Sniper-Traders

EssentialThe 20 EMA is inching dangerously close to crossing below the 50 EMA on the daily chart — a key technical zone that often signals the start of a short-term downtrend. 📉 What this setup could mean: Momentum is fading, and bulls are losing grip. A confirmed crossover may invite fresh selling pressure. Price structure already showing signs of weakness. 🔍 What to...

Decided to enter after the market consolidated post a strong ATH breakout. Looking for a rally toward the channel’s dynamic resistance from here. 📢📢📢 If my perspective changes or if I gather additional fundamental data that influences my views, I will provide updates accordingly. Thank you for following along with this journey, and I remain committed to...

Entered right after the close of the momentum candle that broke the ATH levels. Sl is kept underneath the most recent low. Will be managing the trade depending on the momentum of the market in the coming days. 📢📢📢 If my perspective changes or if I gather additional fundamental data that influences my views, I will provide updates accordingly. Thank you for...

Entered the position immediately at the close of the strong bullish momentum candle that broke the ATH levels. 📢📢📢 If my perspective changes or if I gather additional fundamental data that influences my views, I will provide updates accordingly. Thank you for following along with this journey, and I remain committed to sharing insights and updates as my...

Will be looking forward for an entry in this scrip if price retests the ATH. The entry will be taken with 1% risk. The target levels might vary depending on the momentum in the coming days. Entry is invalid if the current high is taken out. 📢📢📢 If my perspective changes or if I gather additional fundamental data that influences my views, I will provide...

Entered the position on a breakout above the all-time high, confirmed by a strong momentum candle and no immediate signs of retracement. The risk is of 1%. 📢📢📢 If my perspective changes or if I gather additional fundamental data that influences my views, I will provide updates accordingly. Thank you for following along with this journey, and I remain...

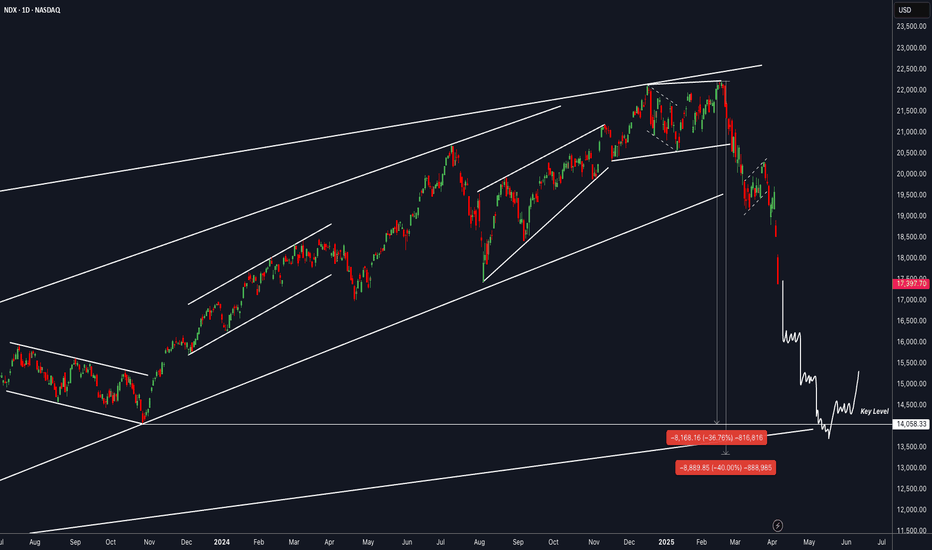

This is a level I'll be closely watching for making aggressive additions. Until then, only selective entries in U.S. Oil ETFs, Silver and Gold ETFs, and a few individual stocks may be considered. However, large-scale accumulation is not advisable until this level is reached. I may also consider dollar-cost averaging into index ETFs if I start to see signs of...

Took two positions of 2.5% of the net capital each, at various levels, summing up the total holding in the scrip for about 5% of the net capital. Will be targeting the all time high for a percentage move of about 20% from the current average entry price. Might consider adding on to the position if price dips and reaches the next critical buying zone, after...

Took this position for about 1.25% of the net capital. Will consider adding on to the position if price crashes to the lower trendline of the shorter time-frame descending channel. As of now, targeting the high of the HTF channel for a move of about 35% from the entry level. 📢📢📢 If my perspective changes or if I gather additional fundamental data that...

Technical Overview : Took a position for about 0.625% of the net capital from a level closer to the lower trendline of the descending channel. Will be targeting the high of the descending channel for a potential move of about 43% from the current average entry price. Fundamental Overview : Mrs. Bectors Food Specialities Limited, a prominent player in India's...

Technical Overview : Took a position for about 0.625% of the net capital from the lower trendline of the parallel channel targeting the highs for a potential move of about 39%. Fundamental Overview : 3M India Limited, a subsidiary of the U.S.-based 3M Company, has demonstrated a mixed financial performance over recent quarters, influenced by various market...

Technical Overview : Took a position for about 0.625% of the net capital from the lower trendline of the parallel channel. The price did form a gap down and hence I waited for a consolidation pattern to be formed before being involved in the scrip. Will be targeting the higher trendline of the parallel channel which is about 35% move from the average entry...

Technical Overview Took a position for about 0.625% of the net capital from the lower trendline of the parallel channel. As of now, the target considered is the high of the parallel channel, to where there is a potential move of about 10% from the entry level. Will consider adding on to the position if the price falls to the, low of the ascending channel as...

I have taken 2 positions at different levels, both close to the lower trendline of the ascending channel. The net allocation in the scrip currently amounts to 6.25% of my net capital. I do not plan to add to the position anytime soon. For now, my target is the all-time high, which would yield a profit of approximately 9% based on the average entry price. 📢📢📢 If...

I have taken 3 positions at various levels, bringing my total holding in the scrip to 1.875% of my net capital. I may consider adding to the position if the price falls to the low of the descending channel marked on the chart. However, both macro and microeconomic factors, as well as the momentum of the decline, will be carefully evaluated before making any...

I have taken 5 positions at different levels, resulting in a net holding in the scrip that accounts for approximately 6.25% of my net capital. I might consider adding to the position if the price falls to the entry levels marked on the chart, depending on the momentum of the decline. For now, my target is the all-time high, which would yield a profit of about...

Took a position in the scrip, allocating about 1.25% of the net capital. I am expecting a potential upside of around 38% to the upper trendline of the channel that has formed. I will consider adding to the position if the price falls approximately 23% from the current level and touches the longer timeframe trendline, which is a significant support level for the...

Took an entry for about 0.625% of the net capital from a level close to the low of the parallel channel. Will be targeting the high of the parallel channel for profit of about 47% of the invested amount. Might even consider adding on to the position if price comes down to the low of the parallel channel, depending upon the momentum of the move. 📢📢📢 If my...