USDCHF - The price is testing a demand zone from Dec 2024. The only valid scenario for this pair is to sell. We can wait to see how the price will react the next days.

EURJPY - Yen was the weakest of the day, Euro continue get stronger in all the mess with the tariffs. It is clear bull on this pair let see how the price will play the next days.

CADJPY - This week 16 - 21/03/2025 both players has high impact news . Yen is stronger and we want to follow the trend if the news will give us the change. Very interesting pair to watch this week.

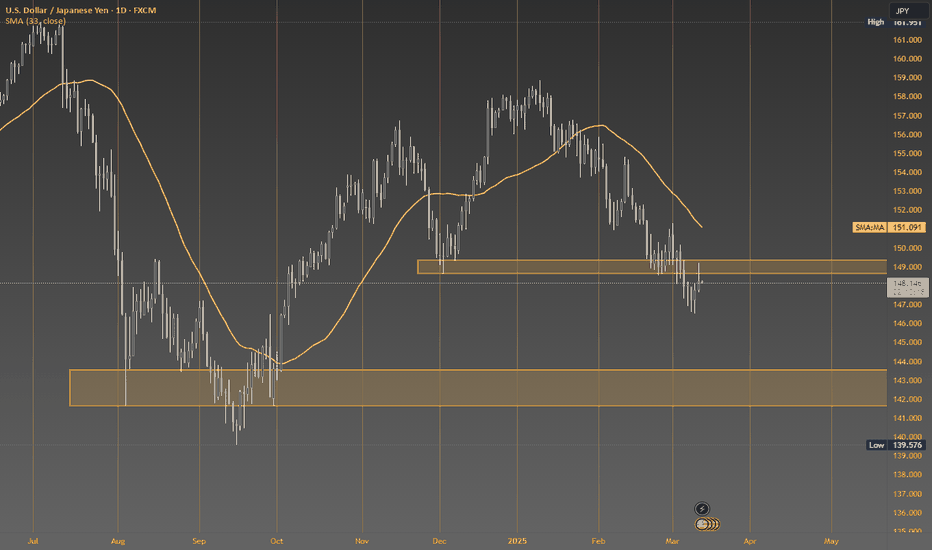

USDJPY - The price rejected today the last demand zone. Market this week in general until today it was slow. Price is possible to make a good bear move the last two days of the week. Today the news for USD was negative we also have high impact news for USD on 13/03/2025 i am expecting the price continue the bear trend on London session so i can find a good...

EURAUD Performance 1W 2.59% 1M 4.58% and 3M 4.69%. High impact news of GBP and USD from this week can push the price higher.

AUDUSD / 10/03/2025 - 14/03/2025 / High impact news for USD on 11.12.13.14/03/2025.

CADCHF - Canadian Dollar was weak today and Swiss Franc one of the strongest. Price is possible to fall on 0.60595

EURCAD - Canadian Dollar is the weakest player of market on 3.3.2025. I can see a possible buy if the price reject the last strong demand zone. On 7.3.2025 CAD will have high impact news: Employment Change and Unemployment Rate which will be decisive for the next moves of the pair.

NZDCHF - Lets see how the price will react this week on the demand zone. Best scenario is the Bear Trend continue and price reject the demand zone and price fall to the lowest price from 5.8.2024

GBPNZD - Clear winner on this pair if the trend will continue we can find good buy opportunities this week.

AUDJPY - I already talked about Australian Dollar on my GBPAUD personal view. I am waiting the High Impact Extended news for AUD to see how the price will move.

GBPAUD - On 26.2.2025 we had the Consumer Price Index (CPI) news for Australian Dollar. From Forecast at 2,6% to the Actual at 2,5%. The negative news make Australian Dollar weaker and as we can see on this pair the British Pound made a good bull performance last week. The price is right now above the last strong supply zone. On 5.3.2025 we will have the Gross...

AUDUSD - Based on performance i had two players to trade this week , Japanese Yen for buy and U.S Dollar for sell. U.S Dollar proved me wrong and it had very good performance with some pairs. The most clear pair for buy U.S Dollar is AUDUSD, as we can see the price is on very strong demand zone if the price will reject this zone we can make profit between the zones.

GBPUSD - U.S Dollar start the day very strong but in 30 days performance is the weakest of all the players. On GBPUSD pair we can find a very good set up for Buy. The price broke the last Supply zone and for the last 7 days price show rejection for the zone. Until the end of the week it is possible to see the price moving to the next zone.

UASJPY - Japanese Yen show that it can continue to be strong. The price in the last four days rejected the last demand. It is possible until the end of the week the pair will fall on the next zone.

EURNZD- Performance: -1.21% W, -0.87% 1M. From 19.2.2025-21.2.2025 the price fall and move between demand zones. This week is possible the pair will continue to move down and reach the next demand zone on 10.12.2024.

USDCHF - U.S Dollar is the weakest of all the major players in the market. Swiss Franc the last two days on the daily chart rejected the last demand zone. It is possible this week Swiss Franc get stronger and the price fall on the next demand zones.

GBPUSD - From 12.2.2025 British Pound broke SMA 30 and price start a bull run for 12 days. Price is now on very strong supply zone from 20.9.2024. Both of scenarios (BUY/SELL) have high possibilities but from the most recent performance of the pair a buy scenario is more favourable . If price break the 1.82313 ( the highest from 2019) next stop is the highest of 2018.