THE-CHART-ALCHEMIST

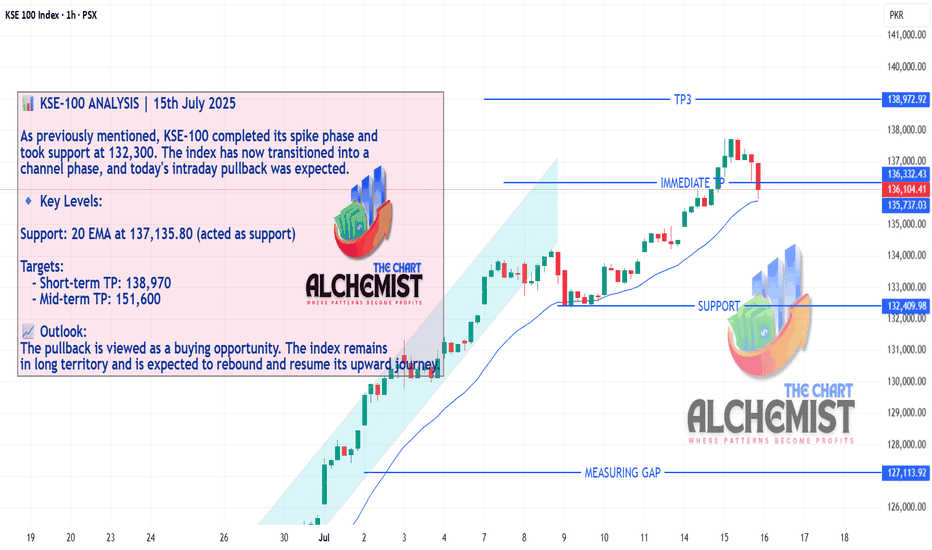

Essential📊 KSE-100 ANALYSIS | 15th July 2025 As previously mentioned, KSE-100 completed its spike phase and took support at 132,300. The index has now transitioned into a channel phase, and today's intraday pullback was expected. 🔹 Key Levels: Support: 20 EMA at 137,135.80 (acted as support) Targets: - Short-term TP: 138,970 - Mid-term TP: 151,600 📈 Outlook: The...

GEMNETS – BUY SIGNAL | 14 JULY 2025 After a strong move from Rs. 12 to Rs. 20, GEMNETS entered a pullback phase, which has now transformed into a bullish flag and reaccumulation zone — a powerful structure setting up for another leg higher.

GADT – BUY SIGNAL (THIRD STRIKE) | 14 JULY 2025 | 1H TIME FRAME After breaking out of a slightly upsloping trading range (marked in light blue) and achieving a high of Rs. 570, GADT pulled back. With the pullback nearly complete, we expect a bounce and a run toward multiple quantified displacement targets.

AGL – BUY SIGNAL (THIRD STRIKE) | 14 JULY 2025 After achieving a high of Rs. 75 and correcting into a selling climax, AGL reversed sharply and entered a sideways accumulation. Recent price action now suggests the stock is poised to move upward.

ITTFAQ – BUY SIGNAL (SECOND STRIKE) | 14 JULY 2025 Given the recent formation of a bullish structure, we're revising both buy and stop loss levels to reflect the current opportunity.

NCL – BUY SIGNAL (SECOND STRIKE) | 14 JULY 2025 After a successful first strike that achieved all targets, NCL has now broken out of consolidation zones on both higher (yellow) and shorter (light blue) time frames. This setup presents a strong second strike opportunity.

EMCO – BUY SIGNAL | 14 JULY 2025 After breaking out of a trading range (light blue channel) and achieving a high of Rs. 59, EMCO completed its pullback and retest phase, positioning itself for upward movement.

