Se7enSkies

1) Global Chip shortage (diminishing supplies) + Extremely High demand = TSEM touching $600-$700 before 2026-2027.

For every action, there is a reaction and I don’t think we have seen Gold react to the giant parabolic move that started in December 2015. You can’t be in an uptrend for over 5 yrs and expect to not have a big downward correction afterwards. I’ve been thinking it’s only the beginning of the bull run, yes it is but when you go from $800/oz to $2,070/oz in 5 years...

Good evening, 1) BCH is forming a gorgeous H&S. I cannot say that it is a complete pattern, but the way the price has been moving I can only think of a H&S. 2) BCH has been trading at a trend line that was established in December of 2018 and the price has not gone below that trend line since then, but if this bearish H&S pattern completes, then we can also...

Ladies and Gents, 1) Silver has been in a downtrend since 20th of May. 2) to me, it looks like the price action has formed a pattern that resembles a Falling Wedge. 3) Usually when a falling wedge is complete, the price breaks out starting a bull run. 4) according to this pattern, we may not be done with the downward price movement. My target for a reversal is...

So what y’all think? Is this a H&S or not? $22 level has shown support and we have a chance to rebound from here, but What if this ugly pattern turns out to be a Head & Shoulder? I would appreciate it if people could share their thoughts in the comment section below.

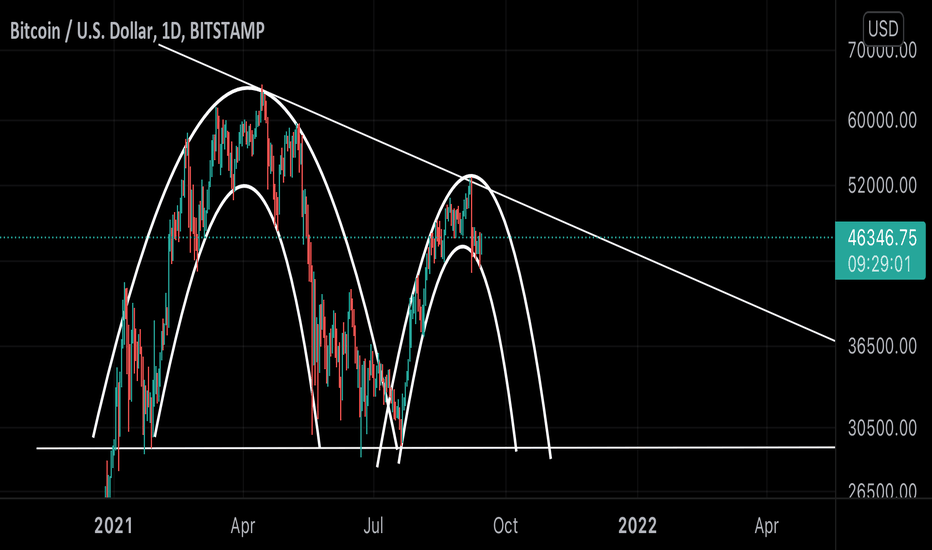

1) Bitcoin is trading within the boundaries of a descending triangle. 2) within that triangle Bitcoin has formed a complete cup in reverse and another cup in reverse is forming and not complete (the second reverse cup is not confirmed yet), which tells me that the jump to $52K was the top for now. 3) I expect the bottom for this reverse cup to be around...

1) you’re looking at XRP weekly candle chart 2) I smell the formation of a parabolic move. The parabola drawn (there is a percentage of uncertainty with the timeline of the parabola) is showing the top to be reached in June 2022 (+or- 3 months off). The target is $310 which is too F***in high so there is a chance that we will reach the top earlier but with a...

1) Ethereum is in a rising wedge 2) My target for the rising wedge is a top of $4.2k. 3) The completion of this rising wedge will confirm the formation of a huge double top. The double top can be the end of the bull market or it can morph into a Cup & Handle which can push ETH to new all time highs.

BTC has been holding up well after a big jump from $29k to $50k, but the daily price chart and the RSI are showing a hidden bearish divergence as shown by the lines on the price and RSI charts. This pattern is indicating a price drop after BTC managed to go up by 72% from $29k. I do not know how low we can go and I don’t have a target yet and I need to study the...

I feel the formation of an Ascending Broadening Wedge on the Gold 1D chart. Gold is experiencing high fluctuation and strong selling pressure as we hit the top line of the channel. This price pattern and the behavior of the sellers can lead to a bearish move for Gold price. On the other hand, there is a strong support at $1,760s shown by the horizontal line. A...

Gold is going parabolic against Silver. It’s a not a giant parabola and my final target for this parabolic move is a Gold to Silver ratio of 85:1. If the ratio holds around 85:1 without a drastic drop, then Gold may gain more value against Silver, but for now I will wait to see if we can reach 85:1 and then decide on what to do.

I recently published an idea that discussed the possibility of an ascending wedge (a bearish pattern). Well, right now I can see the ascending wedge developing, but in addition to that, I also see a hidden bearish divergence (a bearish pattern) on the daily RSI. My target is around $50k and then down we go. I also tried to draw parabolas on the BTC chart and it...

If this is in fact a Bull Flag then I expect the price to reach $1,820-$1,830 soon. But some people believe we are in a big descending channel and Gold will fall down. We will see which one plays out in the near future.

Whatever I want to say is shown on the chart. Please look at the chart and let me know what you think.

If H&S works on RSI and if this is actually a H&S forming on the monthly RSI, then Gold is f*****. If the RSI turns bullish by forming a reversal pattern then the H&S idea will be invalidated. I’m just very worried about this chart pattern on the RSI and there’s lots of room for RSI to go down from here.

My eyes see a pattern that looks like a rising (ascending) wedge (known as a bearish pattern) on the weekly chart of the Gold/Silver. If this pattern completes, then I expect Gold to lose value against Silver. Since the pattern is trying to form in a long timeframe we may see Gold lose value against Silver for a few years. As I said I cannot 100% confirm that this...

I see a rising (ascending) wedge on on the Bitcoin 4H chart. This means we will go down for sometime. My first target for btc is around $42k. It has played out as resistance before, if it turns into support, we may not be over with the uptrend. I will wait and see what happens at $42k level to study what happens beyond that price level. I forgot to mention…I also...

According to Gold symmetrical triangle on the weekly chart, my target is $1,845-$1,850. If we reach that target soon then there’s also chance of breaking out of the triangle. If Gold doesn’t manage to jump from here and the support at $1,680 fails to hold, then we’re f*****.