Rowland-Australia

PremiumUSDCHF is now net long on the regression break. I am using my EA on this pair as it has positive roll long.

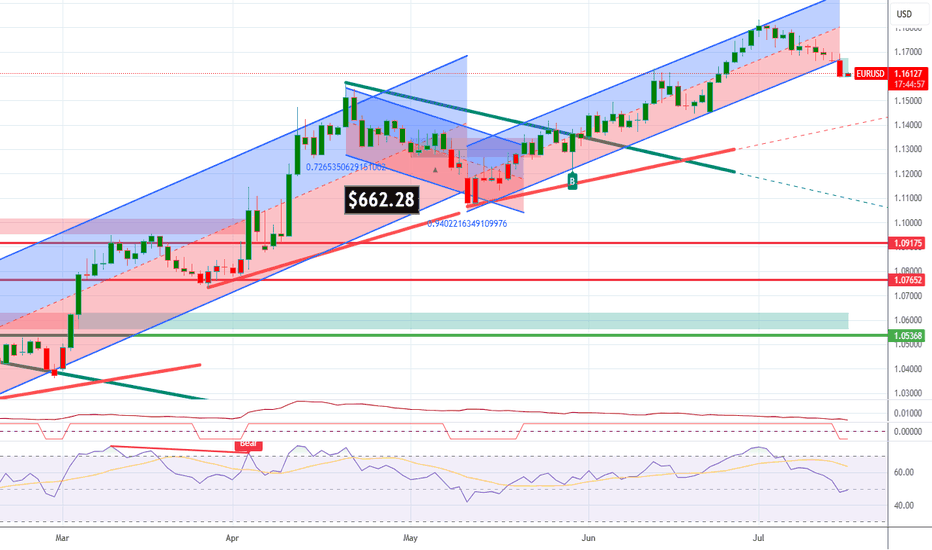

EURUSD is not net short on the regression break. I am considering my options here.

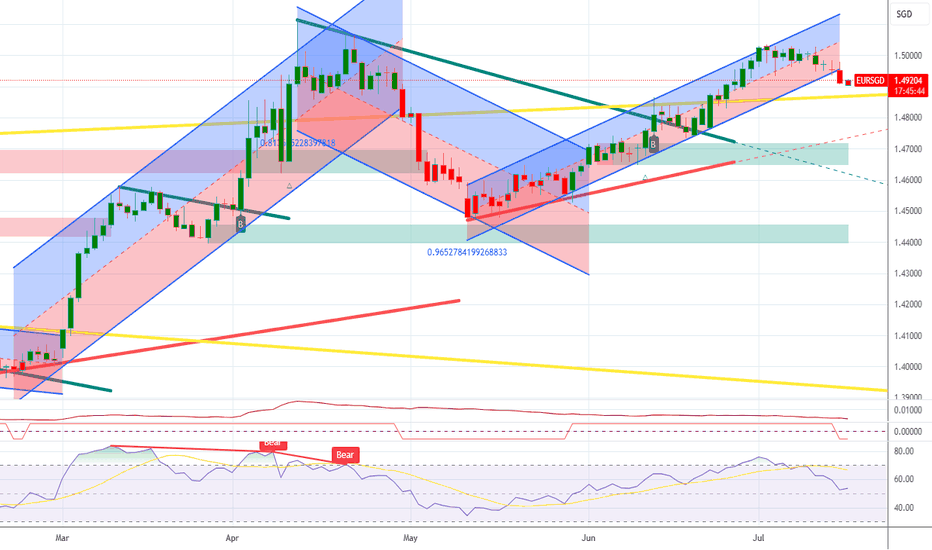

EURSGD is not net short on the regression break. SGD is losing to the majors - I am not sure if this is a trade worth taking.

