StarleXtheTrader

Good day traders, it's been a while since I shared my analysis but here's my take on GOLD There's a high chance Gold will drop as we can see bears are already in control of the trend (Downtrend confirmed), I won't go into much details but this is the possible move that might occur, be ready for anything

EURUSD has a high chance of continuing the bearish movement and the reasons are as follows: 1. We can see EURUSD formed a Double top, this is a sign that bulls could not push the price higher to create a Higher high meaning bears are fighting back to push the price down lol 2. The zone we see a double top at is also a strong zone on the Daily timeframe that means...

As we can see on the MAJOR KEY LEVEL where price formed multiple rejections and reversed, this is a confirmation of selling pressure also price broke out of our Previous support and retested it that gave us a New resistance which shows us that bears/sellers have potential to push it down and we already have multiple confirmations of that along with our Downtrend...

I would like to show the power of combining trendlines and support & resistance on your chart work. As we all know in order for a trendline to be effective it must be used with key major points and the trend must be clear whether it's an uptrend or downtrend, cause if the trend is neither then that would lead to false signals that would cause people to get stopped...

Silver is in a bullish trend and the price showed us some bearish movement by creating a Solid low but that was later rejected by buyers which took over the trend again thus breaking above the Higher high and retracing back to it, meaning price is likely to continue its bullish movement after some liquidity grab on the "Higher high" area

Good day traders, my analysis shows that the price will head up but we need some few confirmations first before that The previous trend was a bearish trend and price failed to create new lower lows and we had our Change of Character/Trend. Price broke above our CHoC giving us a New higher high which shows that buyers are more than sellers, causing price to head...

There's a huge possibility US30 might continue dropping, the analysis shows it's possible and we can see bears are pushing the price down

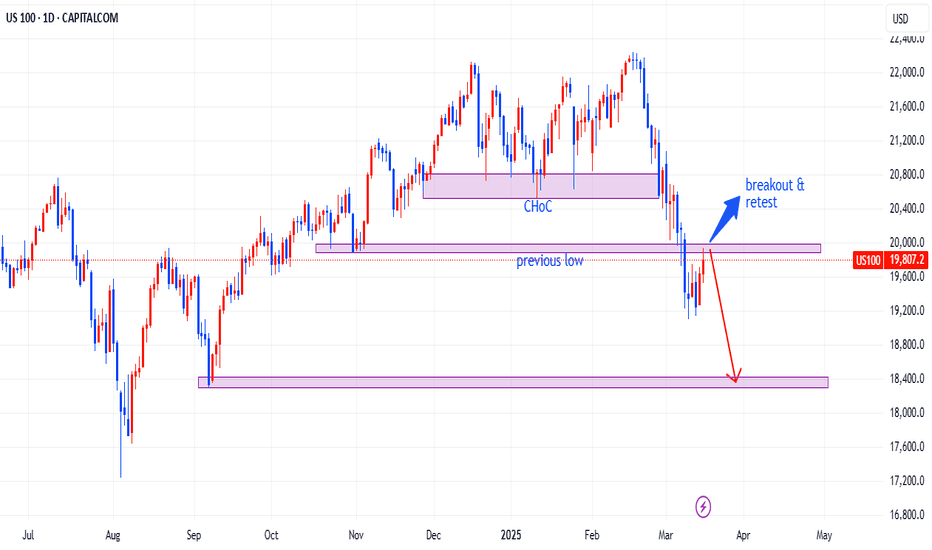

As we can see the previous trend was an uptrend, we got a Change of Trend before the market dropped showing strong selling pressure and now the price looks like it's Retracing(Retest) before it continues it's movement down what are your opinions on NAS100?🙃comment below

my analysis shows that AUDCAD might drop, as we can see we had a Triple top(declining) and price broke our major low which acts as support, this is a bearish sign and means price might continue to drop, a pullback and a rejection on the Zone would be a better confirmation for price drop so all in all look out for the upcoming drop in AUDCAD

as we can see the price is making higher highs and higher lows meaning it's in uptrend, and recently price broke through our higher high and retested it this gives us a confirmation that price will go up 🚀

It seems like Gold has more buyers than sellers thus pushing the price high. Gold broke our resistance this means it might continue to push up

AUDUSD about to shoot up on both small timeframe and higher timeframe, we have some bullish momentum and buyers are more than sellers which means the market is about to continue up for some time, studying the chart and the use of S&R and some trend lines I've come to the conclusion that AUDUSD will shoot up🚀 , let's wait and see how it plays out comment your...

Most people tend to not check the overall trend not knowing that could potential be a danger to their trades and account If the overall trend is a downtrend(making lower lows and lower high)- you should look only for selling entries especially if you trade bigger time frames(M15 to upwards). However it's not that simple or everyone would be making millions of...

good day traders, our past trades were a success and as you can see UK100 is repeating the same pattern again, meaning we are anticipating another drop, I won't explain much because it's simple and clear analysis that is self-explanatory. all I can say is wait for a candle rejection and enter

as we can see from the analysis USDJPY broke a major zone indicating it's bullish momentum and this might be a CHoC, meaning uptrend will form

There a high chance that EURJPY will break above the Zone and continue heading up for sometime. We can see according to the price analysis that the downtrend is finished and market formed a strong Invert H&S pattern which indicates strong buyers. Price is now in the Major Key Level with a high chance of breaking through due to the strong bullish momentum and if a...

good day traders, as we can see from the analysis neither buyers/sellers are in full control of the price. It would be a bad idea to be placing trades now especially if you're a day trader. The best time to trade Gold would be if a breakout on either side happens, If price breaks the resistance then we can expect the price to push up as that would show us that...

Greeting everyone, it's been a while since I posted but let's get to it These are my reason why NZDUSD will shoot down 1. As we can see our Uptrend Trendline was broken, this shows us a sign of bear/sellers coming into play to push the price down 2. Price failed to create a New Higher High showing that bulls/buyers are losing momentum to push the price higher,...