This chart of the U.S. Dollar Index (DXY) on the 4-hour timeframe shows a strong rejection from the highlighted resistance zone around 109.800–110.000. Key Observations: - Rejection at Resistance: Price attempted to break above but faced strong selling pressure, leading to a rejection. - Possible Downtrend Formation:** The price could now move lower,...

This chart shows a bullish trend for gold (XAUUSD) on the 1-hour timeframe, with price respecting an upward trendline and staying above key moving averages. A possible buy zone is identified near the trendline support, suggesting potential continuation to the upside. The first target is set around 2,880, while the second target extends to 2,901. The structure...

This is a monthly chart of XAU/USD (Gold Spot) showing a long-term ascending channel. Key Observations: 1. Price is near the upper boundary of the channel, around $2,874 2. Potential resistance at approximately $3,202, marked with an upward arrow. 3. Previous price action shows respect for channel boundaries**, meaning a pullback from resistance is...

Gold is currently trading within an ascending channel on the one-hour chart, approaching the upper boundary near 2840. The price has shown strong bullish momentum, but the marked resistance zone suggests a potential pullback. A rejection from the upper boundary could lead to a retest of the highlighted support area around 2820. If this support holds, the bullish...

This BTC/USD chart (2-hour timeframe) shows a descending triangle pattern with a strong resistance trendline. Key Observations: 1. Price Rejection & Support: - BTC recently bounced from a support level around 93,747 and surged back above 97,952. - This suggests a potential short-term recovery. 2. Potential Upside Target: - The chart highlights a...

This chart shows a potential bearish setup for gold, with a breakout below a key level. The price recently failed to sustain its move above a resistance zone and has started declining. The structure indicates a shift in momentum, with a possible move toward the lower trendline of the ascending channel. Key downside targets include the areas around 2799 and 2764,...

This chart shows XAU/USD (Gold) on the 1-hour timeframe, highlighting a potential sell opportunity around the weak high zone near $2,810-$2,820. Key Observations: 1. Bearish Confirmation Needed : - The price is approaching a resistance zone within an ascending channel. - A rejection or bearish confirmation (e.g., candle reversal, strong wick, or BOS...

This chart shows gold (XAU/USD) on the 1-hour timeframe, highlighting key resistance and support zones. Key Observations: 1. All-Time High & Major Resistance: - Price recently reached an all-time high and faced rejection from the major resistance zone. - A pullback is currently in progress, and the chart suggests waiting for **bearish confirmation**...

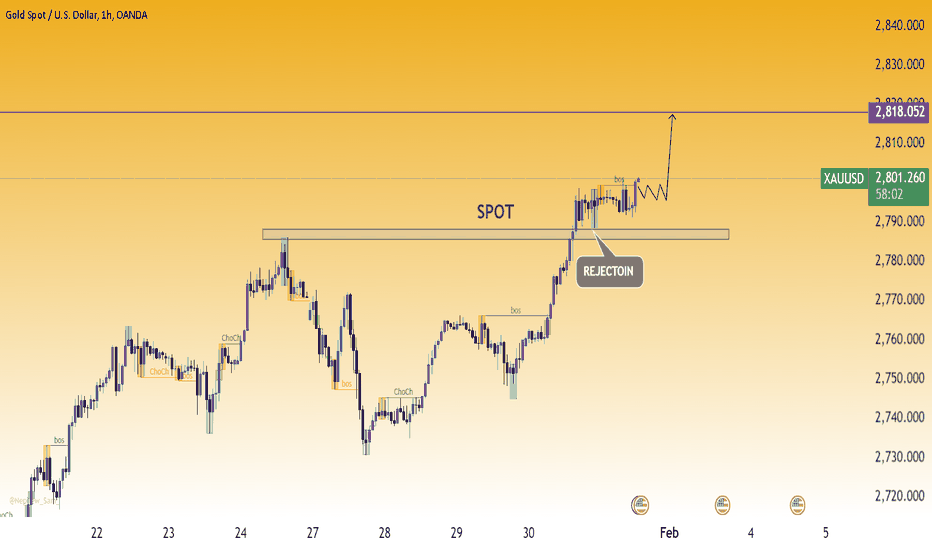

**Gold (XAUUSD) 1H Chart Analysis:** - **Current Price:** Around **$2,800.29** - **Key Resistance:** **$2,818.05** (Potential target zone) - **Spot Zone:** Previous resistance turned support around **$2,790** - **Recent Price Action:** - Gold broke above a key resistance level (now acting as support). - Price faced a **minor rejection** but is...

**Gold (XAUUSD) 1H Chart Analysis:** - **Breakout Confirmation:** Price has broken above a key resistance zone, indicating bullish momentum. - **Retest Zone:** A potential retest of the breakout area may confirm support before continuation. - **Targets:** - **1st Target:** 2,772 zone. - **Last Target:** 2,783–2,784 zone. - **Market Structure:** - Multiple...

BITSTAMP:BTCUSD **BTC/USD Analysis (4H Chart)** - **Current Price:** ~$105,331 - **Major Resistance Zone:** Around **107,500 - 110,000** - **Major Support Zone:** Around **97,500 - 98,000** - **Key Pattern:** A possible **cup & handle formation** is forming, suggesting bullish momentum. **Bullish Scenario:** - BTC is approaching a key resistance...

OANDA:XAUUSD **Gold (XAUUSD) 1H Chart Analysis** - **Resistance Zone:** The price is currently testing a resistance area marked in gray, aligning with a descending trendline. - **Potential Rejection:** The chart suggests a possible rejection from this zone, leading to a bearish move. - **Target:** If rejection holds, the price is expected to drop toward...

This DXY 1-hour chart suggests a potential sell opportunity around the 108.400 resistance zone. The price is approaching the marked "Possible to sell zone," and the analysis indicates waiting for bearish confirmation before entering a short position. Key Observations: - **Resistance Zone:** 108.400 area acts as a key resistance, previously causing reversals. ...

OANDA:XAUUSD **Gold (XAU/USD) 1H Chart Analysis** OANDA:XAUUSD 1. **Uptrend Channel:** - The price has been respecting an ascending channel, with higher highs and higher lows. - The channel’s lower boundary is acting as dynamic support, while the upper boundary serves as resistance. 2. **Current Price Action:** - Gold is pulling back from...

This EUR/USD 1-hour chart indicates a **bearish breakout** from an ascending channel. Key observations: 1. **Breakout Confirmation:** Price has broken below the lower trendline of the rising channel, signaling a potential trend reversal. 2. **Bearish Momentum:** The price is retesting the broken trendline, and rejection at this level could confirm further...

This 1-hour chart of gold (XAU/USD) shows a clear trendline break, indicating potential bearish momentum. The price is now retesting the broken trendline and resistance zone around $2,769–$2,780. The plan is to wait for a bearish confirmation (e.g., rejection or reversal candles) at this resistance zone. If confirmed, the price could target the $2,740 area,...

This chart for BTC/USD highlights the following key points: 1. **Double Top Formation**: - A clear double top pattern is visible around the 108,000 resistance zone. - This is a bearish reversal signal, indicating a potential move downward. 2. **Break of Trendline Support**: - The price has broken below the ascending trendline, further confirming bearish...

TVC:DXY This chart shows a clear Head and Shoulders pattern on the 4-hour time frame for DXY (US Dollar Index), which is a bearish reversal pattern. Here's a short analysis: Key Levels: The neckline is at approximately 108.000, acting as a crucial support zone. A breakdown below the neckline would signal further bearish momentum. Pattern Confirmation: Wait for...