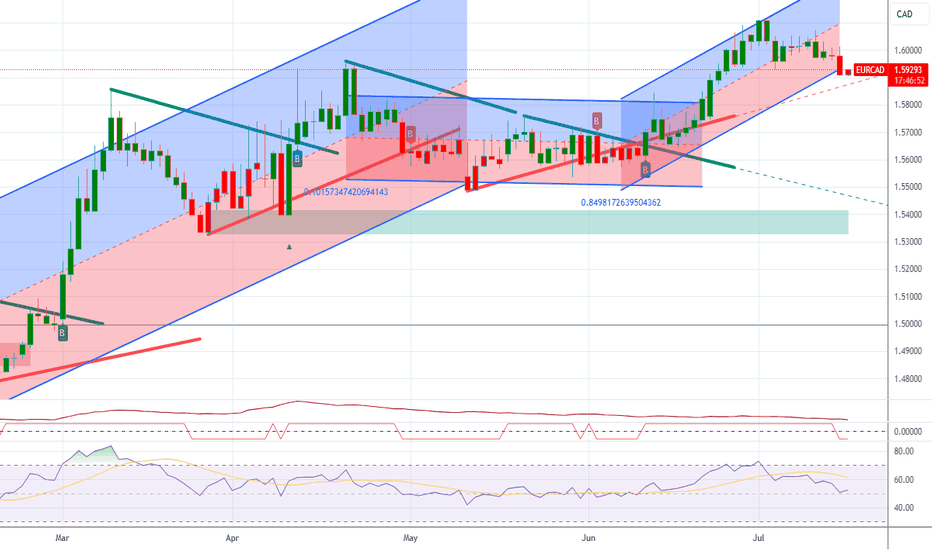

EURCAD is now net short on the regression break. I am considering my options on this pair. (EA with limited risk)

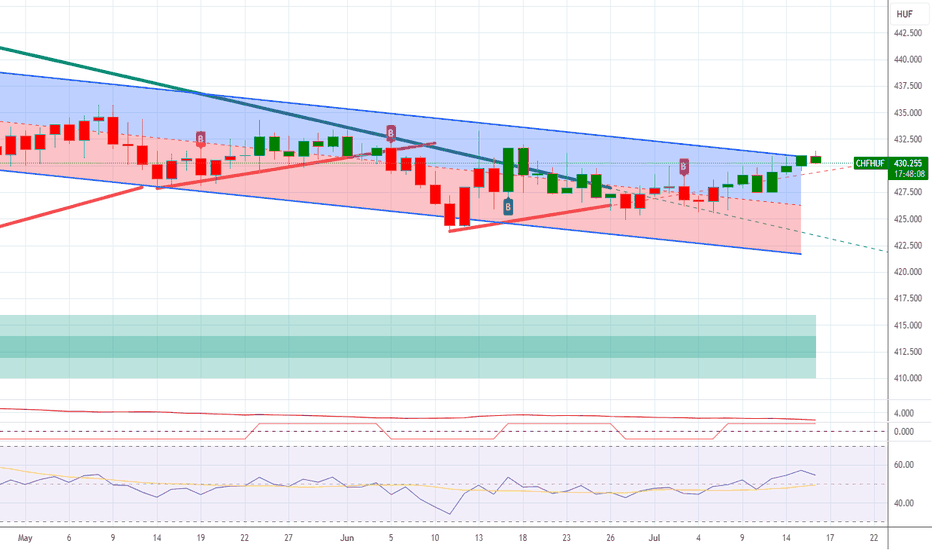

CHFHUF is now net long the regression break. I am not taking this trade as the roll is just terible.