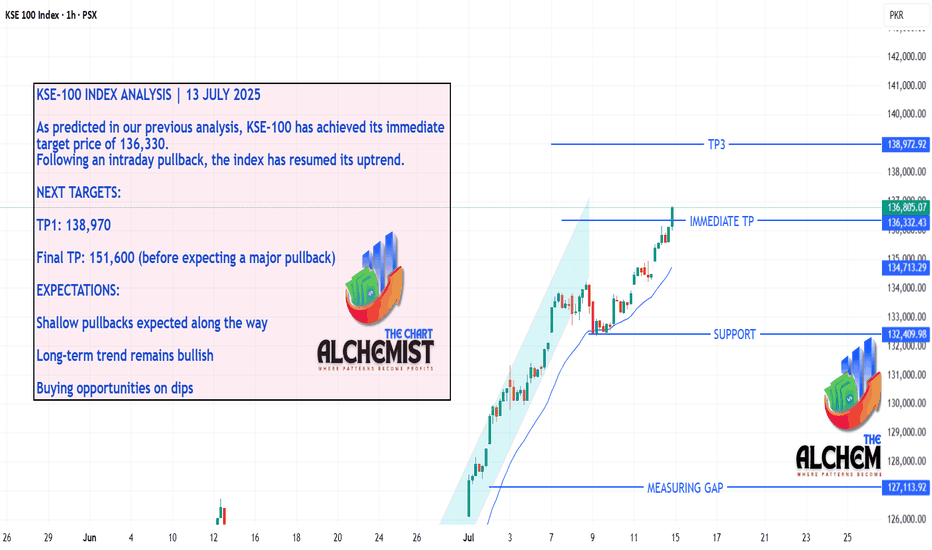

KSE-100 INDEX ANALYSIS | 13 JULY 2025 As predicted in our previous analysis, KSE-100 has achieved its immediate target price of 136,330. Following an intraday pullback, the index has resumed its uptrend. NEXT TARGETS: TP1: 138,970 Final TP: 151,600 (before expecting a major pullback) EXPECTATIONS: Shallow pullbacks expected along the way Long-term trend...

MACTER – LONG TRADE REVISIT (SECOND STRIKE) | 13 JULY 2025 After a successful first strike call that achieved all targets, MACTER experienced a deeper-than-expected pullback. With the stop loss now adjusted below Rs. 400, we are issuing a revisit entry as a Second Strike, based on renewed bullish potential.

Gold has been trading in a range ($3230 - $3440) marked in light pink channel. After an upward leg and pullback to $3245, gold has resumed its uptrend, creating a bullish structure near current prices.

KSE-100 ANALYSIS | 13 JULY 2025 The KSE-100 index recently experienced a steep uptrend accompanied by shallow pullbacks. However, since July 8, 2024, the slope has moderated, and the index is now trending upward at a relatively mild pace. EXPECTATIONS: We anticipate deeper pullbacks in the coming days, but remain confident that the index will achieve its...

BATA – LONG TRADE (SECOND STRIKE) | 13 JULY 2025 The stock broke out of a consolidation phase (marked in light pink) after remaining in a downtrend (marked in blue channel). It achieved TP1 in our previous call and has now formed multiple bullish structures that are expected to act as major support for the next leg up.

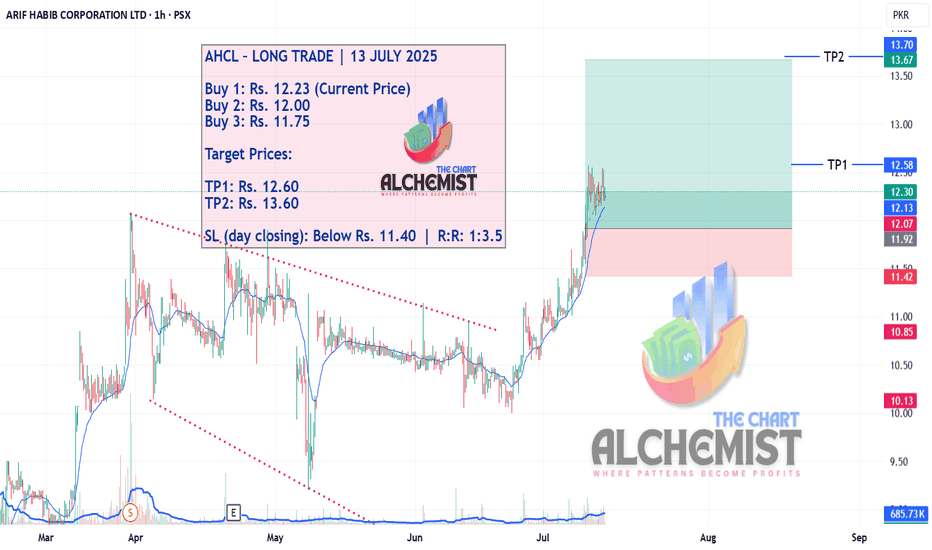

AHCL – LONG TRADE | 12 JULY 2025 The stock achieved a high of 12.07 PKR, then entered a complex correction forming a diverging channel. After breaking out of this channel, the stock has created bullish structures and currently lies at a newly formed support, making it a safe place for a long entry.

