SpicyPips

Essential📍Current Price: 143.437 TimeFrame 30Min Bullish Reasons: + Strong Support + Psychological Level + Tweezer Bottom + Bullish RSI Divergence + Channel Bottom = Potential Bullish Reversal Support & Resistance Levels: • 142.000 – Strong Support + Psychological Level • 140.000 – Strong Support + Psychological Level • 148.000 – Psychological Level + Price Target •...

After squinting at the 4H chart like Sherlock with a caffeine addiction, I’ve confirmed: our price broke out of a flag pattern like it was tired of napping. It even did the polite thing—came back to retest—like, “Excuse me, just checking if I actually broke out. Yep. Cool.” Now it’s back on its bullish treadmill, charging uphill like a gym bro after...

After analyzing the 2-hour chart, we can see that price has been bouncing around like a pinball between 3374 and 3264 — rejected twice at the top, supported twice at the bottom. Currently, price is chilling at 3309, smack in the middle of the range, probably wondering what to do with its life. Now, 3345 is standing tall as a strong resistance. If price finds the...

After analyzing the 15-minute chart, price action is currently squeezed between a strong resistance level above and an ascending trendline below. A rejection from resistance followed by a trendline breakdown may trigger a move toward the target marked on the chart. Remember: Stop loss doesn’t eat your money — it guards your capital like a loyal bodyguard. Happy...

Market Analysis (Daily Chart View): The Daily chart indicates that price has declined after reaching a record all-time high and reacting from the upper boundary of an Ascending Broadening Wedge. Both the Weekly and Monthly charts remain in extreme overbought conditions, suggesting caution. Additionally, the upward trend across all three timeframes—Monthly,...

Market Outlook – 2H Chart Analysis After analysing the 2-hour chart, we can observe that the price has been consistently trading within a respected ascending channel since April 10, 2025. Following the formation of an all-time high (ATH) at 3357.775, the market experienced a shallow retracement, dipping just below the 38.20% Fibonacci level. Currently, the price...

Multi-Timeframe Analysis – Gold (XAU/USD) ⸻ 1H Chart – Bullish Continuation Potential On the 1-hour chart, Gold is trading within a defined channel structure after reaching an all-time high (ATH) of 3357.775. Following this peak, the price made a shallow retracement between the 38.2% and 50% Fibonacci levels, indicating underlying bullish...

BTC 3D Technical Outlook By SpicyPips Upon analyzing the 3-day chart, we observe that BTC is trading within a well-respected ascending channel, which has held as dynamic support and resistance multiple times. After reaching its all-time high of $109,637.53, price retraced into the Golden Zone (Fibonacci 61.8%–50%), a key area where buyers stepped in. BTC has...

4H Market Outlook – EUR/USD After analysing the 4-hour chart, it’s clear that EUR/USD is riding a strong uptrend — and let’s be honest, we’re not sure how many accounts this rally has humbled so far! 😅 Currently, price is trading above a well-respected ascending trendline, which has provided solid support multiple times in recent sessions, further confirming...

Market Analysis – 30-Minute Chart Overview Upon analysing the 15-minute chart, we observe that the price opened with a gap during the Asian session and is currently trading just below a descending trendline. There is a potential for a breakout above this trendline; however, I anticipate a rejection around the 3356 level, as highlighted on the chart. If the price...

After analysing the 2-hour chart, we observe that the price is currently trading just below a key resistance level without any significant correction following its recent move. This lack of retracement, combined with the resistance overhead, suggests that a pullback is likely. We anticipate the price to retrace toward the potential target highlighted on the...

Market Outlook – 15-Minute Chart Analysis After reaching an all-time high (ATH), price action retraced to 3193 before finding support and consolidating within a rising wedge pattern inside a defined channel. The confluence of the rising wedge, declining volume, and resistance near the upper boundary of the channel suggests a potential bearish move. We anticipate...

Multi Time Frame Analysis: 1. Monthly Chart; • RSI: Extremely Overbought at 84.66 • Volume: Declining – signals weakening buying pressure 2. Weekly Chart; • Historical Volume Spike • RSI: Overbought at 78.26 3. Daily Chart; • Price near Upper Channel Line • R2 (3246.25): Resistance/Trend Continuation Zone • MML +2/8 (3281.25): Extreme OverShoot zone...

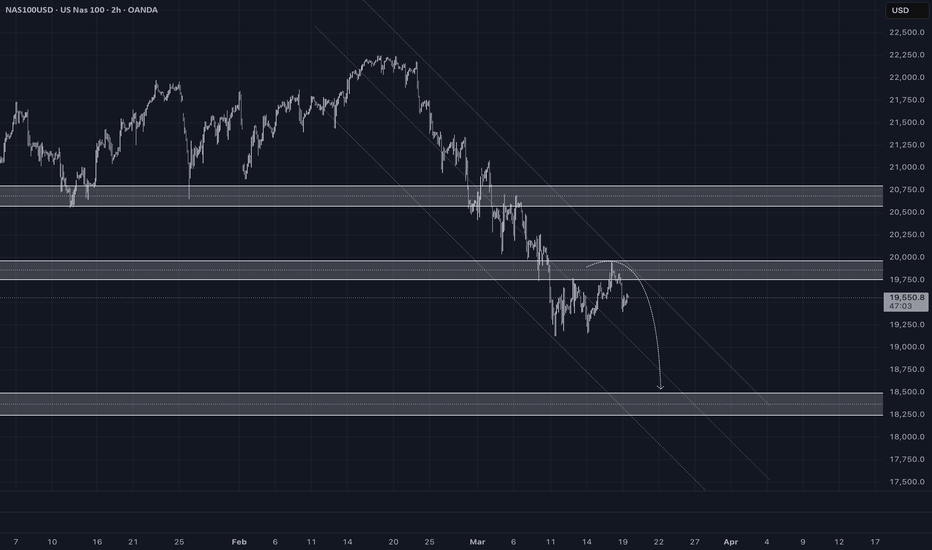

After analysing the US100 chart, the index has been trading within a downtrend channel since Friday, February 21, 2025. After dropping to 19,131, it attempted a recovery but faced strong resistance at 19,957, leading to a decline. As the saying goes, “ Follow the trend—the trend is your friend. ” Given the ongoing downtrend, US100 may continue to decline toward...

After analyzing multiple timeframes, we observe that the price has surged significantly and is now trading within a key resistance zone. The resistance remains strong, and the RSI across multiple timeframes is in the extreme overbought territory, showing bearish divergences. Additionally, despite the sharp rally, the price has not undergone any meaningful...

Previous Analysis: Successful Bullish Breakout In our previous analysis, we identified a Falling Wedge pattern accompanied by bullish divergence, forecasting a breakout above 147.807. The price hit our target, confirming the bullish momentum and reaching key Fibonacci levels. What’s Next: Upon analyzing the chart, we observe that price has found support at...

After analyzing the chart across multiple timeframes, we have identified a Falling Wedge pattern, signaling a potential bullish breakout. Additionally, bullish divergence is visible on most timeframes, reinforcing the likelihood of upward momentum. Currently, the price is trading above a strong support level at 146.213, indicating a solid base. Our nearest...

In our previous analysis, we anticipated a price drop—and it played out perfectly, securing 10,315.6 pips in profit. What’s Next? Now, after analyzing multiple timeframes, we see that the price has bounced off the 2nd large channel’s middle line, a key support level respected multiple times in the past. Currently, it’s trading around 2915.44, near our...