In my first post in a minute, this idea offers a concise analysis of key futures stock indices and treasury futures for the upcoming week. I look at popular indices like MES, MNW, and MYM, alongside the 10-year and 30-year treasury futures (ZN & ZB). By examining multiple timeframes, the current prices suggest a probable modest decline in stock...

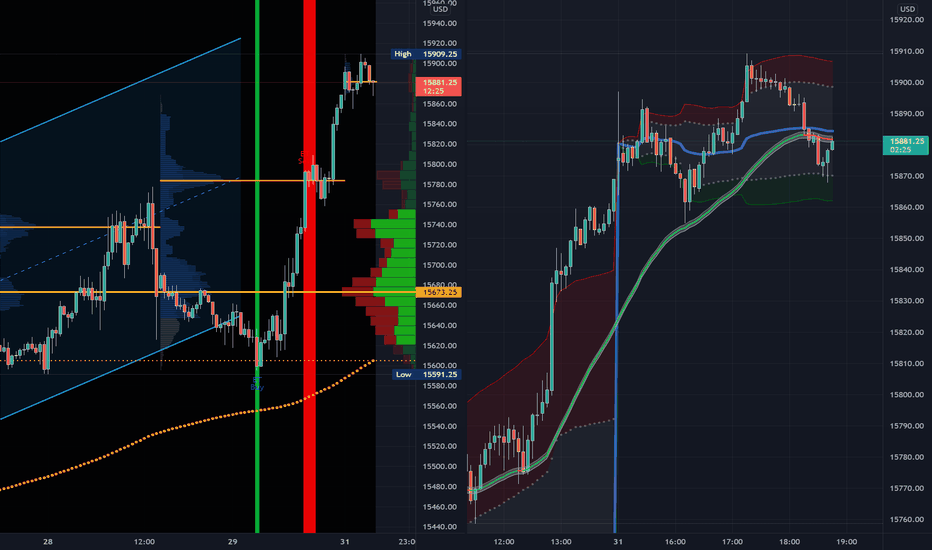

The sellers had the ball to start off 2024, especially for the NQ which had its biggest decline in over 3 months. In this brief 5-minute video, I touch on my 2 favorite *indicators* of potential price direction, Anchored VWAP combined with a range-based Volume Profile. This methodology highlights areas the market may revisit, potentially in short order, as we...

NASDAQ:MSFT & NASDAQ:GOOG reported earnings after the market close today, but there isn't much that most stock or options traders can do about it until the market reopens tomorrow morning. However, the futures markets, specifically the Micro Nasdaq Futures ( CME_MINI:MNQ1! ), provide opportunities to participate in earnings directional movement hours before...

10 minute lesson idea about using sizing for risk management and identifying high probability turning points in the stock indices and treasuries.

OKay, this video idea is neither Analysis or a Tutorial. So "I won't be mad if my idea is hidden," but hopefully you catch it first, or it sneaks through uncensored, since it is super valuable for any, and all, TradingView users that trade futures, want to learn to trade futures, need access to real time futures data, and like the TradingView supported broker...

Another wild session, another opportunity to suggest that you learn how to use RSI to find turning points, and perhaps more importantly, stay away from the drops that keep on dropping. In this short video, I revisit the same concept from my past 2-3 posts, which is how to use Relative Strength (with the correct settings) to identify potential reversal points in...

The Dow Jones Futures Contract (YM) produced the perfect sell signal today, a one bar (30m) Extreme Turn condition. Be sure to watch the Related Ideas post called How, When, & Where To Catch A Falling Knife Using RSI for the context, theory, and indicator logic, behind the sell signal covered in this video. Note: The hand mouse-over cursor got a little wonky...

Wow, it was a reversal day for the ages! And a perfect session to revisit how to use the Relative Strength Index (RSI) to better time your dip buy, if that's your sort of thing. RSI (Length 3, Upper 84, Lower 16)

Yep, that's right. Your best email gets you instant access to my entire 30-video futures foundational online course for nada, zilch, nothing-honey. Let's make 2022 a great year for trading, and especially a year that you learn more about the best instruments/products for active day trading which are ... futures! Check the signature below for a link to access the...

I can make this one short and sweet. The stock indices were all up last week - a lot. The levels are all pretty clear. Can the Santa Rally continue? Apparently, the planets are literally aligned ... for something to happen. Ha!

Let's take a look at potential key levels for the week, most notably the session lows from Friday. Will a Santa Rally begin to take hold, or is there more naughty action for the bulls? This weekend the crypto markets experienced a 15-30% decline, mostly looking like another scene from the movie "Horror For Over-Leveraged Longs." Given that backdrop, and the...

What a fantastic week for range trading! Today, on a very red Friday session, we had the perfect Extreme Turn Buy signal. Let's break it down. Note: The Extreme Turn Signal featured in this video is generated from a custom, hybrid indicator, build with love and passion, from my team here at the tradersdevGROUP ("TDG" among friends). But you can recreate the...

In this lesson, I discuss the important levels to know for the Range Trader Futures Trading Strategy. The indicators on the chart that produce these levels and values are the following: 1) The "T-Line" is a 233 period Exponential Moving Average (EMA) | Built-ins >> Indicators 2) The prior session highs and lows are plotted using the 4C Yest HLC/O indicator |...

In tonight's fall back, daylight savings edition of the Futures Outlook, I revisit briefly a trend trading futures strategy I've named the 5-Thirty-Four. The ingredients are a 5 minute candle and a 34p EMA. Add a dash of VWAP bands and you've got everything you need. Then I look at the ES channel that's been in place for the past month that gives us a potential...

HNT has a halving event this weekend which cuts in half the amount of HNT that miners (hotspot owners) received for providing network coverage. Crypto halving is often a bullish catalyst as supply decreases. In this video idea, I continue using the TradingView Volume Profile Scripts to identify a key price level of high volume that has formed support for the move...

Trick or Trade! Paper Trading on mobile has arrived on TradingView. So here's a quick demo tonight in lieu of a Sunday Futures Outlook, given that markets are at all-time highs, it's Halloween, and an exciting elimination game in the World Series.

The force is strong with the market adage that strength begets strength. But this week, it will likely be all about the NQ earnings to see if it can catch up to the all-time high prints from the ES (S&P) & YM (Dow Jones). We get 'em all this week - FB, MSFT, GOOG, AMD, AMZN, AAPL. In other markets, can CL get to the top of our channel around $86? Will Gold...

With the exception of energy (CL1!), most commodities and stock indices are stuck in ranges. We dig this price action, or lack thereof, since pong is our favorite game! 😁