Taiwan_Bear

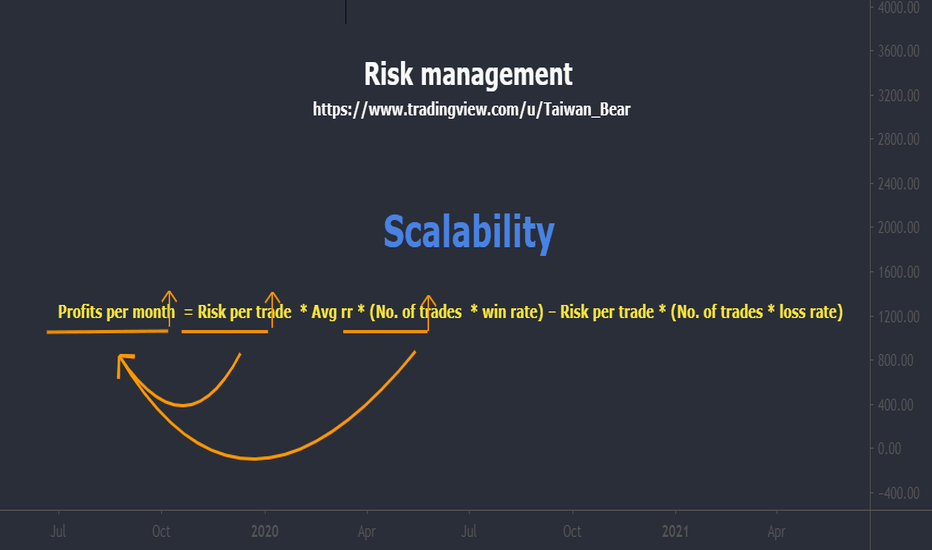

If you have read my previous 3 chapters on risk management, you should understand: • The 1% rule • How to calculate position size • The inverse relationship between risk reward ratio and win rate (and that you only need 34% win rate to make money) Let’s now put them together using the below assumptions: • Account size = $10,000 • Risk per trade = 1% ( = $100) •...

On the higher timeframe, Bitcoin is still showing sideways action with slightly bullish bias. Therefore, we want to focus on buying on the smaller timeframe. On the 1hr, we can see 2x harmonic patterns are in confluence with the demand zone @ around $9,300. Therefore, we can try to buy and aim for $9,600 as the 1st target. Once price breaks above $9,600 I will...

My previous trade has closed manually with tiny profits. I have explained the reasons why I closed the trade as well as the difference between a limit/market order in terms of trading fees. In addition, the importance of waiting for a pullback which has a huge impact on the risk reward ratio. As you know, I think the market is more like to go sideways for a while...

Unfortunately the price hit the $9,300 target before hitting our buy limit order @ $8,400. Trade was cancelled. Now, there is a counter-trend short idea on the 4hr timeframe. A bearish engulfing pattern has emerged at the bearish bat pattern potential reversal zone. Let me remind you again, the current market condition is the most difficult to trade since...

After hitting the 0.618 fib retracement BTC did a significant drop. ~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~ Regarding my long term investment positions: ~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~ I am going to add back the 5% portfolio I bought previously @ $7700 and sold @ $9250 (if price does get to $7700) I am also going to use another 10% capitals to buy...

On the 4th of May I told you that the bullish structure is still intact and I won't consider to short the market unless the price drop below $8,400. Then, two days ago I warned you again that the price has broken above the downtrend line on the 1hr timeframe, please do not short the market. I could have told you to buy the breakout but I didn't want to, as many of...

"The prediction did not age well" is a comment that I see frequently by many traders. These traders aim for 100% accuracy (100% win rate) as it is human nature wanting to be right and avoid the pain of going through a loss. ~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~~ Right or wrong does not matter, the key is the balance between...

Before talking about the market movement, let's review what my portfolio looks like at the moment. ~~~~~~~~~~~~~~~~~ My current positions ~~~~~~~~~~~~~~~~~ Long term investment portfolio: For $7,000 positions (roughly 40% of my investment portfolio) - still holding For $7,700 positions (10% of my portfolio) - booked half profits @ $9250 This leaves me...

In the last risk management chapter I explained to you the importance of the 1% rule. You should understand by now that if your account size is $10,000, you should only risk $100 per trade according to the 1% rule. The 1% rule leads us to the next question - "How do I calculate the position size so every trade is risking exactly $100?" ~~~~~~~~~~~~~~~~~ What...

