ShogunDK

PremiumWe have a little zone of confluence. With the 0.382 macro retracement from ATL/ATL stacking with the 1 to 1 fib trend from ATL coming in around 32. You have have monthly level and the pyschological 30 level. 1 way to approach the long would be to see price go below previous low/key level and look for some strength in terms of closing a daily or weekly candle back above.

Should VISA pullback to the lower support zone. Look to swing long back to ATH with the big target of around 400 where 1 can look to swing short. The typical 3 peaks and a dump setup.

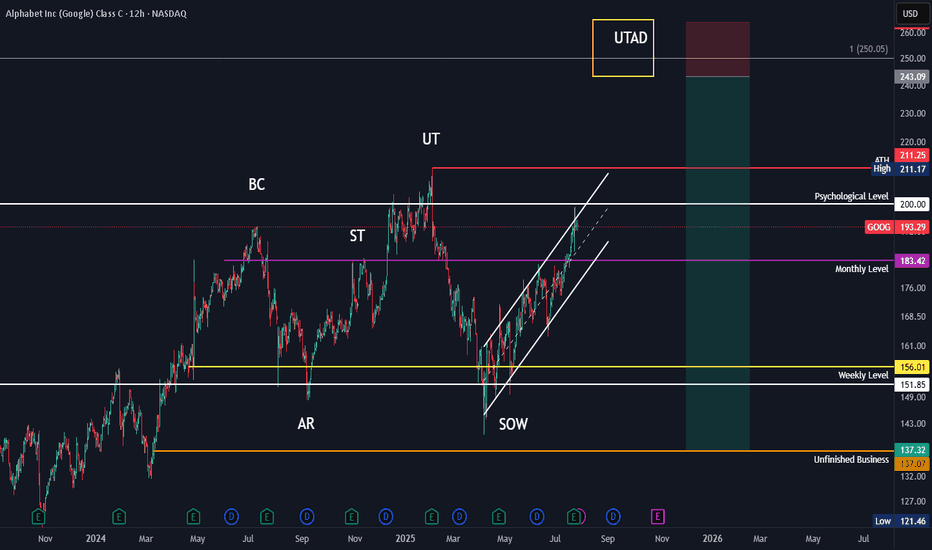

Based off HTF Wykoff Distribution Pattern. Overall target top 250ish Based off fibtrend/extensions. Followed by a ABC corrective pattern to play out over several months.

Potential swing long setup. WXYXZ corrective pattern. Taking the lows 1 more time onto the 1 to 1 fib trend. Overall target 80 which should align with BTC hitting 135-150k.

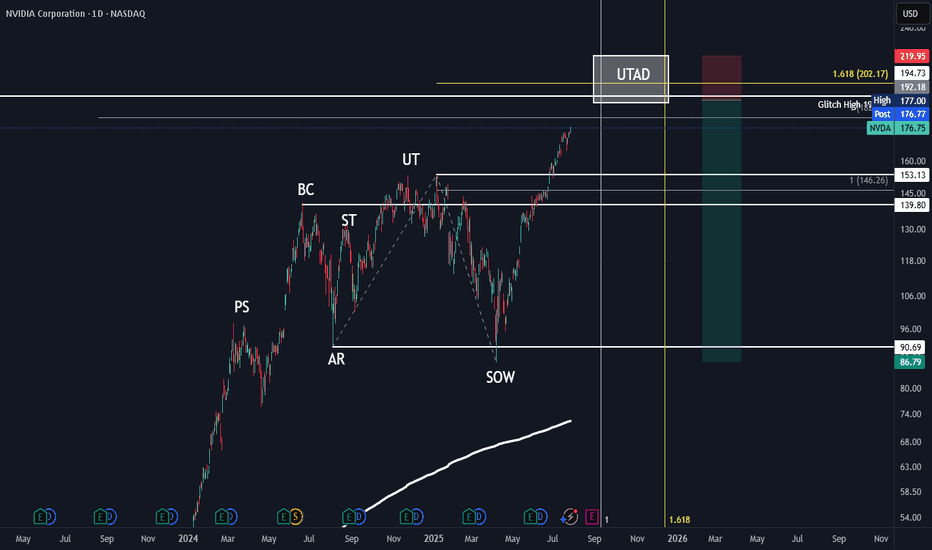

HTF Elliot Wave Count aligning with HTF Wykoff Distribution Pattern. In confluence with Fibonnacci trend/extension and fibonnaci time. Also further confluence with SPX HTF Wave Count and Distribution

HTF Wykoff Distribution pattern in confluence with HTF fib trend/extension and fibonnacci time.

Based off the HTF elliot wave count aligning and in confluence with a HTF Wykoff distribution. With the top coming in between 6600-7000ish around September 2025 till January 2026. Further confluence with trendline, fibonnacci time and fibonnaci trend and extension.

Higher timeframe potential WXYXZ correction pattern. With Z coming in between 88 and 105. Higher timeframe harmonic target of D again between 88 and 105. Invalidation of the corrective pattern and harmonic would be going above 187 first.