$SHOP Shopify has been a amazing trade this year, but all good things must come to a end. It is due what would be a healthy pullback, before continuing to new highs. Earnings season will approach once again, with wise investors locking in profits for sure, we missed it going up but intend to catch going down.

You have to respect the price history in this stock, it has hit its normal level for short covering and traders will ride it back up again.

Its so ugly it may be good, but seems unlikely a recovery is in the near term future, more pain ahead.

Momentum is with the bulls, even Trumps tweets could not halt the advance, the golden pocket should lead to a reversal.

After a torrid year Goldman Sachs is showing signs of life. Troubles with yields and scandals seem to abating. Had a very positive move on last earnings report and the charts point to another upward move after consolidating. Please follow our website link below to sign up to avail of our FREE E-Mail and Text Message ALERT service so you don't miss another...

$CCI is a under the radar company, which by looking at the chart has executed perfectly for years. This is a 5G play as they own the infrastructure which has increasing revenue and profitability. We have missed this on the way up but the chart strongly signals a downward move in concurrence with the price action for many years. Please follow our website link...

Boeing $BA had been having a awful time, but it could have been a lot worse. Short term there is a long play available, bearish volume has dropped as has the volatility, it is starting to take baby steps back up to resistance. Keep the stop lose tight and hope for no more headlines. Please follow our website link below to sign up and avail from our FREE E-Mail...

$NTES Netease is a Chinese company with multiple revenue streams. Due to the Government in China banning the distribution of many games, Netease suffered greatly and investors fled. Regulators have now started to issue new licences which could unlock vast gains. This is not a stock for the nervous investor but we think it is well worth a punt. Please follow our...

Cisco may not be as glamorous as AAPL AMD MSFT & GOOGL but it has made a very impressive breakout on strong earnings and guidance. CSCO is the worlds leading provider of communications equipment and at the forefront of 5G. CSCO is a integral part of many industries and has diversified and recurrent revenue streams. It is not old tech anymore, data center,...

Tiffany has had quite a recovery and pop after earnings but we see this as slightly overdone and unjustified. Tiffany is still trading at quite high multiples in comparison to major competitor Signet Jewelers. We would suggest reducing any holding as 200ma and major resistance approaches, a conservative reversal area is between $97 - $92 .

$AAPL This is a battleground stock, some investors love the products and don't like the stock, others love the stock but hate the products. Carrying the burden of "First Trillion Dollar Company" proved to heavy, since the revelation of slowing phone sales, it has been a endless stream of negative analysts and media coverage. last week Apple launched a new batch of...

Broadcom is the maybe not as enticing as NVDA or AMD, but it should be. Broadcom invests heavily in diversification and acquisition so it is not dependent on certain revenue streams. It is also in the middle of a massive buyback program which places a floor under the stock. Please follow our website link below to sign up and avail of our FREE E-Mail and Text...

$HG Copper is the ultimate gauge of the global economy. Since the trade disputes with China, Canada and Europe Copper has had a drastic decline. Positive signs have developed, a nice double bottom should give investors reassurance, coupled with Chinese economic stimulus. If the Dollar was not so strong the climb back up would be much greater. Long in the short...

"I wish, I wish, I wish I had bought more " is a common statement regarding the VIX, the October massacre provided amazing earning opportunities and safety for those trading the VIX. Just Like our GOD we only go looking for him when we NEED him most. Dont get caught Please follow our website link below to sign up and avail from our FREE E-Mail and Text Message...

NVDA has not found the love of investors like other chip stocks but a break above $185 would certainly be very positive.

Snap is at a critical level, touched major trend line on several occasions, shorts expected this to fall much faster, stay on the sidelines until trend is broken, within the next week probably.

Facebook is at the heart of political dismay with big tech. It is not unthinkable that FB becomes the first victim of regulation. Sentiment is changing quickly on this stock, MUST avoid the gap below $160.

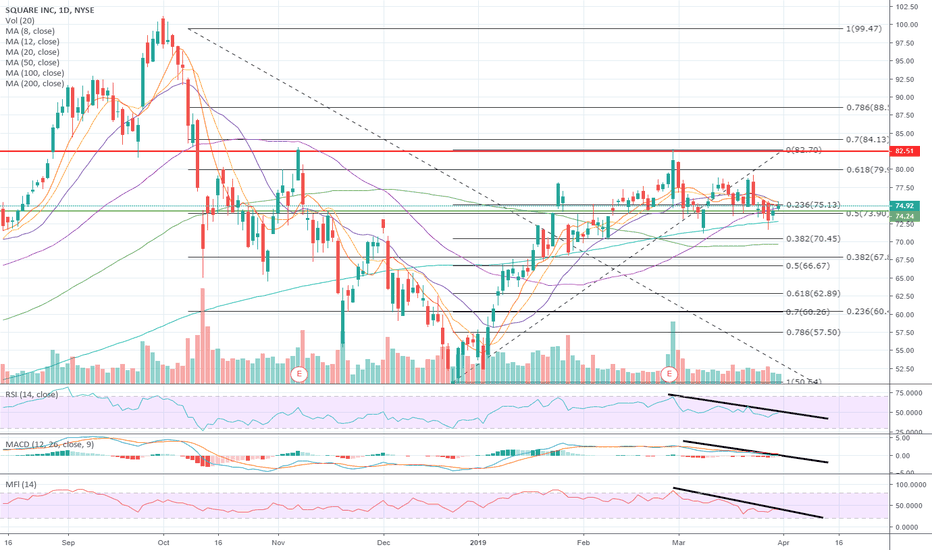

Square is stuck between support and strong resistance, indicators are negative but 200ma has been holding this up since January. Popular stock for traders but we remain neutral until support or resistance is broken.