NYSE:DHI Typical pattern of reversal of a trend in financial markets. Entry on the breakout of the neckline and management of the trade in trailing stop for a greater possible risk reward. The question is, "Which Broker and which financial instruments could you trade best with?" In this case, I use stocks securing them through options. This is one of my...

BME:ANA Broken very well the support of this clear descending triangle. If we consider the height of this pattern the Risk Reward is 3.8/1 therefore seen the speed of the short positions with respect to the long ones, the return on the allocation is very fast if the target is reached.

NYSE:TSN Resistance broken and potential start of an uptrend, considering the height of this pattern, so excellent Risk/Reward.

NYSE:AEG If you want to short the stocks this is a classic descending triangle on which you could take advantage.

NYSE:CBT What would I do when the price comes close on these two clear levels? I will be on the side where the statistic gives favorable results. If you are curious soon you will receive information that you can use to learn how to trade in the financial markets. Trading is not particularly difficult or unusual. A company also trades: on products, on services, on...

NYSE:KEY Fantastic ascending triangle with more retest of level 18.50. Sellers have no longer held purchase volumes and therefore can be a good opportunity to ride a potential bullish trend.

NASDAQ:WDC Breakout of the double bottom, and first target in trailing stop at the level of the previous pattern.

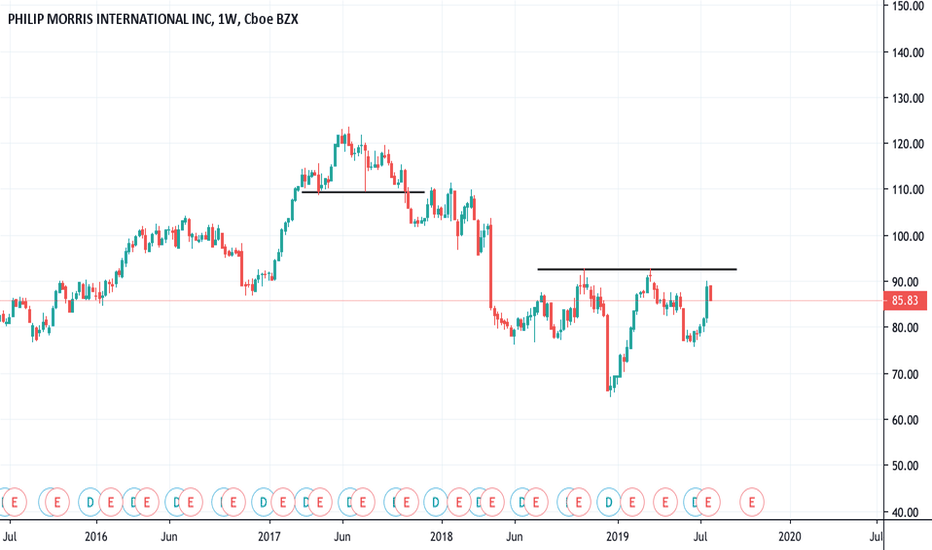

NYSE:PM Do you know this pattern? The so-called head and shoulders in the analysis of financial markets is an opportunity to be taken if you trade. Do you know why? It's all about math and probability. Staying on the statistical side in your favor is what creates potential financial growth, which in turn will give you time to do what you like.

Excellent breakup of the resistance of this continuation Cup & Handle.

AMEX:LNG Did you set the alerts? What do you do on level 70? Do you have a clear strategy? Trading is mathematical and if you understand your way of trading you may achieve financial freedom.

Bullish setting in EPD - Enterprise Prods Partners. Breakout of the bullish triangle and we try to ride this trend too. NYSE:EPD

NYSE:BR Our Long position on BR was the trade of the month with a 10-fold gain over the potential loss. As always, Risk Reward and % Profitability are the fundamental data to evaluate the efficiency of your way of trading, in addition to the Mind-Set.

HOF2020-RBF2020 Our trade on this spread between Heating Oil Futures F20 and RBOB Gasoline Futures F20 has started. In 87% of the times this spread is profitable in the seasonal window. Our job is to find the best time both statistically and technically.

NYSE:CFG A break in the symmetrical triangle after a short bearish trend. Risk Reward makes this trade interesting.

Clear rupture of the static support for this descending triangle . Interesting Risk Reward Ratio, if we think that our target is on the level of the previous retracement, and we position our Stop Loss just after the maximum of the Breakdown candle.