Gold made history in July of this year when it created a new all-time high. Prior to this, the last time a new all-time high was created was 9 years beforehand. Not only was a new-all-time created, but in the process, price moved above the major $2000 round number. When price moves past major levels of support or resistance we tend to see price revisit that...

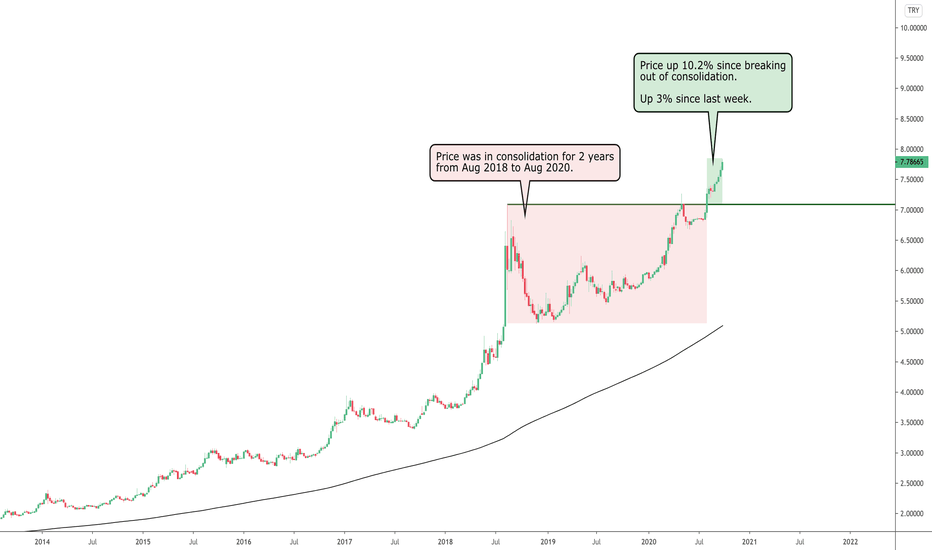

Since posting about the USDTRY last week, price has continued to rise, handing out easy profits so far to those investors that have added this to their portfolio. This forex pair has been mentioned in our community leading up to our entry and as you can see, a linear trend is starting to form. In last week’s post, price had moved up over 7% since breaking out of...

Taking our minds back to February at the start of 2020, anyone claiming a market crash was happening would have been believed, as we were witnessing fast declines in the global markets. The S&P alone went done by 35% from February to March 2020, even falling below the weekly timeframe’s 200 simple moving average. Global pandemics can have an unpredictable effect...

Forex pairs have been off the radar for some time as most of the action has been in stocks. But here and there, certain forex pairs will pop up with opportunities and this is the reason that we never take our eye off the ball. You can clearly see from the chart that the US Dollar is gaining strength over the Turkish Lira and has consistently been on the rise for...

Nike has been off the radar for some time, especially since it started consolidating from December 2015 to May 2018. The trend following its breakout of consolidation has lacked the energy and momentum of the prior trend when Nike shares saw a growth of 612% from March 2009 to December 2015. The trend experienced its first pullback and made contact with the...

Microsoft is looking strong and another stock that has performed well following the global pandemic is Apple. Tech stocks, in general, have seen great results which is also evident by glancing at the Nasdaq Index. Due to the fact that many people are working from home, it is no surprise that this sector has seen staggering growth in a short period of time. In...

This week has seen the S&P 500 make new record highs, which is far from what many investors expected to see during the middle of the global pandemic in March. The previous all-time high at $3393 set back in February, was holding strong last week as we witnessed the buyers trying to claw its way above this level without success. Price has been sailing higher for...

With Tesla seeing a rapid 400% ascent from March to July this year, has the steam finally run out or is price setting itself up for the next assault on levels of resistance? In March, price found a base at the 200 simple moving average, using this zone as support. The 200sma cushioned the fall in price which saw a drop of 61% during the global pandemic. From that...

The S&P 500 made a sharp reversal following the 35% huge declines we experienced as a result of the global pandemic. From the lows in March of this year, price has moved up 52% and still climbing. Since price moved back above the 20 simple moving average on July 1st, the 20sma has been used as support which is a good indication of a strong linear trend. Momentum...

Apple has seen some significant growth since April this year and still has the potential to soar to new heights. From looking at the history of this stock we can see that following the end of trends, price tends to pull back before resuming the trend. Right now price is in the trend phase and a pullback could kick in at any time. The other thing we can notice...

The S&P has started off August with good momentum, opening for the day with a gap up candle and edging ever closer to the all-time high at $3393 from the February 19th 2020 high. The pattern of higher highs and higher lows is evident when looking at the daily timeframe, from the March 23rd 2020 low. If the momentum continues to build then price should make light...

The S&P edges closer to the current all-time high at $3393 from February 2020. Since March, following the declines triggered by the recent global pandemic, price has been forming higher highs and higher lows. Price did experience a mini period of consolidation from June 8th 2020 to July 20th 2020 where price broke out of consolidation. However, on Friday price...

The wait for Gold has been long and has tested our patience, but after 9 years of consolidation, record highs are being created for this precious metal. Prior to the consolidation period, price was in an 11-year strong bull trend, rising from a low of $250 all the way to the previous all-time high set at $1920. As with most good things, they soon come to an end...

Amazon has gone on to reach staggering highs of $3344 this month and is proving to be a dominant force in online shopping. While the world has been in lockdown during the pandemic, Amazon has been busy delivering much-needed items to people around the world. It was in 2017 when Amazon moved above $1000 a share, then in 2018 price first broke above $2000 but then...

The S&P has been held up well by the $3000 round number, the 200 simple moving average and a major resistance turned support level from the 26th July 2019 high at $3027. This level was a previous all-time high and is now acting as a strong level of support and has been responsible for keeping price from falling recently. Following on from the impulsive move we...

After such a rocky start to the year, the S&P appears to be finding its feet and getting a grip using the daily 200 simple moving average. Price declined by 35% from February 2020 but quickly recovered once price found support in March at a low of $2191. The recovery took price to a high of $3233 on June 8th 2020 before the expected pullback took place and...

Gold is not a fast mover but nonetheless is proving to be resilient and creating higher highs and higher lows despite obstacles along the way. The global pandemic forced price down rapidly to the 200 simple moving average in March of this year. Price quickly found its footing and soon began rising and breaking above previous highs. From April 14th 2020 price...

The FTSE 100 has displayed consistent strength since the low at $2191 in March 2020, soaring up through the important 200 simple moving average. The 200sma was acting as resistance but now appears to be holding as support. This support level is clustered with the high from July 26th and the $3000 psychological round number. This area was used as support earlier...