Christine Lagarde, head of the European Central Bank, alluded to a remark made by Margaret Thatcher regarding inflation, saying "the woman isn't tapering." It appears that the ECB is already starting to ease monetary policy even as the Eurozone economy emerges from the depths of the epidemic. And while it's true that the ECB's bond-buying program has been tweaked...

== == 📢 Signal#:12 🏦 OrderType: Sell 💱 Symbol: USDJPY 📈 OpenPrice: 110.186 📈 ClosePrice: 109.952 🕓 Duration: 1 days and 22:38 💰 Profit: 23 PIPs (212.82 USD) This trade closed in profit while the stop loss trailed with the assistance of a complex set of calculations done to cut this trade in profit and take the pips into our pocket. All trading is always...

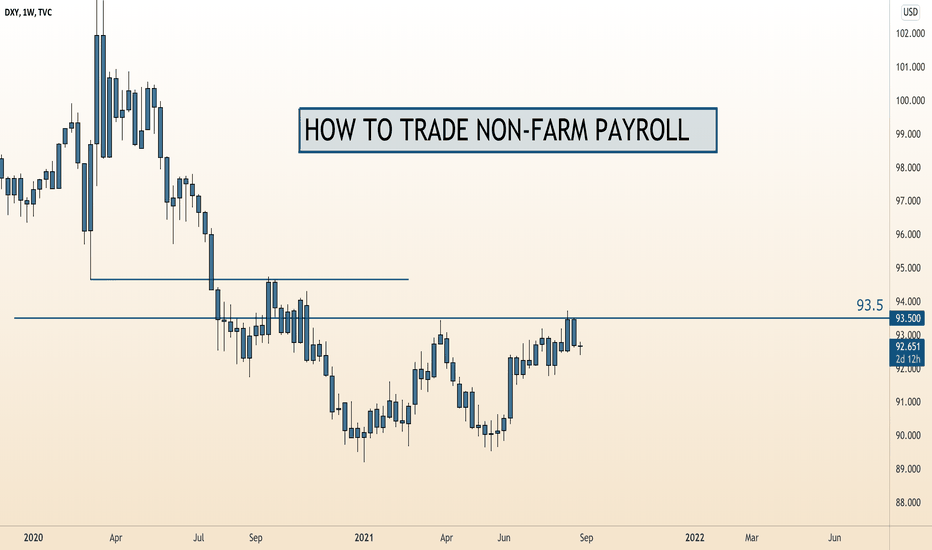

The job market in the United States slowed significantly in August, worsened by difficulties in the leisure and hospitality sector, which coincided with another large coronavirus epidemic. According to nonfarm payrolls (NFP) statistics, the economy created just 235,000 jobs, far below the consensus expectation of 733,000 new hires and the lowest reading since...

This trade sustained a minimum fo nine pips for over 59 pips of upside profit. Original order:

As anticipated in the second quarter fundamental view, the Japanese Yen spent the bulk of the second quarter losing versus its main counterparts. Nonetheless, the rate of depreciation has reduced considerably as compared to the first quarter. Due to the continuous decrease in stock market volatility, it is doubtful that the anti-risk currency would attract much...

Last week, hardline members of the European Central Bank's governing Governing Council came out one after the other to warn that the Eurozone's monetary policy will need to be tightened in the coming months. However, they are very likely to be outvoted by the doves in this week's Council meeting, and the current strategy will be maintained, with no...

Trend change. With little fundamental news coming from the UK to move the British Pound it has been strengthening recently against the US Dollar but weakening against the Euro. However, both GBP/USD and EUR/GBP are nearing resistance on the charts and that could mean at least a pause for breath and perhaps trend reversals. As the GBP/USD chart below shows, the...

Previous price movements, according to technical analysts, can be used to forecast future price movements, whereas fundamental analysts believe that economic fundamentals drive market movements. Understanding the differences between fundamental and technical analysis, as well as how to combine the two, can be extremely beneficial to traders. Many traders have...

