Stanislav_Bernukhov_Exness

Crude oil had initiated a classical short coverage rally: despite a big bullish day, around 2% (42699 contracts on Nymex) of total open interest for Crude oil futures was liquidated, which means that a massive pullback was not associated with the new business coming in, but rather an old business getting out. Despite the local optimism, market fear still...

Euro has gained a remarkable strength against the British pound during the latest round of tariff announcement from the US administration. However, from the historical studies we know that EURGBP rarely makes substantial trends, and more often it turns black having reached 2 standard deviations from the 20-day moving average (the upper band of the Bollinger Bands...

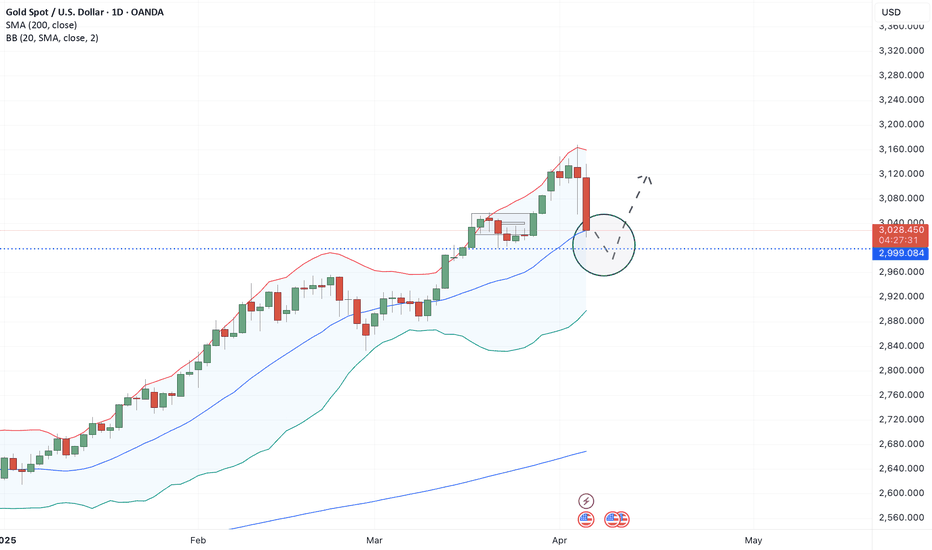

Gold has been overbought technically, which was visible from RSI (it was flashing the overbought conditions positioning above the 70 point line), Bollinger Bands (price was spiking above the 2 standard deviation zone), and the price action: after the initial breakout, it was rapidly sold off not holding the buying pressure anymore. So, the most expected scenario...

EURJPY is on the radar. After the announcement of US tariffs, the market will stop pricing them in and will focus on other drivers. As stock indices are dipping across the globe, the carry trade remains to stay a “no brainer investment”, as borrowing costs for the Yen are still quite low, and according to consensus forecasts, inflation in Japan might have...

EURUSD had bounced off to the 200-day moving average, having trimmed its recent gains amid a local growth of yields of 30-year bonds of the US. The pressure looks quite strong, but the 200-day moving average is a strong technical reference, and it’s possible to witness a bullish counter reaction from this level. Focusing on the area between 1.06 and 1.07 might...

Crude oil had reached the psychological level of $70, and that might become a potential crash test for the rally: should the level be rejected, it may trigger a liquidation of the upside move, as this level is considered as a fair price according to the supply and demand equilibrium. Technically, the price is located at a higher band of Bollinger Bands, according...

Crude oil has developed the upswing having hit the neckline of cup-and-handle formation. Currently, the price action is muted, but should the price come to test this area again, it might develop the upswing with a target of $70, as it is still considered a fair price from a supply/demand point of view. OPEC+ has announced plans for several member countries to...

Gold has been the biggest runner in Q1, 2025, pulling in much capital from institutional investors, which was seen in a form of growing open interest for GC futures and increasing net position of commercial traders in Commitment of traders report. Technically, it might have reached the problematic area for growth: the upper boundary of the Bollinger Bands...

Crude oil is consolidating in a narrow coil after a medium-term downtrend. As the position of the price is close to the lower border of the bollinger bands, and below the fair price of $70 (that’s a supply/demand equilibrium according to the STEO forecast), the neckline of a current formation can be broken to the upside should the price come closer to it and...

This week in the financial markets have continued current trends, which involves declining of the US dollar, strengthening Euro and Gold. The market seems to be gravitating towards “safe havens” like Gold and Yen. From a technical standpoint, Gold is moving inside of a strong upswing visible on several timeframes, and now is located slightly below the 3000 area...

Crude oil is under pressure as political narratives drive it lower. The $70 area is a fair price according to the supply/demand estimate from the Energy Administration of the United States. The sentiment still remains to stay negative and is pressured down by tariff talks and meltdown in other markets. So, we can expect USOIL to hit a new low, but this action...

Gold had plummeted for the 3rd day in a row, sliding from the peak of the range, as the upswing for Gold was already mature and developing for more than 46 days without any meaningful correction. So, the correction was anticipated. The spike of the US dollar after GDP publication had brought some logic to the price action (as DXY can’t correlate with stocks and...

After almost 50 days of unstoppable growth, Gold might be posing for more extended corretion to the downside. Gold has been the only trending asset so far among major markets, and had attracted a lot of buyers, as Open interest was consistently growing and keeping steady along the entrire Februrary. Volumes have been drying up across all markets, waiting for new...

Stocks of crude oil have not changed much since the end of January, in a plateau. That had stopped a losing streak for the WTI light oil contract and boosted a short-term recovery back to technical levels. Geopolitics is a bearish factor, as US-Russia talks may create expectations of lifting some sanctions, so in a medium-term, Crude oil would probably stay...

Natrural gas was moving in a strong uptrend, and the good question whether this move will conitunue. Inventory of natural gas is moving down along with the 5-year seasonal, as withdrawal period continues. That keeps natural gas in a seasonal uptrend, until expiration of a current futures contract, while the next will discount the upcoming injection period and...

Alibaba stock price was moving in a sharp rally within the last two weeks period, having reached the psychological level of $117 and a strong resistance area. If this level holds, it’s possible to witness a wide “cup-and-handle” pattern, which might serve as a trigger to an intermediate-term reversal. Otherwise, price may plummet following profit-taking that might...

Despite the strong driving narrative, BIDU had displayed less prominent growth than BABA, and had reached the upper border of Bollinger bands indicator with a parameter of 50. This usually might indicate an excess, and lead to a mean-reversion move back to the middle of the range. Conversely, it might be a decent point for a breakout if the positive sentiment for...

ETHUSD Short Setup – Bearish Breakout Potential 📉 Technical Setup: Ethereum is forming a narrowing structure, and a downside breakout of the trendline could trigger an acceleration towards $2400 and lower. 📊 Daily Structure: ETH remains in a strong downtrend with notable bearish momentum. Significant acceleration is observed below the 20-50 MA zone, which...