TRX has been making lower lows since March 18th, while failing to make higher highs. This creates an ascending triangle, which TRX is now breaking out of. Target is the depth of triangle - which would put it in the 900s. RSI is overbought across the board, so it could use a small pullback before continuing higher.

NULS has formed a MASSIVE bull flag, with the pole extending from the all time low to the all time high on the daily chart. It just broke up after almost 4 months. This will take time to develop - get your popcorn.

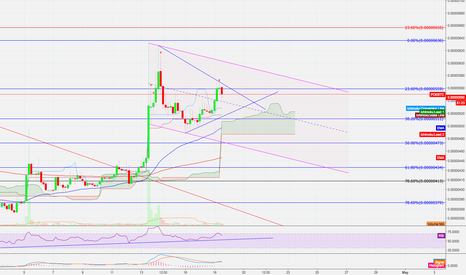

Pretty self explanatory. POE is traveling in a descending channel atop the flag pole from the most recent bullish movement AKA bull flag. Within the flag there is a symmetrical triangle (blue lines). RSI is respecting the uptrend on the 4 hour. Expectation (assuming BTC behaves) is that price will continue to appreciate, with a break up of the triangle leading to...

LSK had a strong retrace of just more than 78.6% of its complete movement from the pair's absolute high and low since being introduced to the Binance exchange. Price is currently sitting above that retracement level now, as shown in the daily chart on the right, and recently pushed through the top of the symmetrical triangle. Further upward movement is being...

After breaking through the red resistance and entering the cloud, LEND predictably broke out violently from the blue symmetrical triangle. It is now over bought on multiple time frames, so looking for a breather.

REQ just broke the second descending resistance, and cleared the 1 hour and 30 minute Ichi clouds. It is making it's way to the top of the 4 hour cloud, and has found support on the 50 and 200 EMAs on all of these time frames. RSI is moving towards overbought, so a test of previous resistance as support would not be a surprise. Than, assuming BTC behaves, onward...