TKProphet

PremiumOANDA:US30USD We entered our last US30 position early, but we got a 400-pip move in the process. This is still a key level on the daily. I'm entering from this zone when price begins to consolidate to show signs of support. Until then, use the alerts to notify you if price creates a lower low on the 2-hour time frame. Again, if this area builds support, there...

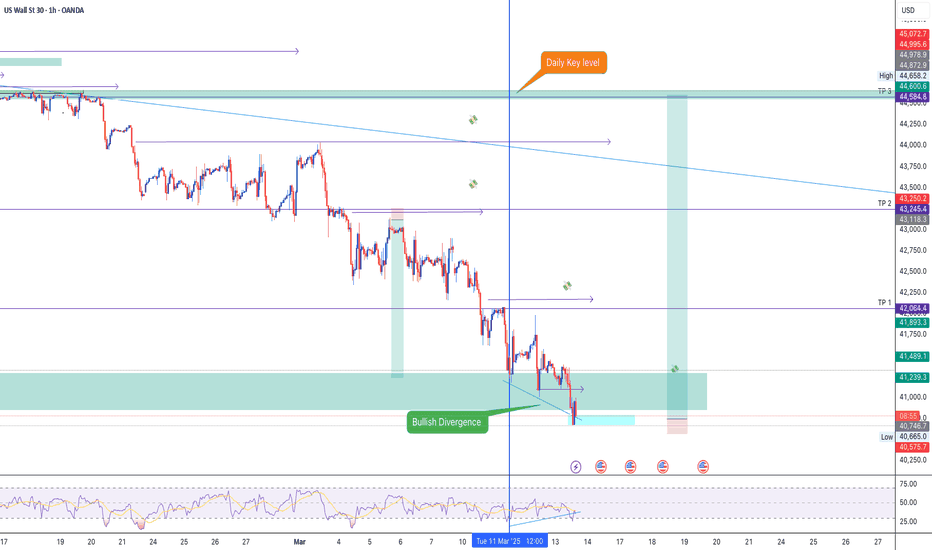

OANDA:US30USD We caught a massive sell on US30. At this moment, price is retesting a Key-Level on the Daily time frame. The break beneath the 41,736.5 area seems to be a huge liquidity grab while also retesting this structural level. If price fails to break this zone, there is a big chance that we will see a retest of the highs over the month. We enter this...

Looking at USDJPY, we are testing a double bottom on the monthly time frame. Depending on what happens during the London Session we could see a false breakout above the highs or a continuation of the uptrend.

FX:USOIL USOIL has been on a steady downtrend and now we are faced with another potential bear flag. Recent price action may have left us a opportunity for a entry on the sell. I'll set an Limit order to see if price will retest this level before the fall.

We've reached an area structurally where something has to give on Gold. If price breaks the highs we could see a continuation of the uptrend. On the other side of the coin the 200 day EMA is right above price on the 15 min time frame. If a rejection occurs we could see a pull back to the 50 FIB.

Usoil gave us a nice pull back last week forming a potential bull flag. With the break of this structural level of resistance USoil may continue the uptrend.

FOREXCOM:XAUUSD Gold has been on a beautiful bull run and the questions is when will she run out of gas? After breaking above the previous highs at the 2590.12 area, we witnessed another impulsive move. Now, price is consolidating on the 15 min with bearish divergence printing on a few different time frames. The momentum is still bullish while price action and...

FX:AUDUSD This pair created a really strong uptrend until this point. Last week price stayed within range most of the week. Let's see if the market has created enough liquidity to break the lows. Depending on the strength of the momentum when price retests the highs, we could also see the formation of a Bull Flag. To be safe wait until price breaks above the...

FX:AUDCAD On the higher time frame price shows a strong uptrend on this pair. With the current condition, we may be in for another impulsive move. The question is will the trend continue or will the market pull back? Looking at structure in this area as long as the highs are not broken there is a good chance that we will see a slight pull back before the...

FOREXCOM:XAUUSD What's going on? Through the strong move on Gold to create higher highs we have a few bearish sign. We have bearish divergence being formed showing possible signs of fatigue in the market. On the 4 hr time frame we have a potential double top being formed showing us the early stages of a reversal. On the other hand, if Gold manages to create a...

Let's do a quick market review during the London session. I look through our winning trades to show how we took advantage over a few quick sells and a few potential setups. (😒 My apologies I forgot to turn the mic on.)

The dominant trend so far is to the downside with USOIL. If price holds at this resistance we could see a continuation in the current downtrend. Pice also created a double top above the highs, so this sell may not be long term. If price fails to hold at this resistance level we could see a retest of the double top before we see a change in direction with USOIL....

OANDA:US30USD Taking a look at the 2 hr time frame. I noticed that price created and confirmed a double top, which is a top reversal. Also at the closest structural level of support price also formed a inverse head and shoulders pattern on the same time frame. In this battle of patterns, let's see if the double top holds after being retested by price. If ...

FOREXCOM:XAUUSD We've had a steady downtrend with this pair and not many pullbacks. With the wicks printing on the last few candlesticks, it's possible that the sell may be running out of steam. Let's watch this level closely, if this structural level of support holds up, we could see a reversal in the downtrend.

FX:GBPCAD This pair created multiple rejections at the highs before printing a top reversal. Those rejections on the 1 hr time frame formed a Micro level of resistance in the market. If this level holds we could see a test of the 78.6 level on the Fib. If Momentum remains bullish on the higher time frames we could see a break of the highs. If that occurs I'll...

FX:AUDUSD Preference: AUDUSD has been trending downward for the majority of the week. After consolidating and breaking above, we set a buy limit order at the double bottom on the 30-minute time frame and waited for this structural level to be retested. Our trade is now active. If this level holds, we could see a retest of the highs before a continuation of the...

TVC:USOIL Preference: Oil was in a downtrend until price retested the lows on the daily time frame. In this area, if the price fails to create a lower low, we could see a retest of the previous support level, which is now resistance. Alternative Scenario: "If the downward trend in the market continues with the same strong momentum as before, we may see a...

FX:USDJPY Preference: With the first TP hit on our original sell price pull back immediately. This pullback retested the highs but failed to create a higher high. If the bears hold on to momentum at this level we could see a break of the low. Alternative Scenario: With multiple rejections above the highs, liquidity retests above the highs are also possible....