StockScaper

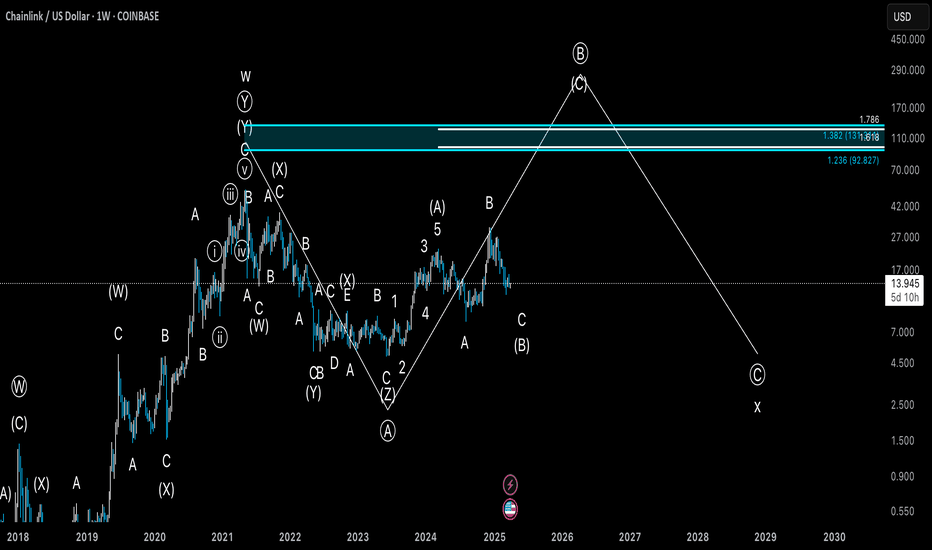

EssentialGenius Stablecoin Act just got passed! LETS GO! STABLECOIN SUPERCYCLE! A few months ago I presented a Primary Elliott Wave Count that suggested Chainlink would top out between $60-$100. Here is the Alternative Elliott Wave Count that suggests that Chainlink will easily hit $230 this market cycle and possibly even 4 digits! In this alternate wave count,...

🚨 XRP: Breaking Out of Accumulation! 🚨 XRP is missing Waves 3, 4, and 5 in green to complete the bull market. There are two ways to measure the target of Wave 5 which should be the bull market top. The 1st is taking the 1.618 fibbonaci retracement of Wave 4 which would give us a $5.39 XRP. The 2nd method is taking a 0.618 to 0.786 trend based fib extension which...

🚨 New Video Just Dropped! 🚨 Today, I cover the latest Genius Stablecoin Act update, Shanghai’s surprising interest in stablecoins, and go deep into Chainlink’s technical setup — including Wyckoff, Elliott Wave, short-term outlook, and Fibonacci time analysis. Video Timestamps: 0:00 Genius Stablecoin Act Update 1:25 Shanghai considers stablecoins! 2:53...

📈 US10Y: Treasury Yields Are About to Explode Higher Longing bonds was the consensus trade heading into 2025. Everyone expected a “flight to safety” as equities tanked, but guess what? Bonds have been a massive disappointment. Instead, Bitcoin and Gold have stolen that narrative—who saw that coming? But here’s the real kicker… The 10-Year Treasury Yield is now...

The cryptocurrency gods have not been favorable to ICP holders with ICP still down over 99.8% from its all time high! From an Elliott Wave Theory perspective, the trade setup is that ICP has formed an impulse (White Circle Wave A) off the 2023 Bear Market Low, followed by a 3 Wave ABC correction (Green) potentially bottoming at the white 1:1 trend based fib...

Ethereum has been moving in 3 wave corrective structures this entire bull market, possibly in an ending diagonal structure. Wave 4 (Green) most likely unfolded as a WXY Double Zig bottoming at the 1.618-1.786 trend based fib extension. Focusing on Wave 5 (Green), a common target of Wave 5 (Green) is the 1.618 to 1.786 fibbonaci retracement between $8,007 and $9,607.

