Sippinwok

Bitcoin dominance appears to be forming a bear flag formation. It's target is shown above. This would give altcoins an opportunity to catch up to Bitcoin.

It seems that ETHUSD is now testing the neckline of the inverse head and shoulders it has broken out from. Stop loss can be placed below the neckline. The target should be around $630.

The ETHBTC ratio has been consolidating after a decent pullback. Target of the ascending triangle is a few percent away.

I think it has a decent chance of playing out like this. It's not far from ATH and is getting a bounce off of support.

Gold looking very strong here. Looks to be in a downward trending channel; target of ~1900 should be easy.

Target is around the $18 dollar level. Be cautious of a breakdown.

Technicals look pretty good and the BTC ratio is oversold. Given the market, this pattern will likely break to the upside.

Wait for a break of the neckline before entering a trade.

Could fall lower within the wedge, but ultimately, this will break out more often than not.

We can see DEFIPERP is cooling off and having some healthy consolidation after a massive rally. I believe this will break up as this pattern is an inherently bullish one.

SXP yet again finds itself trading in a falling wedge pattern. Prices will likely drop below $3 before moving higher again.

Looking very bullish here on the weekly and monthly. Good things will come to those who are patient.

ERDBTC is looking very bearish here. The target of this pattern is quite low, so I don't know if it will reach it given how bullish the space is at the moment. I wouldn't hold this right now.

SXP looking to hold some key levels as it travels within this falling wedge. If it breaks support, it can head all the way towards $2.18. However, breaks bullish, it can easily pass $5

SRM looking fairly bullish here. If it can breakout to the upside, the target would be around 18700

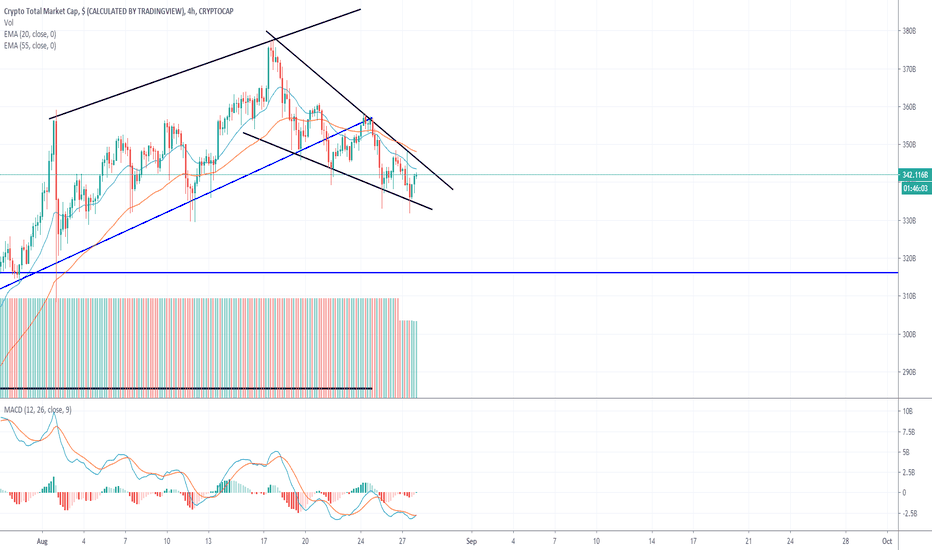

The total crypto market cap has broken out of an ascending triangle pattern. This is an extremely bullish development. The first target is roughly 12% higher than our current levels.

SCUSD is currently trading within a falling wedge, a bullish pattern. We could potentially have a fakeout to the downside before going higher. If it breaks above the blue resistance above, this will likely go quite high. I'm seeing slight bullish divergences on H4 timeframe.

Siacoin is looking very bullish on the longer time-frames. If support fails at 29 sats, it will probably retest 25 sats. The weekly MACD has also just crossed into positive territory. The monthly time frame is even more bullish; it has been printing higher highs since October 2019. RSI looks very healthy and MACD has crossed bullish for the first time (on the monthly).