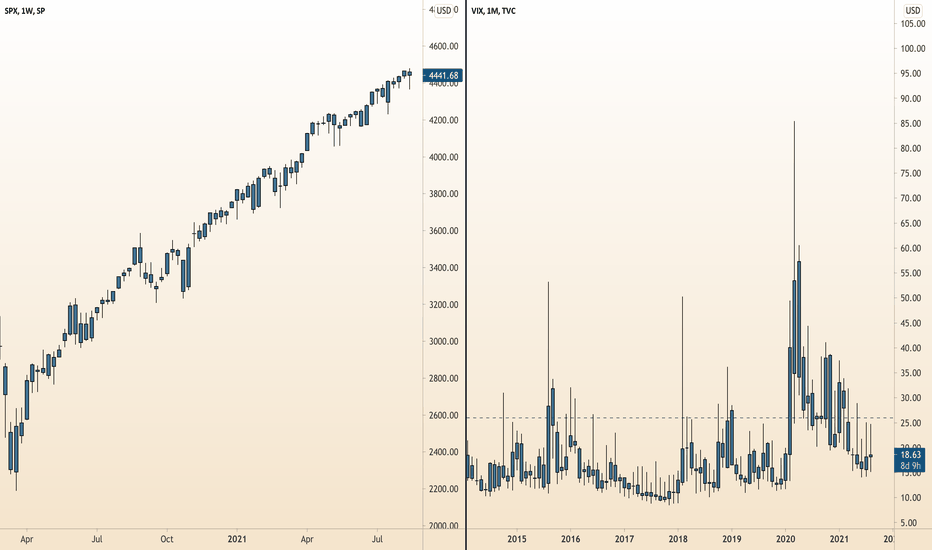

As the trading day on Wall Street came to a close, stocks concluded in a mixed bag. The SPX was unchanged, up 0.03 percent. Meanwhile, the Nasdaq Composite, which is heavily weighted toward technology, rose 0.52 percent. The Dow Jones Industrial Average fell 0.14 percent as cyclical companies underperformed the wider market. The primary variables at work here...

Central banks have a significant influence in the foreign currency market. Central banks are mainly responsible for managing inflation in the long run, while also contributing to the financial system's overall stability. When central banks deem it necessary, they will intervene in the financial markets in line with the previously defined "Monetary Policy...

It is essential to note that the non-farm payroll (NFP) number is a key economic indicator for the United States economy. Including agricultural workers, government employees, private home employees, and employees of nonprofit organizations, the number of new employment generated is represented by this indicator. In general, the publication of the NFP causes...

The US Dollar Index (DXY) has continued to fall despite reaching a new yearly high in the middle of the month. Is this, however, a brief respite or the start of a more serious downturn? It's difficult to say for sure at this point. True, the trend since the May low has been shaky, and the DXY is no better off now than it was two months ago, but that does not...

The S&P 500 index recovered on Friday as investors seized the opportunity presented by Wall Street's recent selloff. Equity traders will look for clues about the Fed's next move at this week's Jackson Hole symposium. According to the minutes of the most recent FOMC meeting, a majority of Fed members support reducing the $120 billion per month asset purchase...

Traders were looking forward to the Federal Reserve's next move at the Jackson Hole symposium, and the S&P 500 and Nasdaq 100 both hit fresh highs on Wednesday. The markets in the Asia-Pacific region are likely to open cautiously. Stocks on the Dow Jones Industrial Average, the S&P 500, and the Nasdaq 100 all ended with increases of 0.11 percent, 0.22...

The US Dollar continued to fall in Tuesday's session, continuing a trend that started last Friday, soon after the USD reached a fresh nine-month high. Fears of a taper were high last week with the release of the FOMC meeting minutes from the July rate decision, but they have decreased this week for a number of reasons. The most obvious is how dovish the FOMC seems...

EUR/USD tries a three-day recovery after breaking through the March low (1.1704), but the minutes of the European Central Bank (ECB) meeting may undercut the recent gain, as the Governing Council seems on track to maintain current policy for the rest of the year. It remains to be seen whether the resurgence of COVID-19 cases will persuade the Federal Reserve to...

== == 📢 Signal#:35 🏦 OrderType: Sell 💰 OrderSize: 2.25 💱 Symbol: EURUSD 🇪🇺🇺🇸 📈 OpenPrice: 1.17495 ⏰ Expiration: Good til' Cancel 🎯 TakeProfit: Hidden 🛑 StopLoss: Hidden

Spreads are determined as the difference between a currency pair's buy and sell prices. The FX market's spreads and lot sizes decide the charges. Spreads on foreign currency transactions are dynamic and should be seen via your trading platform. Forex spreads are critical for traders to comprehend since they are the primary expense of currency...