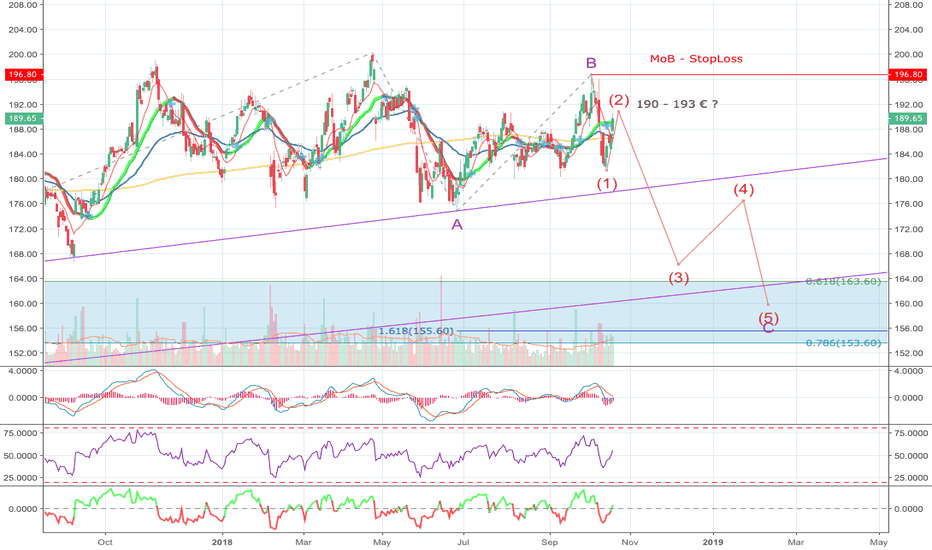

Watch and see if the analysis is correct although I would still miss a low. If we can count with 12345 of the wave (1), then I will examine the correction pattern of the wave (2) with abc in more detail, in order then to find the entry and take the wave (3). But this will probably take several months.

This week is likely to mark the end of the downturn and it should not come as a surprise to reach the 11,000 point range again. Subsequently, a strong upward movement should start and bring the Dax over 12,000 better 13,000 points. But it is still too early and the expected upward movement must then be analyzed again. The danger is that the green IV has not yet...

Entry Short at $ 6,440 Target at $ 3,640 SL at 7,240 CRR=3,5 to 1 Time to short

The Pacific Ring of Fire is increasing in activity. The volcanic eruptions and earthquakes and their consequences such as tsunamis have increased significantly compared to the previous two years. At the same time, the sun is in a solar minimum. Huge sun holes at the North + South Pole and the equator seem to release relatively many solar winds. Is there a...

In the last few weeks we were able to tap the individual turning points very well and make good money. Be it the circled b: or even the low of the 5 of A: Now, the ii of the circled c should be ready and it comes to the continuing upward movement. This is certainly due to the early election on 6/11/2018 in the US and should further improve our annual...

Hello everybody! The Nikkei are in my view in a further upward movement and this could be in one-iii-the 3 of the (3). This should carry the Nikkei to over 25,000 points and thus to new annual highs. Later, there are also over 28,000 points in it. The 22,950 points mark should not be violated! If this mark falls and the 20,000 will be tackled again later, The bull...

The TradingPlan in-Bitcoin -fter Elliott waves is still valid. The-BTCUSD-has made its first anticipated sell off and is still likely to be in the consolidation wave 2. We have already reached the first return zone of $ 6,600 (38.2%) and now the c of the ii is consequently processed at approximately $ 6,900 (61.8%). Following I expect the much sharper sale then...

Aixtron put a candle close below the bd line on Monday and has unlocked a target range of approx. € 7.10. Why the stock could lose another 30%, will certainly show the news in the coming weeks ahead. The StopLoss is 12.07 or 11.41 euros. Thus, the chance risk ratio for a short entry is too bad, but when reaching the 7.10 euro, the correction phase would be...

On the 23rd of July I published this scenario and with big steps the share price moves to the target area. There should now be kept watch for the trend reversal. If this happens, the first reset (as a circled 2) should be used to buy the stock. Perhaps the rising 200-weekly line is the corresponding trend reversal / target area in a few weeks, as there is also...

The correction since March 2017 at IBM could be close to completion and reach a run-up to at least $ 178 if this movement instead of a wave 3 is only a wave (C). That would be a whopping 24% margin. A run-up through the turnaround range is supported by 61.8% of the previous wave (A) / 1. There is a nice divergence in the RSI and MACD which confirm a trend change...

3 weeks ago, the MDAX launched a hammer candle as a turnaround signal. This was sold as usual. This first sale could have been wave 1 of (1). Currently, the 2 of the (1) would have to run. It is now advisable to observe this correction and to find an entry into Short-Plan. StopLoss is 27,370 points in this case. Target is likely to be near the 61.8% retracement at...

Since the beginning of 2018 I am accompanying the SDAX in these correction phase. Now it is time for a new post and currently we are very likely already in the-iii-the c of the IV. The starting point of these waves are the 11,200 points and then even 10,500 in the v can not be ruled out. Make or Break line are 12,641 points. Greeting Stefan Bode

The-Dax30-could have finished higher-level green IV or just the wave (d) of the green IV. Both are possible and therefore it will be exciting, which variant will prevail. Best regards Stefan Bode

It is time again, after all the updates of the old analysis to create a new again to keep the overview. The-euro-sticks to the trading plan but the speed might surprise some people. The vertical time sends greetings - welcome vertical markets, which will all accompany us in the next few months in various markets. Because my focus is on the higher level of the...

What's exciting is that with Ripple for the first time since a 3/4 year, one of the top 5 has developed contrary to the bitcoin price trend. Could the trend reversal in the crypto area be slowly ushered in or is this still premature wishful thinking? In any case, Ripple has hit the possible turning point with a starting impulse due to the brilliant chart...

After the wave X, which ran from January 2016 to December 2017, copper should now finish the correction phase with a wave (Z). However, this should accompany copper until the first quarter of 2019. As a result, copperproducers are more likely to let off steam on the bottom in the coming months when this scenario arrives.

The Daimler chart still looks weak and should continue to down trend. The first collection area is the 49 €uro. If these do not hold a sell off to 30 €uro is possible, which could then be a possible entry point for a long trade.

The US-Dollar-Index, a currency basket composed of 57%EUro, 14% jap.YEN, 12% British Pound, 9% Canada.Dollar and 4%Swedish krona and Swiss francs, is expected to continue up over the next few years. What this means to the most people of the world, I would like to summarize this briefly. The US-dollar is the world's largest and most liquid market for bonds and...