Robert_V12

Nike is a blue-chip name going through a rough patch. But this recent dip, fueled by disappointing earnings and macro uncertainty, could present a classic oversold opportunity. The stock is now in a high-probability reversal zone where risk/reward becomes extremely attractive. 🎯 Updated Entry Plan: $58.00 – Soft support zone; start building a position $53.00 –...

TSLA has rallied from its previous consolidation zone and is approaching a potential resistance area between $290–$295. Momentum is solid, but RSI and volume trends may suggest we’re nearing short-term exhaustion. ✅ Strategy 1: Wait for the Pullback (Safer Play) Entry zone: • $240 – Ideal level near former resistance turned support • $215 – Strong support with...

Earnings season is heating up and Microsoft (MSFT) is once again in the spotlight. With its dominance in cloud and AI, the next move could be explosive. Here’s how pro Im thinking my setting up: 🔹 $390 – A bold speculative entry for breakout hunters. 🔹 $365 – A defensive entry on post-earnings pullback to support. 🔹 $345 – The opportunity zone if a sharp drop...

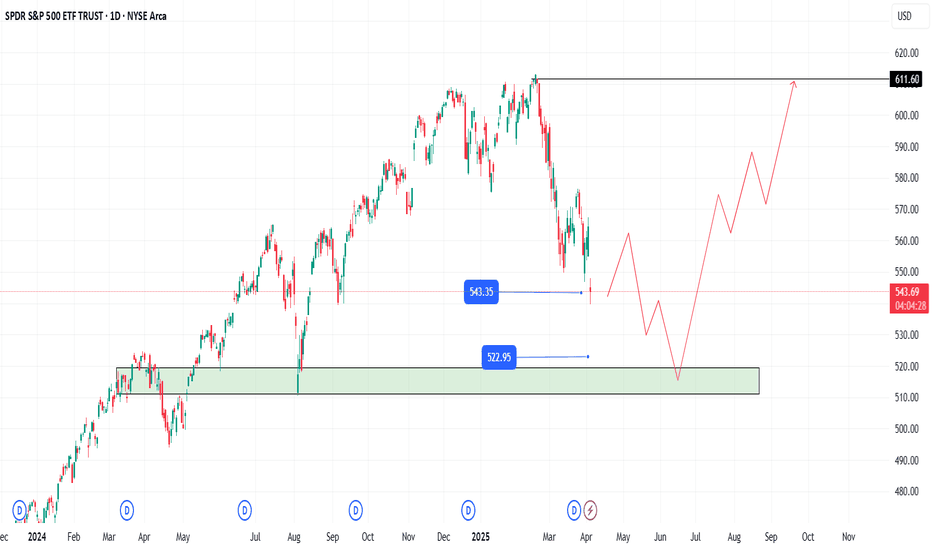

In the Shadow of Headlines: SPY’s Drop Could Be 2025’s Big Opportunity As markets react sharply to renewed tariff fears and Trump-related headlines, SPY continues its descent. Panic is setting in—but behind the noise, a strategic opportunity may be quietly forming. While many rush to exit, others are beginning to position for the bounce. A well-structured entry...

Ethereum (ETH) continues to show resilience, currently trading around $1,790 after a strong bounce earlier this month. While the crypto market remains volatile, ETH is holding key technical levels that could fuel a major move in the coming weeks. 🎯 Entry Points: Market Price: $1,790 — Ideal for an early position, as ETH holds above critical support...

The stock's recent breakout from a descending channel pattern indicates potential for continued upward momentum. Monitoring the $155 support level is crucial, as a drop below may signal a trend reversal. 📊 Technical Analysis Current Price: $161.96 52-Week Range: $140.53 – $207.05 Recent Breakout: Surpassed descending channel resistance Key Support: $155 🎯...

🚀Bitcoin just reminded the world who’s boss. After brushing up against $94K, it’s taking a breath—and for swing traders, that’s the moment to load the slingshot. We’re not chasing green candles. We’re positioning at smart levels that offer real upside when the next wave kicks off. With institutional flows increasing and volatility offering cleaner setups, the...

Bank of America (BAC) has been consolidating quietly, attracting attention as it sits near a key mid-range level. With a 52-week low of $33.06 and a 52-week high of $48.08, the stock currently trades around $36.92 – roughly 11% above its low and 23% below its high. This setup could be the calm before the move. 💥 Technical Outlook & Strategy With financials...

🚀 AMZN 2025 Trade Plan After an early 2025 rally to $240+, Amazon (AMZN) has pulled back sharply to around $167, opening the door to what could be one of the most attractive rebound setups of the year. With AWS still growing strong and net income nearly doubling in 2024, the fundamentals are on Amazon’s side. Add to that bullish analyst outlooks pointing to...

