We had a market structure shift on the M1 timeframe. We should see price bounce up from here with high volume.

We should see price bounce up and make some continuation long. We have also tapped into a key order block. We have hidden bullish divergence on the M5 & M15 timeframe.

We have bounced off the golden zone on the fib. I expect to see price fall from here.

We are coming into a fresh demand zone. We had a market structure shift. So we should see a move long here.

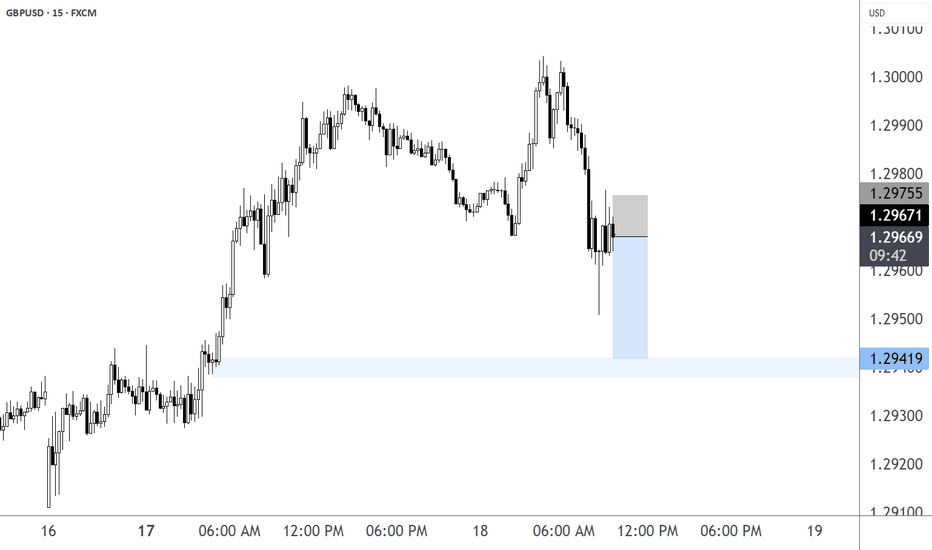

We have tapped into a key supply zone. We are at some key zones on the fibb as well. I expect to see GU drop here.

We have tapped into a key demand area. Price is starting to reject and respect the H1 demand zone.

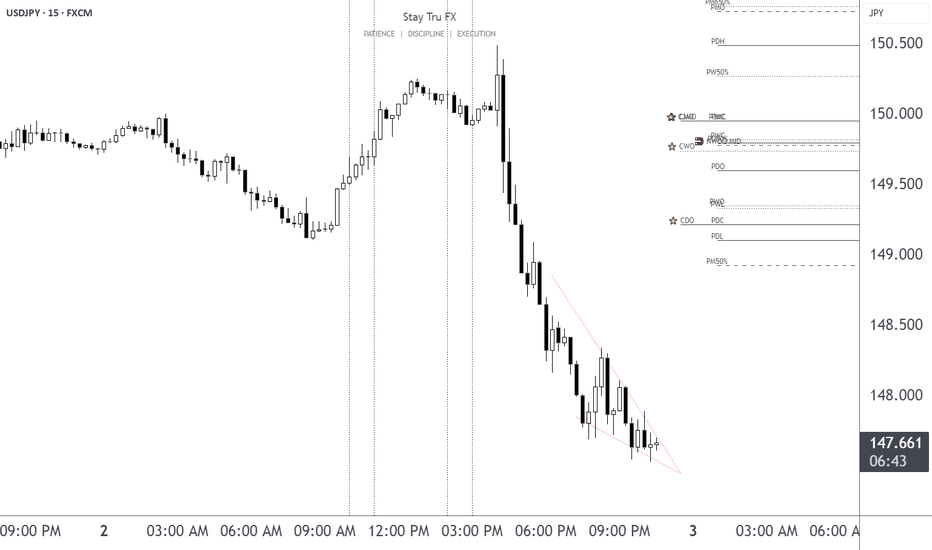

We have a descending triangle/wedge pattern that has formed. I'm expecting to see some continuation short. This trade is based off the M5 timeframe.

We have had a nice pullback after the strong bullish move. I will be expecting to see price to fill the FVG which is drawn on the M2 timeframe that coincides with a breaker block for more confluence. Price is also at .705 on the Fibonacci showing a strong pullback.

This is my buy limit order set up. This is a 1:5 R:R with this set up. We will be looking to fill the imbalanced market, filling the gap & also respecting the breaker block simultaneously. This setup is based off of the M2 timeframe for a more precise entry.

Price has swept liquidity & has also come to an important order block. I expect a bounce up from hereto take out the relative equal highs, which is our draw on liquidity. We have a 1:5 R:R with this setup. Trade is based off the M2 timeframe.

We have a 1:# R:R with this set up. Trade is based off the 2 minute chart.

We swept the equal lows and I expect Gu to stay bullish from here

Expecting to see a short fall here for Nas100. We have a 1:3 R:R with this setup and it is based off the 3 minute timeframe.

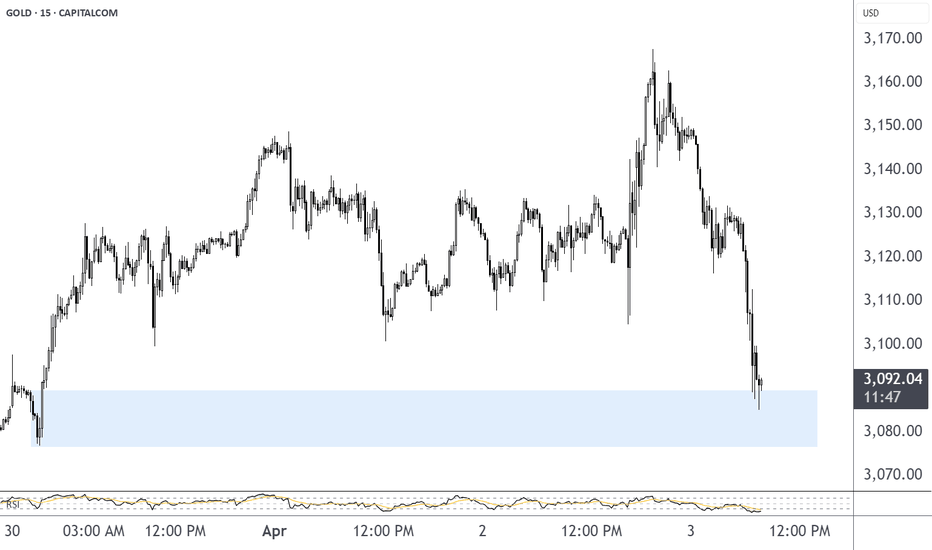

I am bearish until we enter the bullish order block highlighted in blue.

We have a good bullish scalp here on the 1 minute chart. I expect at the least a small breakout to the upside here. We have a bullish triangle on both the 15 minute & 1 minute timeframes.

SMT divergence has developed and we are starting to see bullish price action. I expect a rally base rally here collecting a lot of pips on the way to our draw of liquidity.

This is a another look at the long position taken here. We will be target our draw on liquidity, aiming for equal highs. We are looking at 5:1 R:R ratio. Risking 1% to gain 5%.

We have developed bullish SMT divergence between NAS100 & ES. This is a strong signal to take a long position here.