Roker1

Hi guys, as usual i start my analysis on the daily timeframe. In this case, if you zoom out you'll see the price is actually on a daily resistance level that has played a decisive role multiple times in the past. On lower timeframes you'll see there's a completed Gartley pattern that is still valid and has not hit first targets. In addition to that, we've got an...

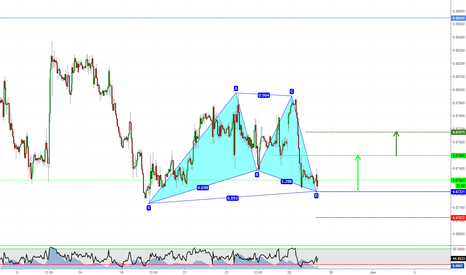

Hi guys, long time no see. Here i am with a new simple analysis: as you can see there's a Gartley pattern on the hourly timeframe of this chart (CADCHF), and i've already entered the market long. Be careful because this is a counter trend trade and it's riskier than other ones. Always put your stop loss when you're against the trend. If you have questions/ideas,...

Hi guys, very easy trade here. There's a Bat pattern completing right now on this 4H chart and i'm going short, with stops above X and targets along with Fibonacci (0.382 and 0.618 of AD). Positive note: price is in overbought and divergence conditions on the RSI below. If you have any question, feel free to comment below. Otherwise, see you in the next chart!

Hi guys, this is my last idea for this year. I hope it'll bring you some insights. First of all, the yellow box is representing a good structure level in the daily and weekly charts, that is the basis for each and every trade i place. After that, you can see the D point of a Gartley formation (though it's not valid at the moment) right near this spot. Alongside,...

Hi guys, it's been a while since i last posted an idea. I wanted to share with you this simple setup i'm looking at right now. I've already entered short in this pair, for a bunch of reasons. First of all, we have daily structure looking left (that is always key), then you can see a big bat pattern completed from some hours, but also a double top with RSI...

Hi guys, it's been a long time without posting. I've continued doing some analysis on the italian section but i've not had the time to publish my analysis here also. I'll try to publish more on the following weeks. I'm back with a very interesting analysis on AUDCAD. I'm not used to trade on Friday but i wanted to bring you something because i think it represents...

Hi guys, there are some instances where i trade directly at the D point of an harmonic pattern, and this is one of these cases. Reason why is that price has been rejected from a major resistance level and right afterwards it created this simple harmonic formations known as Gartley pattern. As of now, i'm looking to short the D completion point and set targets...

Hey guys, this is quite particular as a case study. Here on GBPCHF i've gone down to a lower timeframe because i was looking at the daily chart and i saw a double top with RSI divergence. Thus i went on the 4hr chart and looked for trading opportunities at the retest. Guess what i've found: another double bottom with again, RSI divergence at the second test. At...

Hey guys, this is quite particular as a case study. Here on GBPCHF i've gone down to a lower timeframe because i was looking at the daily chart and i saw a double top with RSI divergence. Thus i went on the 4hr chart and looked for trading opportunities at the retest. Guess what i've found: another double bottom with again, RSI divergence at the second test. At...

Hi all, i've been looking at this pair over the last days, and it finally turned into a trading opportunity right now. The blue zone is a structure zone in which price has lately been very sensitive and it's also been a zone in which price has gone overbought on the 4hr chart, also creating a short candlestick with an engulfing candle. Moreover, on the hourly...

Hi all, i've been looking at this pair over the last days, and it finally turned into a trading opportunity right now. The blue zone is a structure zone in which price has lately been very sensitive and it's also been a zone in which price has gone overbought on the 4hr chart, also creating a short candlestick with an engulfing candle. Moreover, on the hourly...

Hi guys, not so much on my charts these days (at least for my eyes), but i've been able to find this nice setup on the hourly chart. It's a bearish bat formation that's going to complete in a strong structure level (both daily and 4H) and i'm going to get in as soon as the price will touch the D completion point because of the higher trend and because it's a nice...

Hi guys, on the daily chart EURNZD is in oversold condition and it's also testing a key structure zone. That's why i've highlighted the yellow box that you see above. In cases like this, i like to go on smaller timeframes looking for additional clues to take a trade. In this case i've found multiple hints: first of all, on the 4H chart we can see a couple of...

Hi guys, on the daily chart EURNZD is in oversold condition and it's also testing a key structure zone. That's why i've highlighted the yellow box that you see above. In cases like this, i like to go on smaller timeframes looking for additional clues to take a trade. In this case i've found multiple hints: first of all, on the 4H chart we can see a couple of...

Hi guys, very simple setup: a Gartley pattern on the 4H chart that's just been triggered. I wasn't on my computer so i'm placing my order now, if price will hit the D point again, then i'll be in. Make sure to put your stop loss below the X point. As for targets, i've used as usual the 38.2 and 61.8 Fibonacci retracement of the AD leg. If you have...

Hi guys, this is the hourly chart on EURJPY and i'm taking this long trade because of several reasons. First of all, we're in a strong supporto zone on the daily chart and we're also creating a nice divergence on the RSI there. Then, if we lower a timefeame (4H), you can see a couple of pinbars (candles with long wick to the bottom) signaling buying pressure...

Hi guys, this is the hourly chart on EURJPY and i'm taking this long trade because of several reasons. First of all, we're in a strong supporto zone on the daily chart and we're also creating a nice divergence on the RSI there. Then, if we lower a timefeame (4H), you can see a couple of pinbars (candles with long wick to the bottom) signaling buying pressure...

Hi guys, there are several reasons why i'm going long on this pair. For starters, price is testing a very important structure level that you can see both on the daily and weekly timeframe, and in doing so it's creating a nice divergence on RSI on the daily. Moreover, if we lower a timeframe, we can see on the 4HR that we have two engulfing candles (one after...