With consumer confidence off at circuit breaking levels, the market, technically, has reached extreme levels of support. Let's look at it: Technicals: (1) Horizontal Levels of support (2) 50%/61.8% fib confluence (3) exDiv1 (4) extreme indicators (5) Chikou span testing cloud support (6) 28% drop is SPX All of these levels are lining up around the same...

Fundamentals: Meets my parameters for investing long-term. Technicals: Daily: ExDiv1 Triples 161 extension, equal legs and weekly key fib meeting at the same spot (confluence) New Crown high formed on the daily Weekly: uHd+hammerw/ d3 volume @ key fib pullback morning star Met monthly average range Kijun signal extreme indicator Target 140...

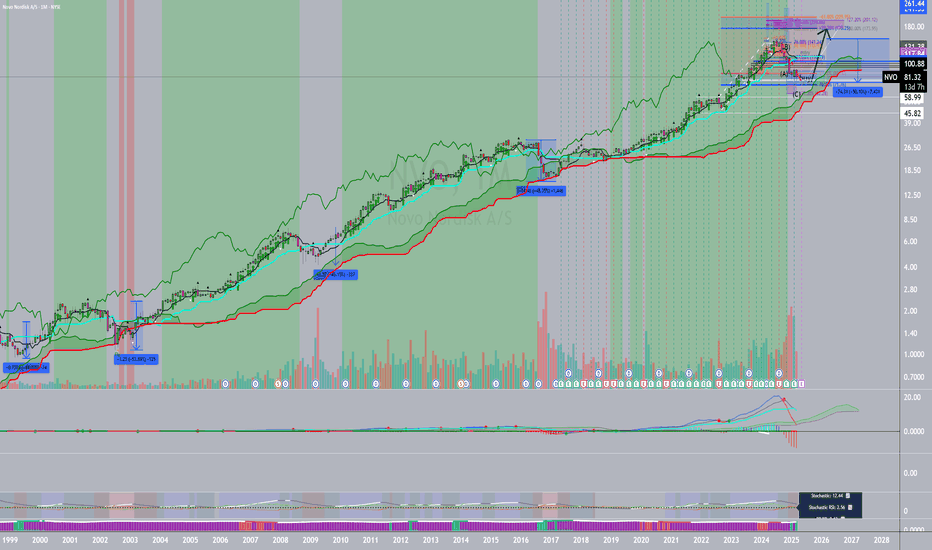

Fundamentals : Take a look at NVO in 1999-2000, 2003, 2008, 2016 and June 20024-2025. Every time it dropped about 50%, that lead to a huge rally for years! NVO has secured contracts with Medicaid for their diabetes and other drugs. It is not going anywhere. It has fallen 50%. We either hold or buy more. Technicals : uHd + extreme indicator +u3 volume last...

Fundamentals : Ignore all the boohoo! Technicals : Hammer time! VPA confirmation uHd ext. indicator 61.8% fib support horizontal support all this = multiple confluences

Quantum is the next revolution after "Ai". Technicals: uHd + counter strike candle w/ vol + 61.8% fib + horizontal supp. Note:A fall from 50 to 25 is a big discount!

Technicals: When the chart hits just right, something are left best unexplained. Look at this month's chart's last reddish color down price bar in Apple's stock (AAPL). Do you see a collapse in it's stock? Or does it just look like it took a brief pause and giving you a chance to buy more "apples" at a discounted price. 🙂 Monthly: Weekly: Equal legs +...

Tech: Dip to horizontal support + 50% fib + TL Normal drop and expect a rally or sideways market

Fundamentals: **I want to own a piece of a company comparable to CFLT (Confluent). And it turns out that Intuitive Surgical (ISRG) is the right one. Technicals: Daily chart pullback back into support. I am putting a tentative stop loss at 500 and a target at 700. Then, hold when it reaches there. Daily:

The SPX500 (SPY) here on the chart has fallen about 4.46% for the year 2025. Already a good retracement for 2025. The price at 587.36 (daily chart) is in a window's range of potential support after hitting that 612 weekly/monthly target of resistance at the top. Tentative Projection for 2025: 680 Daily: Weekly:

I share a letter I wrote to family regarding the fundamentals and technicals of Nvidia and why Nvidia continues to be a great buy. Fundamentals and Recent Events: I understand your concerns about my investment in the U.S. stock market, especially with the news circulating about DeepSeek and its potential impact on Nvidia. And I heard your concerns with rumors...

Daily Technicals: AB=CD or ABC pattern with an Inverted Head and Shoulder Pattern at the end n@ weekly support (yellow area): Daily Chart: Weekly Chart:

Fundamentals: SharkNinja is recognized for its innovative products in the home appliances sector, particularly in cleaning, cooking, and food preparation. The company’s ability to innovate consistently has helped it capture market share and drive sales growth. I believe that SharkNinja presents a strong investment case, driven by its accelerating fundamentals....

The iShares S&P 500 Value ETF seeks to find and track undervalued companies relative to those available in the universe of public companies. Technicals: Retracement to 61.8% weekly Engulfing Bullish pattern at support Confluence of horizontal support and fibs and market reaction uHd Weekly Snapshop: Speculation: A repeat of the bull rally of Q4 2023 will...

Comments: For me, MicroStrategy is a purely technical and seems to track bitcoin more than its underlying product. It reach the year 2000's all-time highs. Technicals: Weekly Zoomed In: Weekly hammer with volume at the 50%-61.8% fib level Weekly Zoomed Out: All-time highs 5EMAs strategy RM KJ Trend Bounce ADX extra confirmation Bounce from horizontals...

Technicals: What appears to be an H&S looks like the hallmarks of a fake H&S by my standards. The market instead is going flat and positioning itself for a rise to 160,500 by the end of 2025 and 300,000 by 2026. This is also similar to Michael J. Saylor's trend of thought that Bitcoin will rise about 20% to 35% every year going forth. Daily: -Fake...

Technicals: Diagonal trendline support Dragonfly doji at 78.2% fib support and horizontal support with d3 volume Weekly cup-with-handle pattern Good buy before elections

Fundamentals : Russia's exports fell sharply after the invasion in 2022. Russian trade surplus continues between exports and import has fallen in the last 18 months. "...the limited number of potential buyers for Russian crude and refined products increased their bargaining power, allowing purchasers to demand greater discounts to the global market"...