SPYDERMARKET

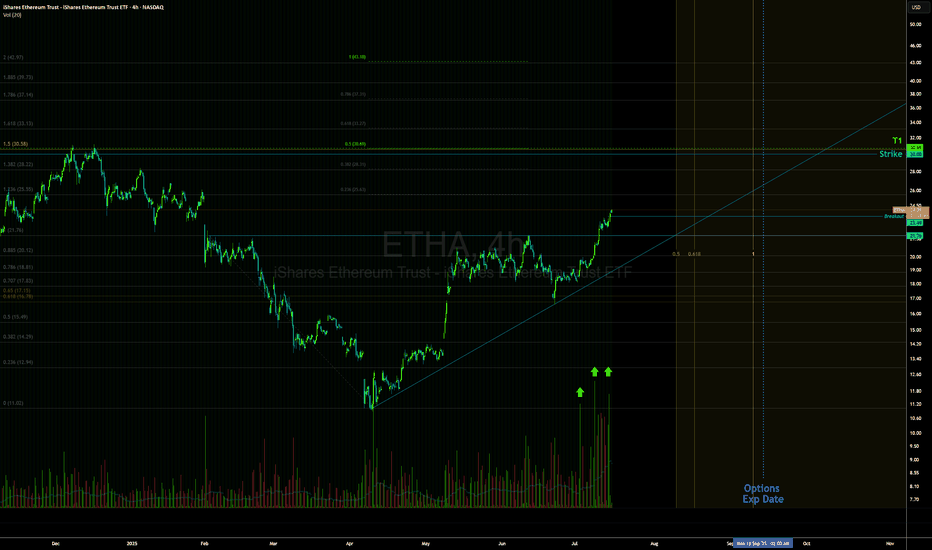

PremiumBreakout of inverse H&S, BTC massive breakout and following through. Looks like we can see $30 +, Buying time on these contracts. Volume looks amazing.

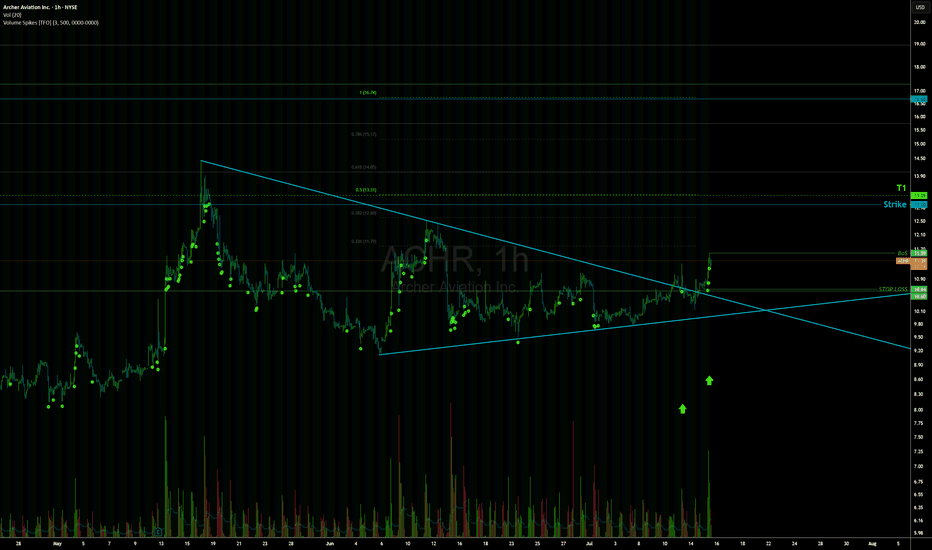

Simple breakout structure with volume, $13 near term target, Will target $16 next.

Strong Profits The company makes solid money on what it sells. It keeps a high percentage of revenue as profit, with strong margins all around. It also generates good returns from the money it invests. No Debt, Plenty of Cash The company has almost no debt and a strong cash position. It has more than enough to cover short-term needs and stay financially...

🚀 NYSE:LDOS – Breakout Setup After Months of Accumulation NYSE:LDOS is showing a high-conviction breakout setup after six months of tight accumulation. Here's what I'm seeing: 🔹 Flagging on the 8EMA with low volume – classic bullish continuation 🔹 Clean structure with higher lows and controlled pullbacks 🔹 Volume drying up during the recent consolidation =...

NBIS Fundamentals. 1. Massive Growth – The stock’s up a jaw-dropping 138% in just 3 months! 2. YTD Beast Mode – Up 81.6% so far in 2025. 3. Momentum Heating Up – Gained 36.9% over the last month alone. 4. Super Low Debt – Debt-to-equity at just 0.06 — strong balance sheet! 5. Sitting on Cash – Over $6.42/share in cash with a killer 9.59 quick...

Watching this wedge, Trump making headwinds with trade talks, striking a vietnam deal. Buyers still in control but hesitant, the "Big Beautiful Bill' being hashed out in the next couple of weeks. Could easily see a small pull back into the EMA's, Betting we see prices higher to the bullish target $700 if we can break above T/L with nice volume.

Following the strong quantum theme. Lice breakout with volume while spy weakening. $18-$21 targets.

Breakout setting up continuation, seeing a squeeze signal, BoS 647, ride to 670+.

Caught shares on the breakout, looking to target the 50% fib extension. $41, ride the rest.

ES Futures have decisively broken down from the ascending wedge pattern that had been forming over the past few weeks. This bearish technical breakdown suggests a potential shift in market sentiment and momentum. Given the high correlation, I'm anticipating that SPY will follow suit shortly, especially as macroeconomic pressures intensify. The catalyst appears to...

Great Earnings, Technicals seeing nice volume into a CHoCH, after many months watching this ticker. Breaking out, Id like to see $23+

PLTR breakout C&H, Sell Climax at bottom of cup, breakout, Flagging on low volume outside the breakout, Looks like we are getting a nice move soon, watching for that flag to break out on lower TF.

Consolidating nice here, Hodling this baby, $6 soon, based on fibs, Log, Wouldnt $32 be nice by Jan 2027! Did anyone expect the first pattern to get a full 100% extension! NOOOOOOOOOO.

Valuation is now ~25x forward earnings (down from >30x). CEO Lisa Su reported a strong Q1 2025 with double-digit revenue growth and a 50% gross margin. Investment view: AMD is a solid value play in the rapidly growing AI hardware market. CHOCH Retesting a Breakerblock / Breakout. $140 Target.

Eying this Adam & Eve Pattern, Volume seems to be in harmony with more upside. IF we see movement W/ Volume past the res line, Ill be a buyer targeting $15+.

In a long position on HOOD, With crypto making nice moves, and Hood being a large holder, Could benefit. H&S got wrecked on the macro, inverse H&S showing strength after the breakout following BTC. a lot could happen with red folder news this week, $70 Im looking for soon.

I’m short NASDAQ:QQQ 👇 based on NQ, obv... Anticipating a 2022-style ICT iFVG bearish model. Front-running the setup w/ GDP shrinkage narrative (real or not, price moves on perception). Targeting $420 → sub-$400, making macro lower lows. I have targets. Sounds nuts? Maybe. But when we get there… I’m very long. 📉📈

I can see SPY moving this way—a potential relief rally off the unmitigated order block from September that caused the imbalance and the macro Break of Structure (BoS). We've already taken out some key sell-side liquidity at the Equal Lows from October/November (EQL), so there's no immediate need to keep chasing more sell-side liquidity. If an aggressive buyer...