RoninAITrader

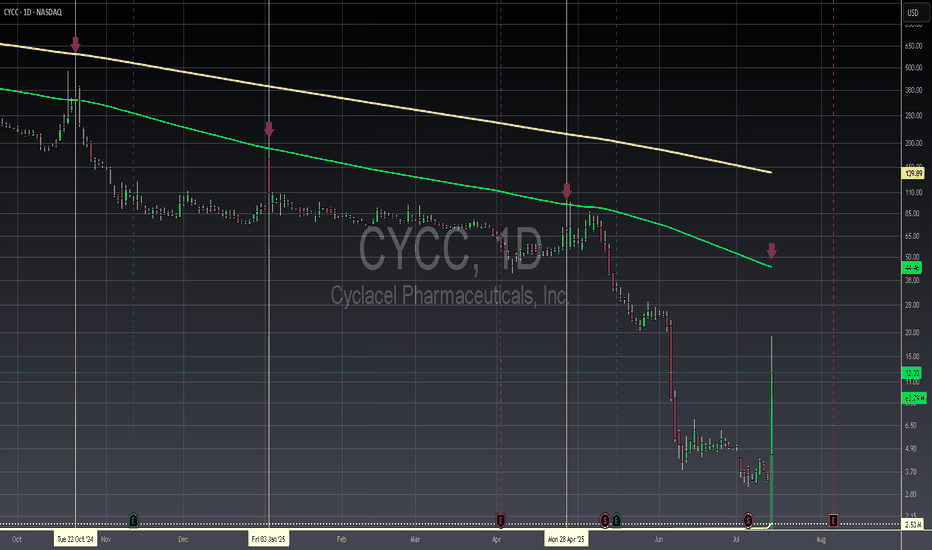

A notable short squeeze is underway, with most short positions closing on July 24, 2025, potentially aiming to trigger stop-losses for remaining shorts from November 2024. The stock has seen quiet accumulation since August 2024, driven by existing money recycling and new participants. Despite being founded in 1999, the company maintains a $40 million market cap...

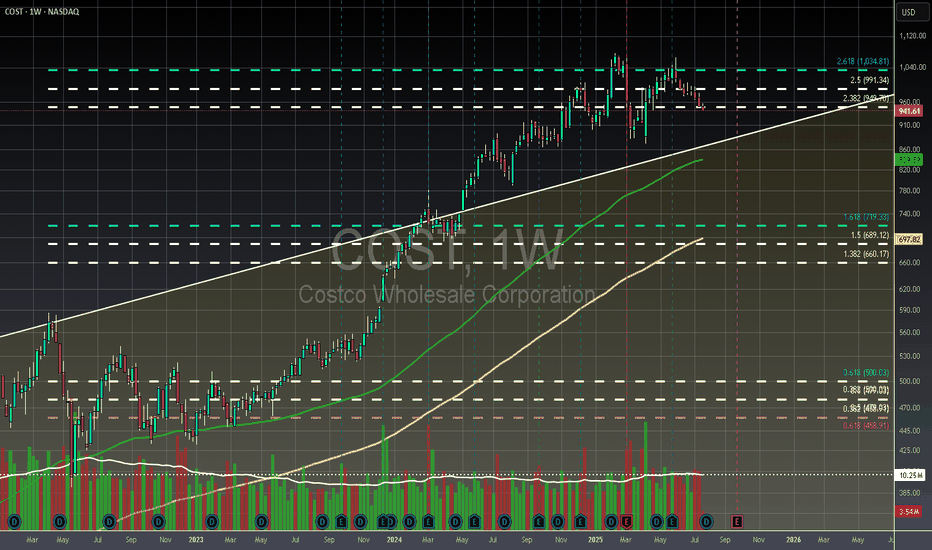

Costco is currently trading outside a monthly channel it has been in since 1992, which could signal strong demand or overzealous traders. If Costco fails to break the $1034 Fibonacci level, considered the golden target for bulls, a reversal is likely, potentially leading to a return to the 100-period weekly moving average. Despite these trading observations,...

If a company is being forced to split just to stay in line with exchange regulations, that's a huge warning sign right there—it's a clear indication to avoid investing. Secondly, consider this: a company that's been around since 1996 and still can't crack a $50 million market cap? That screams problems with their leadership. Financially, while there was a notable...

This company, founded in 2007, maintains a modest market cap of $26 million, indicating a lack of significant investment. They have consistently experienced negative net income between 2022 and 2024, and despite an improved free cash flow in 2024 compared to 2020-2023, their cash and equivalents are nearly depleted, suggesting potential financial difficulties in...

LSAK, currently boasting a low $366 million market cap, presents an intriguing investment opportunity, particularly with institutional backing from powerhouses like Morgan Stanley and Goldman Sachs, each holding over 6% of its market share. While its primary client base is in South Africa, the company's business model suggests a strong potential for continued...

This company, a Software as a Service (SaaS) marketing platform with a market capitalization of $9 billion, presents a compelling investment case. Its SaaS model inherently suggests lower overhead and a strong potential for sustained profitability, a track record this company has consistently demonstrated. Furthermore, the stock's short interest is currently at...

Shopify (SHOP) appears to be on a strong upward trajectory, technically positioned within a sustained monthly channel that suggests continued appreciation. This outlook is bolstered by consistent revenue growth since 2020 and a robust recovery from its 2022 net income deficit, with the company demonstrating improved free cash flow and cash equivalents in 2024....

