2/3 anchors for this signal, bull-div with good volume profile, inverse HnS on the QRsi (4Hour) and a trend breakout+retest. Very Bullish!

Daily + weekly volatility is in the bullrun phase for both BTC and "TOTAL" Marketcap. If BTC flags out in this 6.0 HVQ Volatility Index area, retesting the trend support, bingo = consolidation before megamoon But, that consolidation could go on for awhile. I have an overall LONG narrative, but am not buying at these levels. Looking to YOLO/FOMO a breakout, or...

This video goes through my charting process using the trio of indicator's I've developed to work in concert with each other. This is the process I use to explore historical price action and develop a narrative to use during my near-future trading activity for that asset. Just as important as entries and exits, understanding market structure and being aware of...

From investopedia: "Generally speaking, inflation occurs if M2 money supply expands faster than the rate of productive growth in the overall economy" What I'm looking at here is a classical charting pattern painted by the QuantRsi: With the QuantRsi applied to the Monthly M2 chart, a pattern is painted which can be used for technical analysis and classical...

BINANCE:XMRBTC Finding chart patterns in the QRsi candles and combining those signals with Heffae Clouds trading rules results in a highly successful trading strategy. See my prior published ideas for examples of these patterns in use. You can see prior HnS / IHnS formations on XMR/BTC playing out on the QRsi candles, with one epic failure to rally after the...

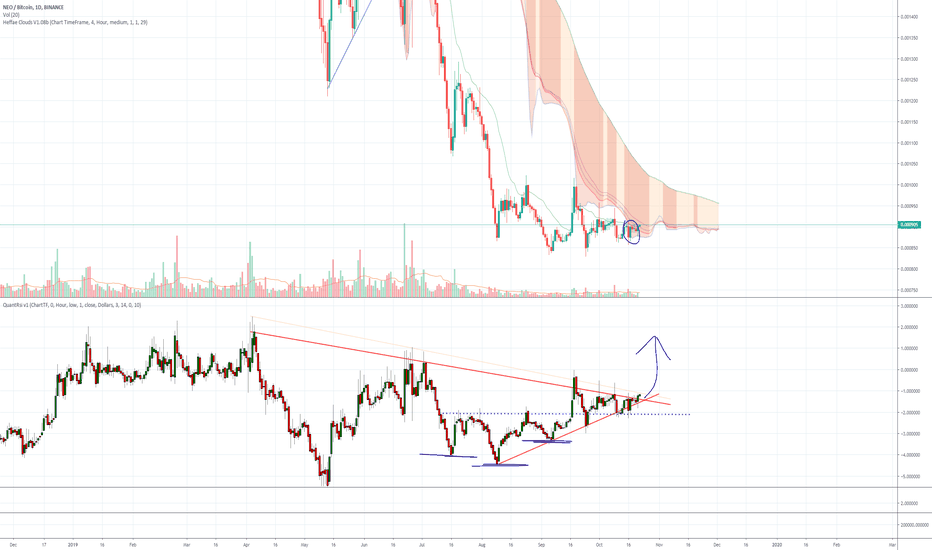

At first glance this NEO chart looks like consolidation with dwindling volume, however the QuantRsi and Heffae Cloud indicators paint a potential bullish scenario. First there is the Daily cloud entry, which is a sign of bullish reversal. The inter-cloud paths still pose a threat of heavy resistance, but historically, high timeframe cloud entries like the one...

Play by play, from left-to-right Price dumps to QRsi - 10 levels Consolidation at -7 to -10 Volatility Gap on escape candle from -7 consolidation pattern First trend resistance is a big rejection Second Trend interaction crosses now as support Price re-tests this breakout R2S trend while making a lower low, completing BULL DIVS on the QRsi Price...

Quick tutorial on QuantRsi - drawing the trends with QuantRsi on EOS/BTC Daily and 4Hour charts. Set up drawing templates so your trends only show on the applicable timeframe Create an alert on the QuantRsi trend you want as support / resistance (note, in current version of QuantRsi, use "alert trigger" instead of "plotcandle Close"

This is part one of a tutorial on the basic principles, techniques, and features of the QuantRsi trading system. This is Part 1 of the tutorial, and does NOT discuss how the QuantRsi can be used for trading decisions. Please see part 2 for instructions for how to use these tools for trade entries, exits, risk analysis and more. We start by building a...

ETHUSDhas come up nicely off of support; I was in a long position from ~130 based off the 3Day QRsi trend support here: However, I'm currently FLAT due to the massive interruption the 4H cloud brings to the rally. This particular 4H cloud path has proven it's strength, and price will need to push it's way through this level with energy left to clear the top...

Building a chart to identify trading opportunities with the Quant Rsi. Here is a quick & dirty (and really ugly) chart as an example for setting up a trade or series of trades with QuantRsi. Don't let the messy chart turn you off... , this is an overdrawn example to show all interactions. Also, once you set up templates for every timeframe in your drawing...

XRP is getting tighter, and as much as I fundamentally dislike the coin, I will trade it. There is a bullish trend cross on the 4H QRsi. First target is ~2.15% up from here. SL is ~ 1.25% down. There is a good chance of continuation here, this trade might be worth holding.

LTC/BTC has had quite the selloff, however all hope is not lost yet. On the 4Hr chart, there are some signs of life as LTC/BTC makes a weak bounce on the 4Hr Cloud as well as vauge QuantRsi support. The 4Hr Cloud interaction has broken through the bearish side and is signaling that the levels we came from won't be revisited anytime soon... but this could...

Left is current BTC price action on the daily timeframe, on the right is BTC on the 12H Timeframe. Using the QuantRsi to find hypothetical Support targets, and Heffae Clouds as a guide for price movement. In this case, both indicators align to paint the same target. Showing a prior instance of similar setup on the right pane.

WTI paints some impressive bullish signals on Heffae Clouds + QuantRsi longer timeframes. The idea of this trade is driven purely by technicals, I am not in the loop on fundamentals whatsoever. Daily chart shows inverse HnS on the QuantRsi as well as a new trend developing that shows upside potential: As warning, The last time Qrsi ran -7 on the 3Day QRsi,...

- I apologize for the chart formatting, TradingView needs to add a preview button and allow chart manipulation during a preview stage. I'm using multiple monitors and the charts looks great until it gets published... I feel like any bearish sentiment will be wildly unpopular, however the technicals indicate that ETH may be on the brink of slipping into a bearish...

From investopedia: "Generally speaking, inflation occurs if M2 money supply expands faster than the rate of productive growth in the overall economy" what I'm looking at here is a classical charting pattern painted by the QuantRsi: Applied to the Monthly M2 chart. Looking at the indicator as well as the fibs (log scale chart, correct fib tool used to prevent...

Chart is Heffae Clouds 4Hour (left) and 8Hour (right) I added arrows to highlight signals you may trade on with the cloud SnR paths. The "target" on the current 4H candle is the RealTime Additive, which is a trend indicator, and can act as resistance here if the trend is to continue down. The 8Hour has signaled a drop out of cloud bottom, which is bearish....