🚘Tesla's been cooking up some serious price action — and now it’s getting interesting. After holding above key supports, bulls might be eyeing their next shot. Here’s the plan I’m watching: 📥 Entry zones: • 240 (aggressive) • 215 (ideal support zone) • 195 (deep discount territory) 🎯 Profit targets: • 265 • 290 • 355+ (if momentum takes off) TSLA has been...

NVDA 💥🔥 Let’s be real, the market’s been shaky. Between the spike in volatility and the new tariff chatter coming out of the Trump camp, tech stocks are getting tossed around. But here’s the thing—volatility is where the setups live. And NVDA, sitting at the center of the AI revolution, isn’t going to stay down forever. This might be the window. We’re talking a...

📊Analyzing AAL, potential entry points are identified at $11.8, $11.0, and $10.0, with profit targets at $13, $14.8, and $18. This setup considers both short-term opportunities and longer-term potential, depending on market conditions and individual risk tolerance. 🎯 Strategy: First profit target: $13 – A reasonable short-term exit if momentum supports a...

📈🏗️🐾Sector: Industrials – Construction & Machinery When the giants sleep, we prepare. And when they wake, we ride the momentum. Caterpillar has been consolidating, and the recent pullback opens the door for a high-conviction setup. I'm looking to build my position in 3 strategic zones — scaling in with patience, letting the market give me the setup on my...

🔥Let’s talk numbers: 🧮 P/E: 9.78x 💸 P/S: 0.66x That’s deep value — Wall Street’s sleeping on this one. While everyone's chasing AI, Citigroup is trading at garage sale prices. 🧠 The Setup: If you're into swing plays with strong R/R and macro upside, C is worth a look. 🔑 Entry Zones: 1️⃣ Market price — for early bulls 2️⃣ $55 — breakout confirmation 3️⃣ $48 —...

In the volatile world of trading, uncertainty is the only constant. Could prices dip to 75k before surging to 115k? Is such a drop a brief pullback or the start of a prolonged downturn? What technical or fundamental signals might indicate a recovery toward 115k? Disclaimer: This content is for informational purposes only and does not constitute financial advice....

LLY Just Dropped — Opportunity or Trap? 🔥 LLY (Eli Lilly) is on every trader’s radar! With biotech momentum and blockbuster drug potential, this stock is ready to rip once the dust settles. Smart money is eyeing key zones for a golden entry. 💊📈 📉 New Entry Zones: 🔥 630.00 – Solid buy level 🔥 550.00 – Strong value zone 🔥 465.00 – Deep discount opportunity...

🚨 We're eyeing AXP for a strategic multi-entry swing trade based on strong technical structure and long-term potential. Here's the plan: 📌 Entry Points: 1️⃣ $248 – First touch on short-term support 2️⃣ $234 – Healthy correction zone 3️⃣ $219 – Strong base of demand 🔻 Deeper Load Zone: $195 – Long-term trendline + major accumulation area 💰 Profit Targets: ✅...

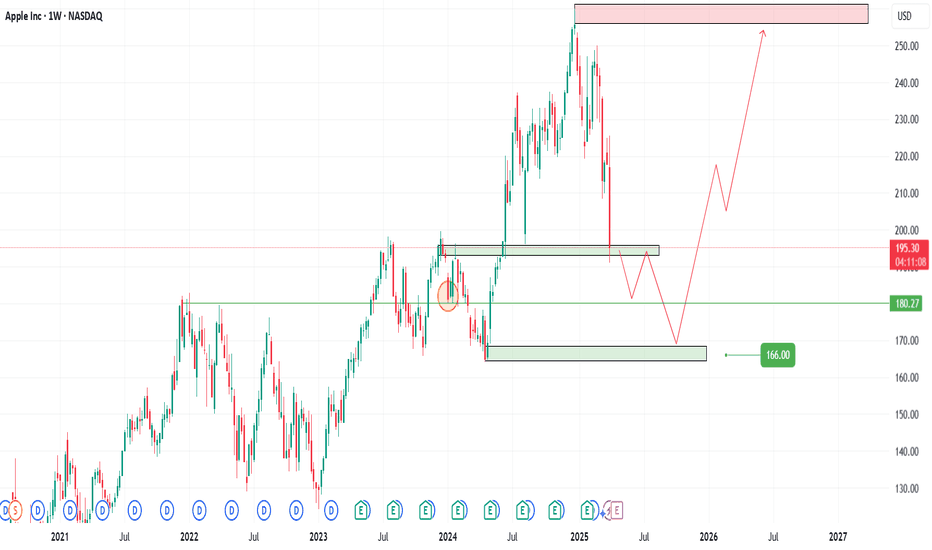

📊With global markets reacting to renewed tariff talk from Trump, Apple (AAPL) NASDAQ:AAPL could face short-term volatility—but that’s also opportunity. As fears of a trade war ripple across Asia and Europe, AAPL may temporarily dip, especially with supply chain exposure in China.🍏📉📈 📌 Entry Zones (Buy the fear, not the panic): 1️⃣ 194 – Light entry as weakness...