TP_Daniel1

Hello everyone! After in-depth research and analysis of the recent market conditions, I believe that the current market has entered the stage of accelerating to the top. From a technical point of view, such as the MACD top divergence sign, the KDJ indicator oversold, etc., all signs show that the market's upward momentum is gradually weakening, while the price is...

During this period, spot gold has been like a rocket, advancing all the way and firmly in the upward channel. I have repeatedly reminded everyone before that once the US tariff stick is swung, the gold price will definitely rush up like a chicken blood. No, the facts prove that our prediction is quite reliable! Tonight, the market ushered in another "big news" -...

Analysis of gold market trend: Today's gold is still fluctuating greatly under the influence of tariffs. Today, we have analyzed that gold has the risk of callback, and long positions are also falling back to lows! Trend realization analysis and ideas! From the surge on Wednesday, it can be seen that the risk aversion sentiment of gold has heated up again. The...

Stop loss is always right, even if it is wrong; holding on is always wrong, even if it is right. Stop loss is unconditional! Without trading principles and trading discipline, all technology is equal to zero! Spot gold fell by $212 in three days, and the bears shined. A while ago, we warned of the risks, but many people scoffed at it, thinking it was alarmist and...

Early layout plan for gold: On Tuesday, the public strategy suggested shorting gold at 3015, which was perfectly hit again, and successfully obtained high-altitude profits. In the real market, short orders near 3014 were also arranged, and the market closed at 3000-2998, and then 14-16 points of profit were collected! Gold technical analysis: On Monday, gold went...

Technical analysis of gold: Gold continued to fall in the US market, and the price continued to return to the low point of the Asian market. The rise was not continuous, and the impact of tariffs remained. The market reported that the tariffs would be suspended for 90 days. It can be seen that US stocks, crude oil, gold and silver all rose rapidly, and then it was...

Gold trend analysis: There are many points worth interpreting in the intraday market. Let's review and replay: Today, the market bottomed out and rebounded in the morning. Did you chase the short position after the opening fell sharply? The 2980 first-line support was tested many times without breaking, which is a move to lure shorts, waiting for you to get...

This week brings new trading opportunities, as well as new market opportunities. Nowadays, the market fluctuates greatly every day. Being a short-term trade means high frequency, fast in and fast out. As long as you do these well, you can make money in short-term trading. Don't be greedy for more. The most important thing in trading is stability. Going fast is not...

Early layout plan for gold: 3.31-4.4 Reviewing this week, a total of 20 layouts were arranged, and the overall harvest was 1245pips! This week can be called a super week. After the tariff fundamentals were implemented, the market started the callback mode, and there was a big sweep in the middle. It is unrealistic to say that we can win all the games. The number...

Gold early layout plan: intraday top and bottom capture is perfect! The strategy layout is truly presented, the strategy prompts shorting at 3135, accurately cashing in the high point, and falling sharply to 3070! Continue to arrange 3072 long positions to smoothly stop profit and exit at 3086. Gold fell by 110 yesterday and rebounded by 80. Today it fell by 30...

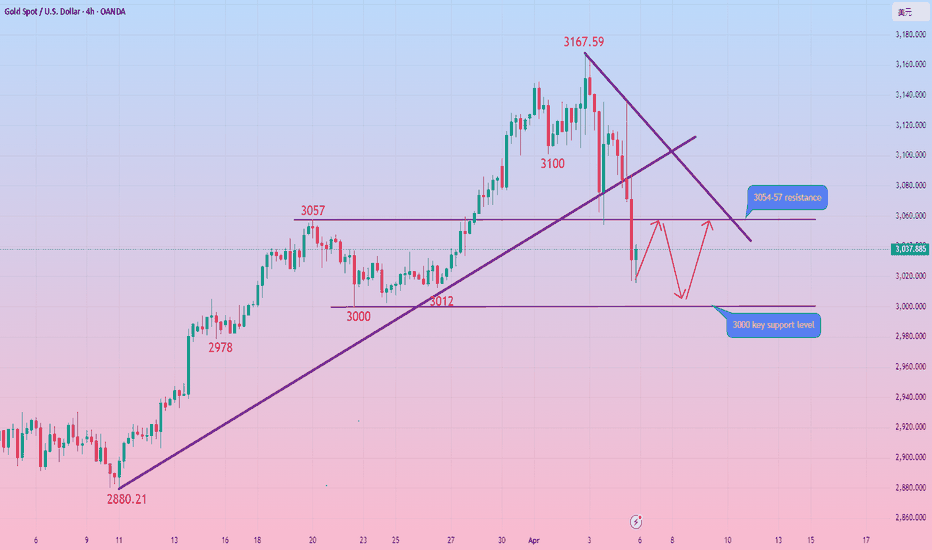

Analysis of gold market trend: Gold fluctuated quite a lot yesterday. It rose at the opening yesterday, rising to nearly 60 US dollars, and then fell back after being blocked at the 3167 line. However, it fell below 3100, and the lowest to the top and bottom conversion was around 3054, a drop of nearly 114 US dollars. Beyond expectations, it pulled back to 80 US...

Gold took a large "V"-shaped reversal pattern on Thursday, with the highest hitting 3167 in the Asian session, and continued to fluctuate and fall in the European session. It successfully fell to the lowest 3054 before the US session and then rebounded. As of now, gold has deeply bottomed out and rebounded to 3135. It has now started the oscillation mode. Gold...

What is coming has come, more than 100 US dollars a day, the decline is always faster than the rise, and more fierce, after breaking the 3100 watershed, it accelerated downward, the current minimum is 3054, the key position below is 3000/3040, pay attention to the plunge and the card position can also participate in the long, but must be patient to wait for the...

The United States has officially launched a tax increase policy on major global trading partners. The wide range of goods involved and the high tax increase are rare in history. The essence of the tax increase is to require countries to have the same tax rate on US goods as the US export tax rate to them. For example, if Indian motorcycles face a 2.4% tax in the...

Technical analysis of gold: Affected by fundamentals, gold rose sharply again. The daily line finally closed in the positive zone and maintained a strong high at the opening. Pay attention to the upper and lower support of 3148 during the day. If it holds, it will have the momentum to continue to rise. The 4H cycle will strongly break through the upper Bollinger...

The tariffs were also successfully implemented. In response, the market bulls and bears also responded strongly. After all, the 3105-3142 area rose and fell in seconds, which was a terrifying market. Of course, to be honest, this wave of turbulence was mostly caused by institutions. After all, the market smashing was also extremely strong. However, I don’t agree...

Gold prices hit a new all-time high as investors seek safe haven assets amid growing uncertainty in the global economy. After several rounds of market turmoil, investors have recovered somewhat in Asian markets this week. In the coming week, the focus will be on the reciprocal tariff plan that Trump will announce on April 2. If Trump decides to take tough measures...

Technical analysis of gold: Gold first rose and then fell, but the subsequent rebound was indeed quite strong, exceeding our expectations. Gold fell into a large range of fluctuations, which added a certain degree of difficulty to the operation. Although gold rebounded beyond expectations, it still did not break through today's high point, so it is still under...