Click Here🖱️ and scroll down👇 for the technicals, and more behind this analysis!!! ________________________________________________________ ________________________________________________________ ..........✋NFA👍.......... 📈Technical/Fundamental/Target Standpoint⬅️ This company shows strong financial improvement with consistent revenue growth since 2020 and...

Click Here🖱️ and scroll down👇 for the technicals, and more behind this analysis!!! ________________________________________________________ ________________________________________________________ ..........✋NFA👍.......... 📈Technical/Fundamental/Target Standpoint⬅️ 1.) The most recent two earnings reports came in slightly below expectations, but not enough to...

Click Here🖱️ and scroll down👇 for the technicals, and more behind this analysis!!! ________________________________________________________ ________________________________________________________ ..........✋NFA👍.......... 📈Technical/Fundamental/Target Standpoint⬅️ 1.) Consistent year-over-year growth since 2020 highlights a strong and established upward...

Click Here🖱️ and scroll down👇 for the technicals, and more behind this analysis!!! ________________________________________________________ ________________________________________________________ ..........✋NFA👍.......... 📈Technical/Fundamental/Target Standpoint⬅️ 1. Long-Term Perspective: While recent market volatility may induce panic, it's crucial to...

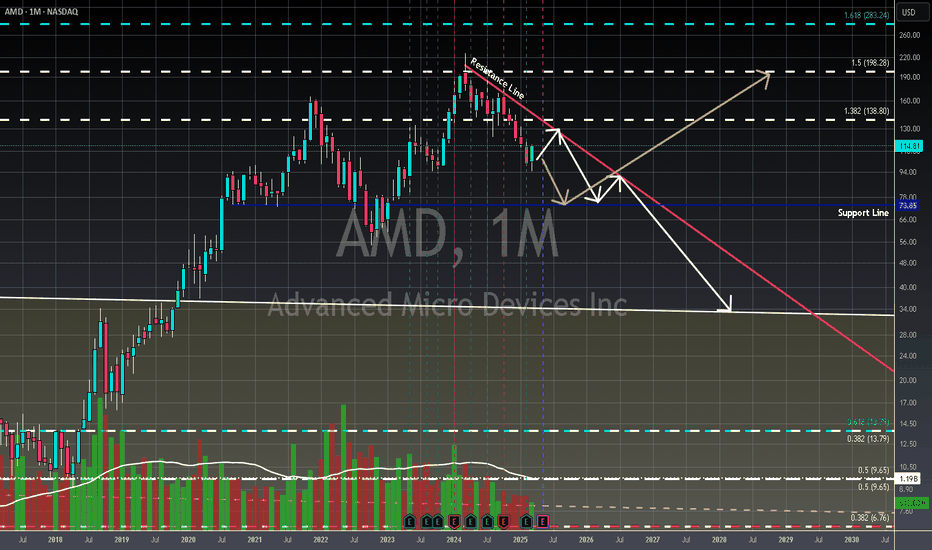

Click Here🖱️ and scroll down👇 for the technicals, and more behind this analysis!!! ________________________________________________________ ________________________________________________________ ..........✋NFA👍.......... 📈Technical/Fundamental/Target Standpoint⬅️ 1.) AMD's strategic execution and innovative product portfolio have fueled a truly remarkable...

Click Here🖱️ and scroll down👇 for the technicals, and more behind this analysis!!! ________________________________________________________ ________________________________________________________ ..........✋NFA👍.......... 📈Technical/Fundamental/Target Standpoint⬅️ 1.) Tariff Concerns Weigh on Risk Assets: Recent tariff announcements are negatively impacting...

Click Here🖱️ and scroll down👇 for the technicals, and more behind this analysis!!! ________________________________________________________ ________________________________________________________ ..........✋NFA👍.......... 📈Technical/Fundamental/Target Standpoint⬅️ 1.) Concerns: - High Volatility: Rapid stock price increases can be followed by significant...

Click Here🖱️ and scroll down👇 for the technicals, and more behind this analysis!!! ________________________________________________________ ________________________________________________________ ..........✋NFA👍.......... 📈Technical/Fundamental/Target Standpoint⬅️ 1.) Technical Momentum Shift: Recent trading activity suggests a bullish sentiment, with multiple...

Click Here🖱️ and scroll down👇 for the technicals, and more behind this analysis!!! ________________________________________________________ ________________________________________________________ ..........✋NFA👍.......... 📈Technical/Fundamental/Target Standpoint⬅️ 1.) Directional Bias: A slight bullish lean is observed, but requires stronger confirmation. A...

Click Here🖱️ and scroll down👇 for the technicals, and more behind this analysis!!! ________________________________________________________ ________________________________________________________ ..........✋NFA👍.......... 📈Technical/Fundamental/Target Standpoint⬅️ 1.) Revenue and Profitability: While 2024 revenue was relatively stable compared to 2023, a...

Click Here🖱️ and scroll down👇 for the technicals, and more behind this analysis!!! ________________________________________________________ ________________________________________________________ ..........✋NFA👍.......... 📈Technical/Fundamental/Target Standpoint⬅️ 1.) Potential Negative Impacts: - Increased Production Costs: Tariffs on Mexican goods will...