Pharma. the drug aims to treat a life threatening disorder which currently has no cure. This could be a real winner but treat with care if you go long, volatility is a certainty.

Mattel has now pulled the Rock n Play sleeper from the market which has now been associated with the deaths of many poor little infants. There is no good outcome to such a issue for the company and families, it is inevitable that this will cause unease among investors, retailers and consumers.

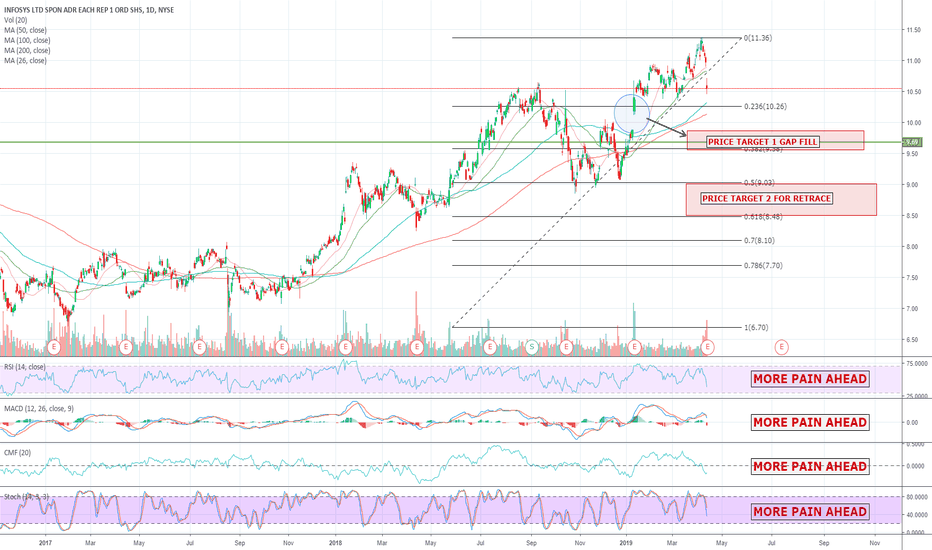

Infosys has had quite a nice stock price increase growing by 70% in 2 years. Despite the growth all good things must come to a end, it is time for a pullback which could be considerable. Today the 15th April analyst's have released 4 downgrades of the stock which is quite a consensus stimulated by the companies earnings release last week, growth and earnings are...

Charles Schwab has gained considerable market share by challenging industry pricing standards. The launch of innovative products and services is expected to continue growth as cost conscious investors become more and more aware of their investment profits disappearing in fees. We are bias on the long side on SCHW despite the considerable fall in price from last...

*****Keep FLKS on your radar for the coming days and weeks, indicators and merger news have signaled to us that huge gains are to be had if it can break the $.70 mark. The stock actually gaped down from $3.50 so has plenty of room to run on any positive break above $.70. Speculative stock like any small cap Bio Tech.

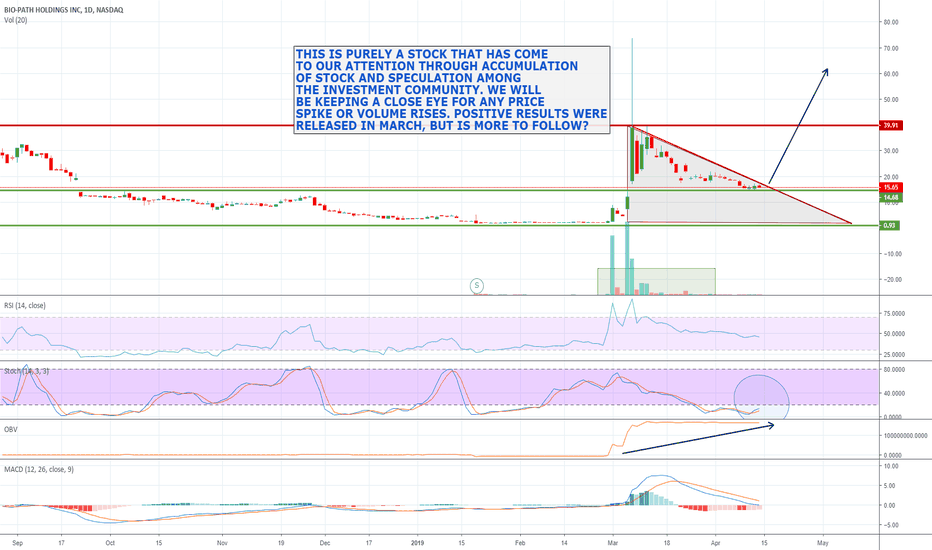

Stock picking has no certainties and often the greatest signals are from whispers among the investment community. Bi-Path Holdings has had quite a lot of good news recently that has brought it to the attention of many investors. Despite this we think that the price is gearing up for a significant move upwards, so we have alerts set on price and RSI spikes. This is...

Not much is expected from the earnings release on Monday, it is a matter of how much are the losses rather than any gains. The entire sector is overvalued and is simply a speculative growth play with limited financials for this growth to be projected. Aphria was one of the first medical marijuana companies that was profitable that was until major expenditure was...

Not really a household name among investors but well known to the ever growing of shorts. As of March 26th there was a 38% short interest. Despite FDA approval for 3 new drugs sales have been dismal and the company has increased expenditure on sales to tackle the issue, thus driving operating expenses much higher. The price currently sits at $4.57 well below the...

Honeywell Int Inc. operates as a diversified technology and manufacturing company worldwide. Its aerospace segment supplies products, software, and service for aircraft's and vehicles. If aerospace is of interest to you HON may be a much safer investment than Boeing whom it supplies. Earnings are projected to be in decline this quarter but the extent of the...

There is just somethings you got to go to a store for, every spring we jump in the car with the wife to get those plants and fertilizers etc etc etc, come home plant them and let then die as usual, then next spring back to Home Depot and buy they same things over and over, Lazy gardeners are Home depots best friends in spring. When we decide there is a project...

The COLA challenge has been won by PEPSICO by diversifying away from COLA, into snacks and other carbonated refreshments. Did PEP see the writing on the wall for sugary drinks before COKE or did the not let pride get in the way of progress?. Pepsico has stolen ground on competitors by the diversification it has set in place through fabulous acquisitions into...

Like most parents I usually say "no" but eventually give in for a easier life. Today that was one of those times, my child asked for a new pair of VANS for school, because that is what everyone wears, apparently. This sent the alarm bells going on Who makes Vans?. VF Corp is the answer and I have been astounded by the growth in this company. After quizzing my kids...

Starbucks has been on a outrageous growth strategy for several years but just how many Starbucks do you need on the one street?. The coffer market has become over saturated with large franchises dominating the market, in many towns and cities there is a movement towards more sustainable business practices and supporting "indigenous businesses". The stock has...

If you like Nike, YOU SHOULD LOVE FOOT LOCKER, the tend to move in a very similar pattern. FL sells at a very reasonable P/E 13 while NKE has a 33P/E, we have every confidence that we will see the price move to fill the gap at $70 before continuing to a all time high of $78. Consumer confidence and spending statistics have recovered from a poor 4th quarter of...