LOADS – LONG TRADE (REVISIT) | 12 JULY 2025 The stock is moving within a bullish channel (pink) and has recently touched the channel twice. After consolidating in a smaller channel (yellow), the stock shows signs of rising towards the top of the channel.

NETSOL – LONG TRADE | 12 JULY 2025 The stock is trading within a range marked by a blue channel. After touching the resistance area, the stock has created several bullish structures, indicating potential upside beyond the current range.

TREET – LONG TRADE (SECOND STRIKE) | 12 JULY 2025 The stock previously trended downward in a blue channel but has reversed, forming an inverted head and shoulders pattern. With multiple bullish structures in place, the current level appears to be a profitable and safe entry point.

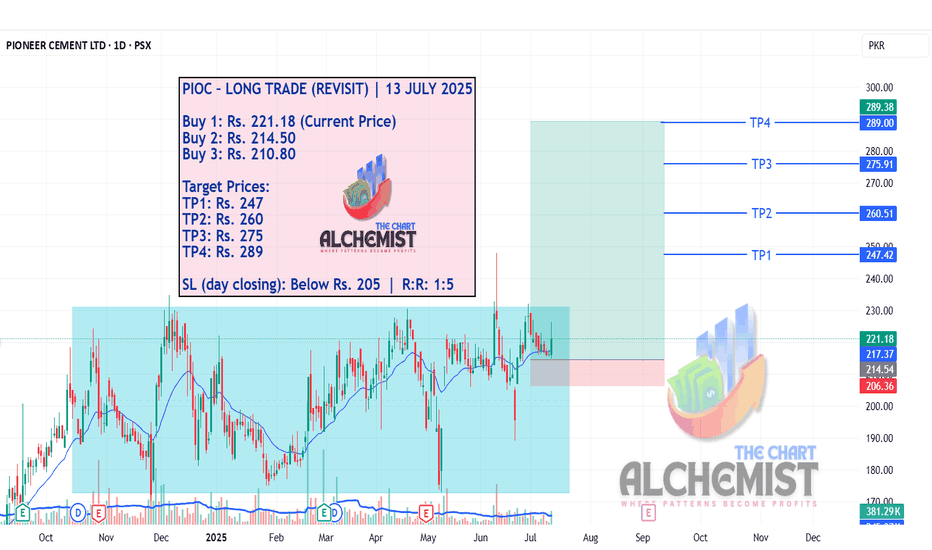

PIOC – LONG TRADE (REVISIT) | 12 JULY 2025 The stock has been moving within a trading range, forming a DB Bull Flag, a powerful bullish pattern. Based on the current price position within the previous range (light blue channel), we identify a safe and profitable entry point for a long trade.

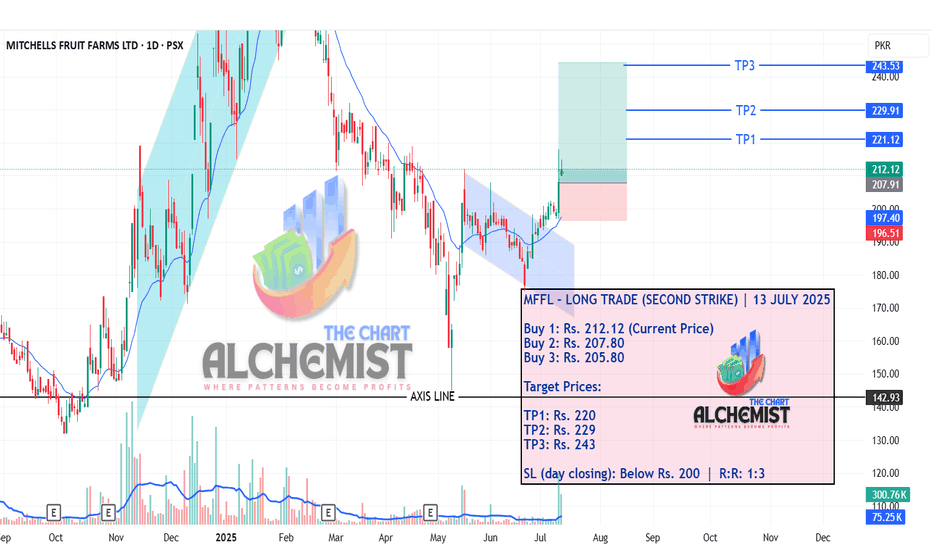

MFFL – LONG TRADE (SECOND STRIKE) | 12 JULY 2025 After our previous buy call achieved its first target, the stock is currently positioned over a bullish structure, indicating potential for further upside. The present price position appears safe against downward action.