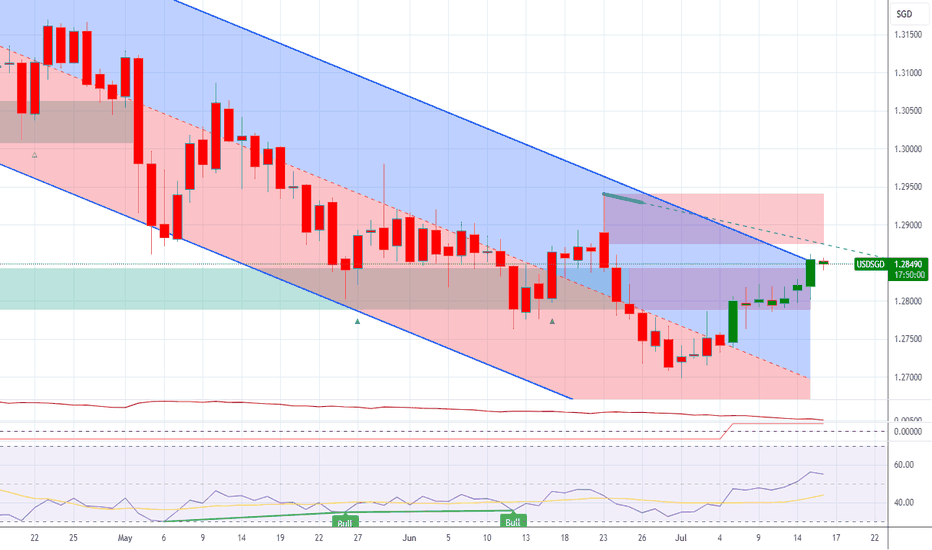

USDSGD is now net long the regression break. I am consider the USD pairs for the day, but this one may not be on the list.

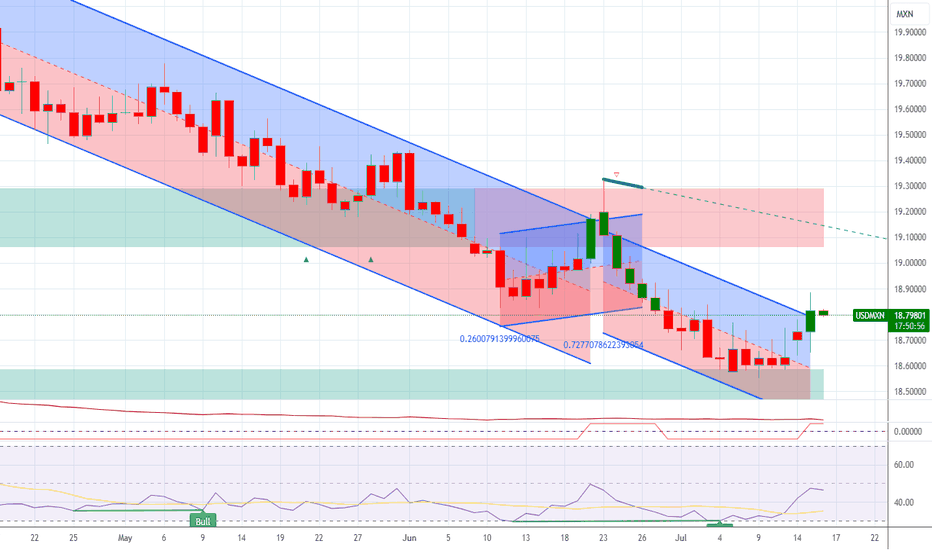

USDMXN is not net long on the regression break. There is a large negative roll on this pair long and I will not be taking this trade.

META is now net short on the regression break. I am not taking this trade.

HE1! is now net short on the regression break. The roll on this commodity short is (-3.2%) for the front month. I am not taking this trade.

GBPSGD is now net short on the regression break. I am consider all GBP pairs today.

NOC is now net long on the regression break. I am considering my options on this trade.

GBPUSD is now net short on the regression break. I am considering my EA options on this pair.

Google is now net long on the regression break. I am not taking this trade at this time.

AUDHUF is now net long on the on the regression break. All AUD pairs are on run and worth considering with the correct pair.

EURAUD is now net short on the regression break. It may be worth considering a trade here.

AUDNZD is now net long, and this is it's first break in months. I am reviewing all AUD pairs.

AUDJPY is now net long on the regression break. I am not taking this trade at this time.

AUDCHF is not net long on the regression break. I am consider all CHF pairs this morning.