ORCL is in a clear uptrend. MACD H made a new high, so we can expect the next move to reach or expand the old high of 66$. MACD H < 0 and ticks up. Price 63,47$ Target 68$ Stop 61,78$ R:R 2,68:1

MACD H ticked up on 30 Dec 20 and OVV was in a clear uptrend. Weekly chart not shown but also in an uptrend. Bought OVV on 04/01/21 for 15,08 First successful trade in 2021 but the entry was a little bit late because of the christmas holiday. R:R 2:1

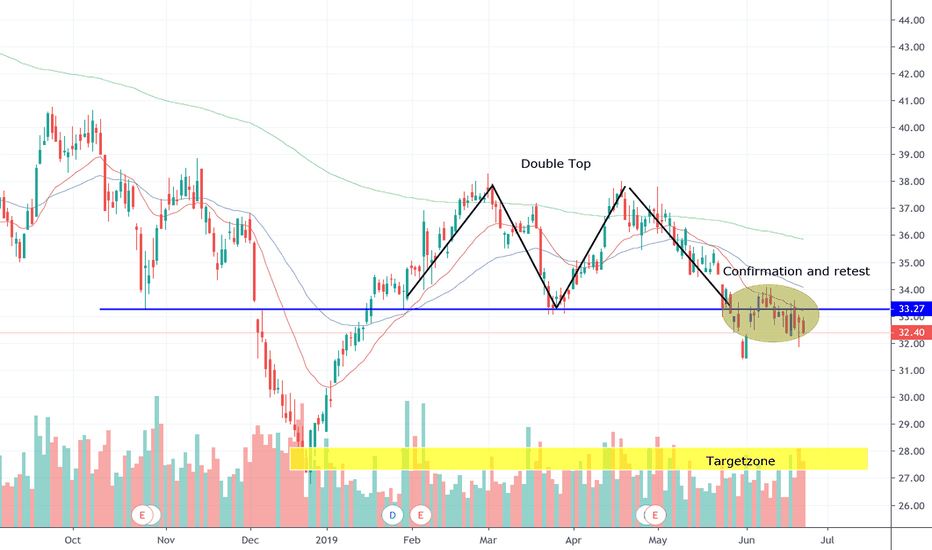

Unm formed a nice doubletop on a daily basis in a weekly downtrend. Retest of the neckline was succesfull so there is a potential down to the previous lows of 27-28$

AAL built a Shooting star at the EMA (30). In the past the EMA was respected by the Price and strong candle Signals were followed by big downmoves.

Ebay breakout of a consolidation/ sideways pattern. There a good chances that the trend will continue to the upside. Wait for better entry for the pullback to the breakoutzone. Target 42-43$ Stopp 37.8$

BKNG breakout of the descending Trendline on the weekly Chart. The old highs of 2.000-2.200$ from march 2018 seem to be a good target. Stop loss below 1.774 (Weekly candle open). For a better entry Maybe waiting for a retest of the Trendline.

AMD is in a strong uptrend. A bullflag built up and so a continuation of the upmove will be possible. The old high is a good Profit target. Stop loss in Price break Below the trendline or Below the ema50

APA is in a downtrend. In the weekly chart a bearish engulfing formed at the ema50. Price bounced off the ema200 and the consolidation flag was broken. Good chances that the downtrend will continue.