Shane-investment

Gold price hits a record $3,167.84 before pulling back as traders lock in profits after a steep safe-haven rally. XAUUSD support sits at $3,083.65, with a break lower exposing $3,000.28 as the next key downside level.

US stock futures fell on Monday, signaling March's market struggles are set to continue in a week highlighted by the Federal Reserve policy meeting.

Stocks continue falling as recession worries surface. Wall Street suffered its steepest decline of the year on Monday, a drop fueled by angst about the economy a day after President Trump refused to rule out the possibility that his policies could trigger a recession. The S&P 500 slid 2.7 percent, the worst daily fall in an already three-week-long stretch of...

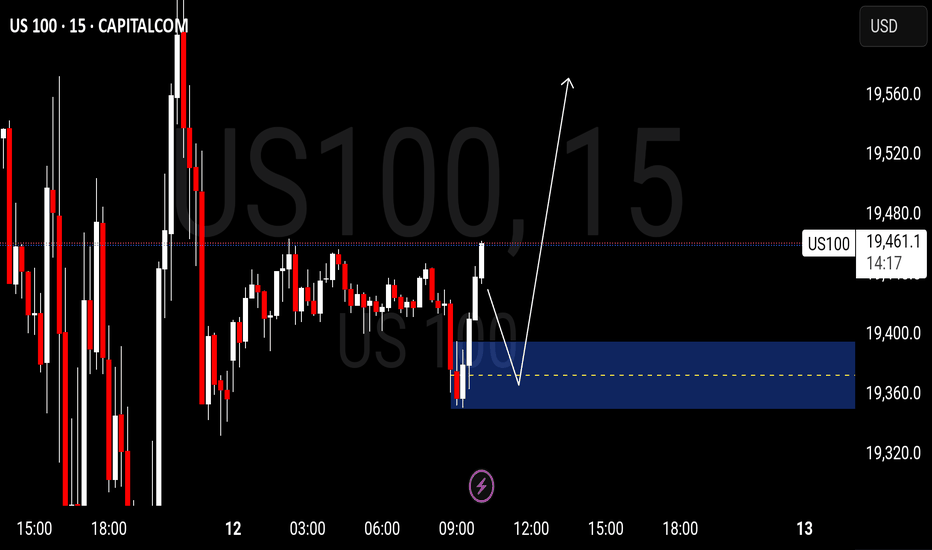

Price created a demand ...before buying price ...it need to come down first before moving back up

US stocks plunged on Monday as investors processed growing concerns about the health of the US economy after President Trump and his top economic officials acknowledged the possibility of a potential rough patch. The Dow Jones Industrial Average (^DJI) fell nearly 900 points, or over 2%, while the benchmark S&P 500 (^GSPC) dropped around 2.7% after the index posted its

Nasdaq broke the Asian low range and now closing inside Asian range ...price might target the Asian High to create a manipulation

US stock futures held steady after a volatile day of trading ended in a rally, driven by President Donald Trump's one-month pause on tariffs targeting automakers. Futures attached to the Dow Jones Industrial Average (YM=F) slid hovered around the baseline and the benchmark S&P 500 (ES=F) slipped 0.1%. Futures attached to the tech-heavy Nasdaq (NQ=F) inched down 0.1%.

Whether you're going short or long, these key price levels provide you with a unique advantage, helping you navigate the market with precision and make more informed decisions based on real liquidity zones and institutional activity.

XAU/USD Gold gained nearly 1% in the first trading day in 2025, sending initial positive signal that recovery off $2582 (Dec 18/19 higher base) might be picking up. The notion is supported by completion of bullish failure swing pattern on daily chart and breach of important barriers at $2637/42 zone (Fibo 38.2% of $2726/$2582 bear-leg /converged 20/30...

Gold prices on course to end 2024 with a 27% gain, the best yearly performance since 2010. 2025 outlook is positive due to geopolitical risks, central bank buying, and safe-haven demand. Trump administration policies present both risks and opportunities for gold prices. Technical analysis shows potential for further gains, but a deeper correction before reaching...

Today Is Final Day of 2024 Trading; Markets Closed Tomorrow Investors are preparing to take a break from trading with the New Year's Day holiday Wednesday, when both stock and bond markets will be closed. Today, bond markets will close early at 2 p.m. ET. Markets will resume normal trading hours on Thursday for the first trading session of 2025. It's been a...

Gold Steadies as Traders Focus on Uncertain 2025 Rate Path

Gold is booming. So is the dirty business of digging it up

With the holiday season underway, this week may be less volatile than the previous one, which was dominated by central bank decisions. This presents an opportunity to analyse the broader trends and outlook for gold prices in 2025.

'Because gold is honest money it is disliked by dishonest men. '

Price has created a 1H B.O.B that's currently u tested...price need to retest that untested B.O.B before price can continue to fall in the long term

The Fed left interest rates unchanged as expected at the last meeting with basically no change to the statement. Fed Chair Powell stressed once again that they are proceeding carefully as the full effects of policy tightening have yet to be felt. The US Core PCE last week came in line with forecasts with the disinflationary progress continuing steady. The labour...

The U.S. dollar, as measured by the DXY index, fell nearly 3% in November, weighed down by the downward correction in U.S. yields triggered by bets that the Federal Reserve has finished raising borrowing costs and would move to sharply reduce them in 2024 as part of a strategy to prevent a hard landing. While some Fed officials have been dismissive of the idea of...