Video Timestamps: 0:00 U.S. Dollar & Stablecoins are now BEST FRIENDS 3:28 Ethereum DOMINATES Stablecoin Market! 4:00 Ethereum Risk & Regression Analysis 5:58 Hong Kong to use Chainlink protocol in CBDC pilot project 7:34 Ethereum Elliott Wave Count + Fibbonaci Work + Bull Market Price Targets

Chainlink has printed a weekly bullish hammer after testing the blue fibbonaci retracement support area. This is further evidence that Wave 2 (Green) has bottomed or close to bottoming, and that Wave 3(Green) to the upside is happening soon. A common target for an ABC (White) correction is the 1.618 trend based fib extension at $121.15. I uploaded a video on...

VIVOPOWER MAKES ASTONISHING 100 MILLION DOLLAR XRP PURCHASE Video Timestamps: 0:00 - Vivopower purchases $100,000,000 of XRP 1:25 - XRP Risk Analysis 3:00 - XRP Regression Analysis 3:52 - XRP ETF Update 5:03 - XRP Wyckoff Reaccumulation Analysis 7:22 - META purchasing XRP!?!?!?

I'm not a short term trader, but Chainlink has potentially finished a 3 wave correction at the previously monthly open + 1:1 trend based fib extension @ $13.54. Additionally, Chainlink is holding the 50 Daily Moving Orange in Orange for the 1st time as support since late March. As stated in previous cryptocurrency posts, things are getting really spicy and...

Who wants Ethereum? Nobody! But that's when the best investment opportunities present themselves. Over the past few weeks Ethereum has seen a sizeable bounce off the 0.618 fib, and the 2017 Bull Market Top at $1,420. The trade idea is that Ethereum never finished its bear market correction, and still needs Orange Wave D & E to complete the bear market correction...

Not only does Bittensor share similar tokenomics with Bitcoin, but Bittensor's current price action also resembles 2023 Bitcoin's price action (Bitcoin ETF HYPE Mania). 1) Both Bittensor and 2023 Bitcoin completed a 5 wave impulse followed by a 3 wave correction 2) Both Bittensor and 2023 Bitcoin bottomed at the white 1.618 trend based fib extension 3) Both...

I’d put ICP a tier or two below XRP or LINK in regard to trade setups at the moment. Funny thing: ICP is apparently a very strong cryptocurrency project with strong fundamentals. This is another example of why Fundamentals and Financials don’t matter in Crypto as ICP has performed like utter crap this market cycle. But…! A trade setup is still valid so long as...

There are currently 37 million alt coins that exist today. Most alt coins continue to bleed and get smashed against Bitcoin as Bitcoin Dominance continues to surge. Even solid cryptocurrency projects like Ethereum and Polygon are continuously making new bear market lows on their bitcoin pairs. Two alt coins that have withstood Bitcoin's onslaught are XRP and...

I'm seeing a lot of Bearish Head and Shoulders XRP "iT's aLL oVeR" posts/videos. It should be noted that XRP is following the same Head and Shoulders Fake Out Chainlink went through in 2024. A stab down below the head and shoulders neckline into the white trend based fib extension support area before going to new bull market highs. Base Case: $8 Bull Case:...

I haven’t bought bitcoin mining stocks this market cycle, and don’t plan on buying them, but I thought this was an interesting exercise. MARA is the undisputed king of bitcoin mining and it’s not even close. From a fundamental and financial standpoint, MARA should be the best bitcoin mining stock to buy. But Technicals say RIOT may outperform MARA for the...

Primary EW Count: Chainlink is trading in an overshooting B wave in a potential flat pattern. A common fibbonaci ratio for the top of an overshooting B wave in a flat pattern is the 1.236 - 1.382 fib which spans between $92.82 - $131.31. Not all flat patterns have an overshooting B wave, hence the Bear Case of $60 (1.618 fib) outlined in the previous Wyckoff...

Chainlink is trading in Phase E of Wyckoff Accumulation Schematic #1. The Golden Window (0.618-0.786) has caught both LPS (Last Point of Supply) for Chainlink. Here are the price targets when Chainlink breaks out of the accumulation schematic: Bear Case: $59.09 (1.618 fib) Base Case: $92.82 - $131.31 (1.236 -1.382 fib) Bull Case: $230.02 - $342.85 (1.618 - 1.786...