RogueCleaner

PremiumVAU has been trading in a range and has formed a rising wedge pattern as shown by the trend lines I have drawn. Resistance level is clearly defined with 3 tops and the lower band is not as clear but take a punt on the support level holding. Gold miners have sold off in the last months while gold has gone sideways. Gold Silver ratio showing a breakout is...

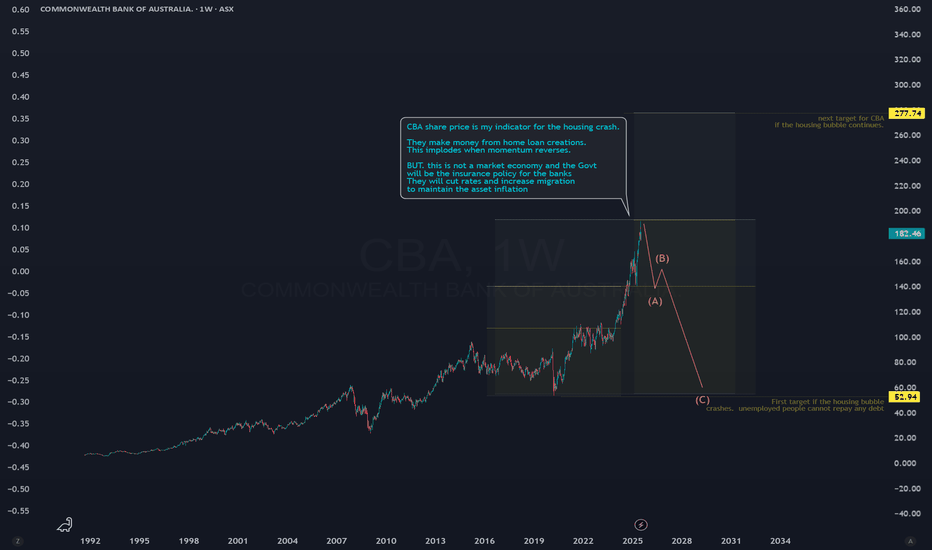

We can use the share price of banks like CBA as the market indicator for the housing crash. Sydney house prices are about $2 million each and higher. I propose 2 targets depending on if the state chooses to continue the asset bubble or allow free markets to operate.

IGO - rarely mined metals looks to have bottomed out and showing signs of buying strength. Sellers have been exhausted and technically support levels have held. Lets see if the downtrend channel has a breakout and we will buy another tranche on this breakout. buying above $5.

Silver has broken out of resistance level of 61% Fibonacci level. This is a bullish signal for Au. Ag breakout and bull run means the dumb money is starting to arrive . the big money is setup in Au now. August will be the month AU will run harder and make new highs. Wars are inflationary and the AMEX:USD will weaken as they need to debase the currency. Also...

OBM explorer has had a nice run and now has pulled back which gives us the opportunity to make an entry .59 looks supportive and I will buy some there. Currently price holding at 50% fibonacci level which means it could bounce from this area.

wow wow. Look at the price of iron ore. now sitting at support level. considering the price of everything has doubled since 2020 and the real price of iron ore should be lower. anyhows, I think the chinese people have had enough of the imperial outpost. They must be accumulating iron ore from South america and africa. The mines they invested in decades ago are...

KCN has done well sinces the previous breakout of a triangle formation. The Weekly line chart closing at a new high shows bullish signals for the price of KCN. I expect it to slowly climb to the next target of 5.50 which is about 100% gain on this break. Gold price will continue to rise as Wars need printed money.

PDI - weekly line chart. Inverse H + S pattern formed and now has confirmed a breakout. Not surprising that the gold price has helped this along. KISS is the key. Keep it simple. no need to excessive indicators. Just look at the price action. Line charts are good as they cut out all the noise and smooths out price action.

weekly line chart of KCN. Triangle setup looks nice and well formed. If the breakout happens to the upside expect a massive rally higher as this baby has been in a congestion zone for 5 years now. The gold price will move higher in 2025 as the USD will be debased to maintain the illusion of growth. Learn the history of the Mississippi bubble. The piper will be paid.

since 2022, the price of oil and gold have been diverging but they mostly will shadow each other. Commodities reflect the inflation of the money supply. This is the simple reason why they move together. they also diverged in 2018 but then realigned. this is a good time to buy oil companies.

GOR has broken out on the daily and weekly chart. Just need the month to close above the resistance level. Ascending triangle setup has completed the breakout. bullish on this miner and the price of gold still climbing. Gold in USD is close to breakout of a triangle. GOLD in AUD is making new highs.

BGL has been trading within a parallel channel since 2020. Price has now reached the lower bound of this channel range. This would be a good time to buy more BGL. Gold price has stablised and sitting flat for months now. I am expecting the gold price to move higher in 2025 unless there is a major crash in equities , which is a real possibility because of the...

QAN chart looks bullish. massive surge in price late in 2024 means insiders know something we dont. I expect QAN to touch $12 in 2025 as oil will remain cheap as well as cost cutting.

WOW looking cheap. technically the price has moved to 61% fibonacci level which is usually a strong level of support. current dividend yield at this price is about 3.5% which is also decent. There is a kabuki dance between WOW and the govt about price gouging but in reality everyone knows big business are very close to government. target sell for me at this...

AUD is weak but done intentionally by the RBA. Canadian dollar and NZ dollar also moving lower while USD showing more strength against these currencies. AUD is almost reached the lower bound of its historical lows around 58 cents. RBA will not raise rates until AUD makes new lows (under 50 cents) RBA is trying to create higher inflation in Australia by keeping...

NST has moved to all time new highs strong green candle has formed for the week ending. take a short term trade on this big cap gold miner up to $23. you can make about 36% every asset class is already hit saturation point except precious metals and their miners. We dont have free markets but we can still make money.

RRL breakout coz gold is steaming higher like a train. buy a position and hold on till $6 is hit and then exit the trade. GOLD will be the final asset class which will feel the inflation from government spending. all the cheap money has washed its way though the housing market already. saturation point has been reached and now the money will flow into GOLD. ...

ok. so it was Silverlake and then it was RED and now its VAU . The daily chart showing a nice down trend line breakout. I expect VAU to run up to 50 cents again and retest the highs for the year. Gold price in all currencies showing great resilience this year. In previous years every rally was followed by massive selling. The sellers are weak this year. ...