RobertaAlsop

Gold has three consecutive negative lines on the daily line, and opened at 3011 in the morning. The overall situation is weak, and the high pressure is obvious. Today is particularly critical. The support below is 2990-2985. If it falls below, it may drop to 2960 this week. The short-term resistance above is 3022-3026. In terms of operation, it is recommended to...

Short order strategy: Strategy ; When gold rebounds around 3016-3020, short sell 20% of the position in batches, stop loss at 3055, target around 3006-2999.

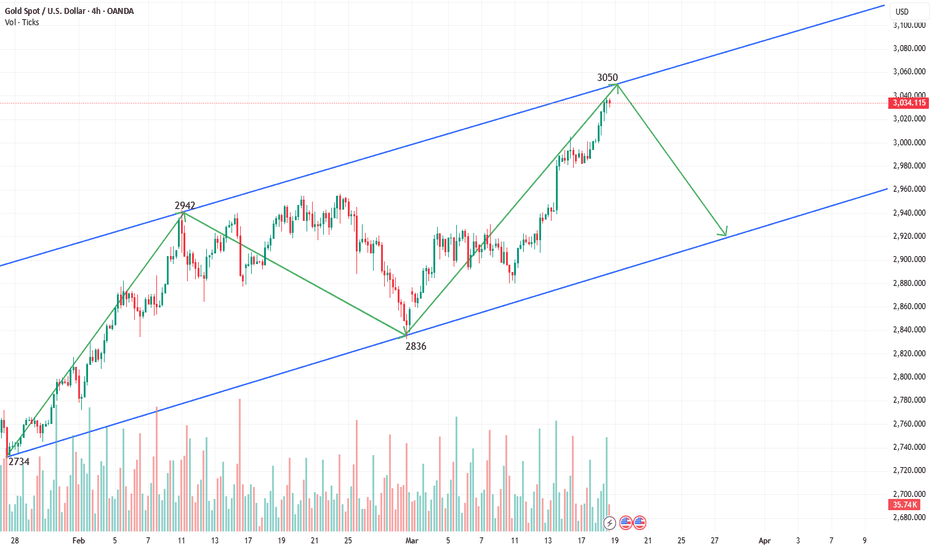

During the decline of gold price on Friday, the high point was moving downward and the low point was also moving in steps. Let's see whether the decline here is caused by the selling behavior of long orders at high positions or the peak of gold price. We will follow the trend to implement the high-altitude strategy to be bearish. The main focus below is the...

After the opening today, the upward sentiment continued and broke through the high again, reaching the 3056 line.Today, the main trend of gold trading is shorting at high levels, supplemented by long positions at low levels. Strategy: The 3055 short position given at the end of yesterday's trading has been reached. If it touches 3060 during the day, cover the...

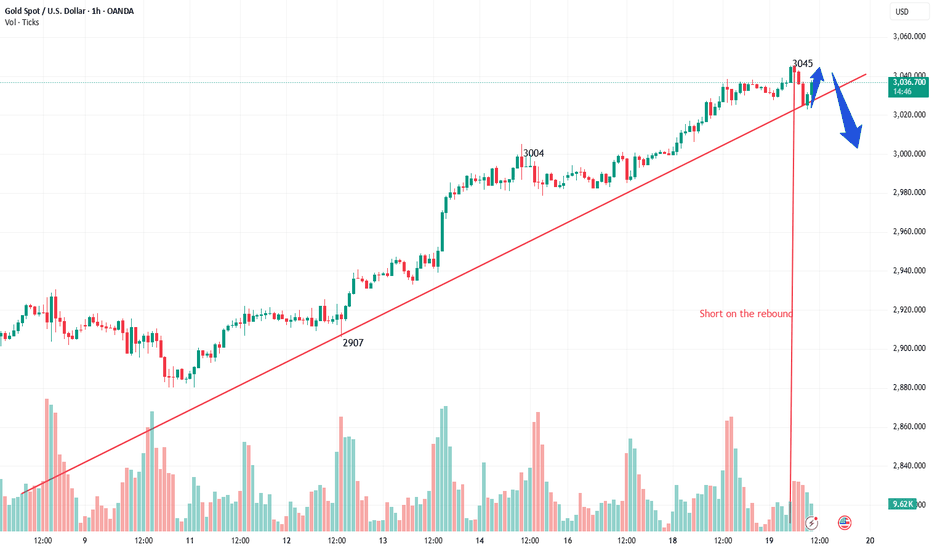

The 1-hour moving average of gold has begun to turn downward, and gold may open up room for decline. The 1-hour moving average of gold has now formed a head and shoulders top structure. Gold rebounds or continues to be short. The market is weakening, and the gold price has fallen below the 3,000 mark. The market direction has turned short, so the short-biased...

