An ASX Stock I picked up on my long range scans. We see in September 2019 a large volume spike which as a news event. Th OBV dropped below the 233 WMA meaning the stock was not ready to go, as all the buyers a dried up on the initial move after the news event. Price moved sideways then in December 2019 another volume spike with support by the ADX , SAR and OBV...

Since June 2019 we have seen a strong bullish move in gold, which then peaked in September 2019. The stayed bullish as show by the OBV indicator stayed above the WMA 233 moving average. A three month decline in price followed as accumulation of sellers absorbed. A new buy signal around the 20th of December with the cross over of the ADX DI+ above the DI- Line...

I've probably held this one back a little longer than I would normally, due to my personal bias of previously being burnt by it...But the charts are now too interesting to leave it in my watch list. If your not familiar with ASX:RAP they are producing a smart phone App to help diagnose respiratory conditions. Some recent news around TGA classification as a...

Between October 2017 and the beginning of 2019, we have seen a 5 wave move from the mid 70's to the low 40's. Any move that starts with a 5 wave move will end with and at least an equal 5 to complete what is called a Zig Zag pattern. The was a correction back to test the bottom of the previous wave. This didn't complete a 5 wave move, therefore this must be a 3...

With a rally in BTC over the past months, and a small A-B-C correction(or commonly known as as flat), a positive reversal pattern has developed in the RSI. This gives us a opportunity to calculate the finally target for wave 5. I do have a Fibonacci target at 15008 and a Gann target of 1491, but another way to calculate a target is when the RSI has formed a...

Gold is currently in wave 4 of a 5 wave move.The target is calculated from a middle of the 5 wave pattern and using symmetry to get a fifth wave target of $1510. We should see a sell off as the 4 wave develops. A move in price back to $1375 would be a good price to enter long.

Now that we have reached our first target of $10900, we can see that the five wave move is incomplete. Using fib levels we calculated the middle of the 5 wave structure to be at $9500. Using symmetry from this middle point we have a final target of $15000, which will complete the five wave move breaking the previous high, which also coincides with the sell area...

Bitcoin's initial rally is ending with a sell pivot printing on the weekly chart. We should see price move lower to the buy zone near 4800 handle. More work is need to shake out the weak hands, before we see prices rally back towards your our first target of around 10500.

One of those stock on the ASX I have had my eye on for a few weeks now. With the initial breakout of the range in January 2019, we have see a pullback as the wick of the candle drove in the buy zone on medium but declining volume. Since that we have seen a steady trend starting with key bars printing followed by small pullbacks(see blue arrow). The Ichimoku...

Jaws of Death pattern playing out on the US markets. Liquidity pumped into the system has driven the index on a fa-nominal move to all time highs. Now with a sell pivot now in place on the weekly chart and a trade war raging, the short plays first target is to the point of Control at 1806. The secondary target will be somewhere between 1237 & 950 level, which is...

The USDCAD has been in a strong up trend since March 2018. Will see it move high as price begins coils before it pops as selling pressure drys up.

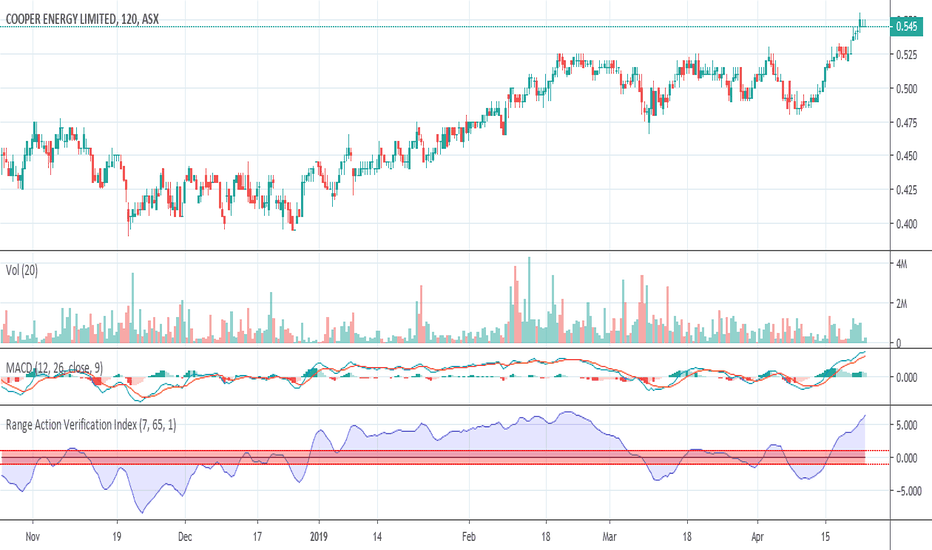

Cooper Energy Limited ( ASX:COE ) is an energy company which focuses on exploration and production in oil and gas. COE has a portfolio comprising of prospective acreage in the Cooper, Otway and Gippsland basins Australia. As the Sole gas project draws closer to completion (expected end of May) there is more interest being generated, with CBA and its related...

After four years of a declining aussie dollar, and price reaching close to GFC levels, there has been a slow recovery. Around mid 2016 price started to trend higher until the first quarter of 2018. There was that stop run again, during New Year 2019, to re-test the lows of 2016 and produce a double bottom. This movement put price right into the buy zone on the...

Since to large stop run on new years eve, we have seen this pair move higher over the first quarter of 2019. With higher time frames showing bullish activity, a buy pivot was printed on Monday when price was in the buy zone of the previous buy pivot candle. With the MACD to confirm the direction, now is a good time to get long. I'm looking for a target of 184.240...

The cable has slowly being coiling like a snake, ready to break higher out of its range. We have a divergence between MACD and price to confirm the move. Trend lines are only draw to highlight the divergence between the MACD and price so they are not use in my analysis. All other higher time frames are bullish, where we have a target of 1.6390, which is the POC(...

If you are suffering from FOMO today with the big move in bitcoin, don't panic. The price action will re-trace back to 4647 level, where I expect a lot of pending orders are waiting to be filled. The next entry level to buy will be around the 4400 level (the 25% fib), so don't feel you have missed out. This will also be a retest of the prior range, which started...

I'm still bearish, but I believe price needs to move a little higher before the bears appear. A nice bull trap to break the all time high, before a reversal to the 1800 handle. Calculating the mid point of the wave and using symmetry, the target should be around the 3100 level. Coming from another angle, I used another method to get close to the same result. So...

Auckland International Airport ASX:AIA continues to trend well and has generated another entry signal following recent activity. Declaration: We are already holding this stock.