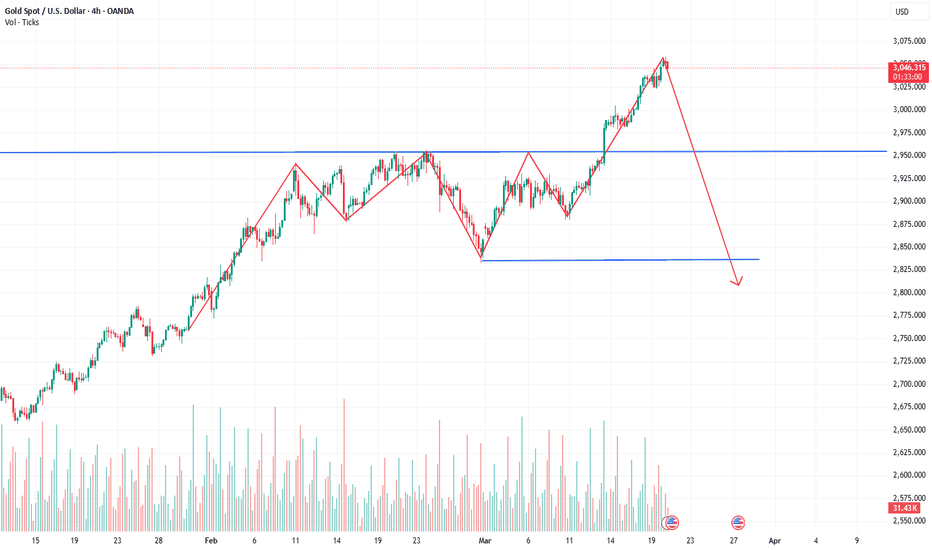

On the 4-hour chart, gold has a minor support level near $3,022, which is also the neckline of the head and shoulders top pattern. Buyers are expected to intervene here and use the neckline as a risk control point, with the goal of pushing gold prices to new highs. On the contrary, sellers will focus on gold prices falling below this support to increase confidence...

The gold hourly chart is forming a head and shoulders top, and it fell back as expected. Now it has stopped falling at the neckline position of 3022 and rebounded again. However, the 4-hour chart did not close higher, and the market continues to be bearish.Operationally,It is recommended to continue to implement the strategy of increasing positions and short...

As the continuous rise of gold fully demonstrates that short-term bulls take the initiative, this will undoubtedly increase the probability of gold prices hitting the 3070-3080 area, but we also need to be prepared for a false break or a real break in the market.In the 4-hour period, since stabilizing above the 3,000 mark, gold has maintained a bullish trend and...

At night, based on the in-depth analysis of market trends and comprehensive consideration of various technical indicators, we decisively placed short orders at the high level of 3050-3060.When the price hits the low, place a long order at 3025 - 3030

Gold quickly rose in the morning today, so we remind you to beware of the risk of market reversal today. Gold is likely to fall back after rising in the morning. Don't chase more easily. Gold is stagnant near 3056, and gold is directly short at 3055.On the whole, today's short-term operation strategy for gold is to short on rebound and to go long on...

Gold continued to rise today. This is the power of the trend. The belief that it will fall after rising too much is just a subjective will, not market logic. There is no turning signal. All peaks are risky. Of course, the market is always relative. It is impossible to keep rising. We need to prevent the risk of large adjustments. Gold operation strategy...

Gold has been rising for several consecutive trading days, and the general trend is still bullish. We can continue to trade gold after it falls sharply. In the short term, gold has fallen below the rising trend line. It can be seen that gold has been running above the trend line recently. It has now fallen below the trend line, so we can rebound and short gold. ...

It is inevitable that the Fed's interest rate decision remains unchanged, and it is inevitable that gold will rise. These are all within expectations. We still need to see a decline, because the hourly line of gold price has directly derailed. This trend is abnormal, and it is inevitable to return to the moving average. The derailment, this is an extremely...

From a technical perspective, the daily and 4-hour levels show a bullish structure, but the indicators show that the current price has shown signs of divergence after a continuous rise. Gold strategy: It is recommended to buy at 3040, stop loss at 3030, target at 3055-3060; it is recommended to sell at 3060, stop loss at 3070, target at 3045-3038

In terms of short-term indicators: the 4-hour stochastic indicator is blunted and glued at a high level, the MACD double lines are glued and blunted upward, and in terms of K-line pattern, the step-by-step rise continues, all of which are signals of bullish control.Operation: From a purely technical perspective, today's market should be long, and no bearish...

3.18 After yesterday's high-level shock correction, gold started to rise today, reaching a high of around 3038 in the US market.Looking at the evening, we continue to maintain the bullish and long position. In the short term, it will fall under pressure and move up to around 3018 support, as well as the 3010 support below. The main idea in the evening is still to...

Judging from the current trend, although crude oil is in a short-term rebound phase, the overall bearish trend has not changed.Personally, I think the 3-4 wave rebound is likely to have ended, and the MACD indicator shows that the rebound momentum is weak. Therefore, today's operations should focus on shorting the rebound and seizing the falling opportunity of the...

From a technical perspective, gold is undoubtedly bullish at the weekly, daily and 4-hour levels, but the indicators show that the current price has shown signs of divergence after a continuous rise.The risk of long positions still needs to be considered. There are definitely still many current trends.Suggestion: Look at the gains and losses of 3015, and continue...