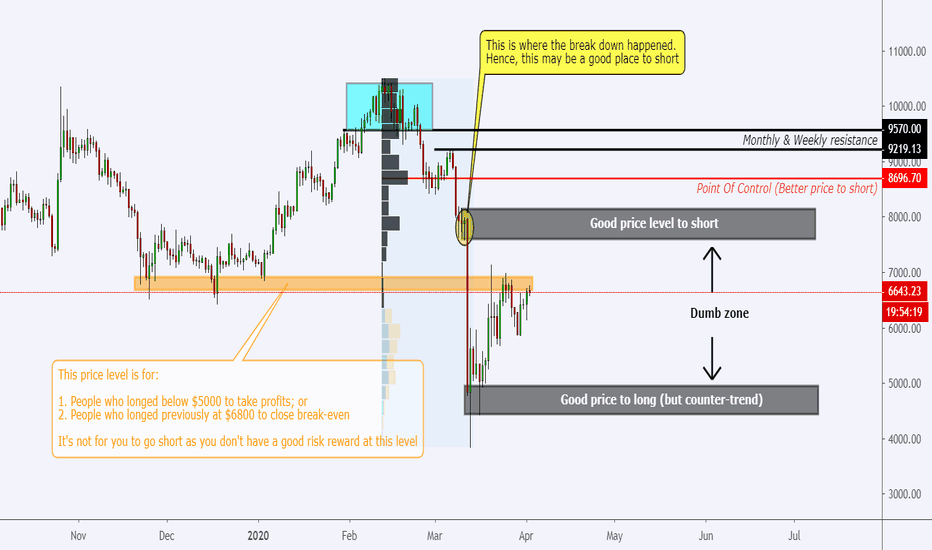

On the 2nd of April when I posted the dumb zone idea (chart below), many people thought that I was stupid to have a $2500 price range as a dumb zone. Can you now see why it is better not to trade the dumb zone? If you have been following me for a while, you know that I only care about the price actions around key structures as these structures give the best win...

Have you been in a situation where you followed a prediction that went perfectly but you still lost money? Or, have you seen a similar chart like the above and decide to sell when the price breaks down the support and soon realized you short right at the bottom of the move? If you are a new trader, I am sure you have been in these situations before and struggled...

In the previous BTC update I showed you a bearish curve appeared on the 1hr timeframe where we can open a short trade on the pullback. After the first take-profit was hit, the market decided to do a fakeout and price returned to sideways action. Now, on the daily timeframe, a Lower-High (LH) has appeared showing the market may be currently in consolidation. Will...

Although price never reach my interesting shorting area on the daily timeframe ($7,500 - $7,900), the current price action has created a bearish curve on the 1hr timeframe indicating a possible short-term trend reversal. This possible trend reversal is based on the 1hr timeframe (lower timeframe) meaning you need to lower your target expectations, with a smaller...

In my last idea I told you $6,800 was not a good level to short due to it’s within the dumb zone – a zone that has no significant support/resistance, low volatility and with a poor risk reward ratio. Not surprisingly, price has broken above the minor resistance @ $6,800 and is now moving towards the 2x interesting shorting areas I mentioned previously: 1. $7,500...

11% profits were added to my investment portfolio after my last idea. Currently, I have roughly 39% long positions entered around $7,000, 12% at $7,700 and 49% in fiat. In my recent idea, I told you $6,800 - $7,000 was my target for taking profits (orange box) due to the weekly resistance level. The resistance level was due to: Traders who longed below...

This is a quick update on my long term positions. In my previous update (here) I told you I bought some long term positions between $5,000 - $5,500 and that I was going to take profits at around $6,800 so that I can free up some of my capitals. Above chart shows how my positions were entered (spread across $5,000 - $5,500). Being the consolidation was too...

Yesterday a member in the group told me that I was wrong and I shouldn't have told people to buy ETH at $220. I wasn't angry because I have started to get used to these sort of comments after two years of publishing my analysis for free. As many of you know, I have published many successful trades since 2018. They are not just 1% - 5% gains, but 30% - 300%...

Few days ago I gave you an update in the group that if you were long, $9200 & $9400 are the price level to possibly secure your profits. But if you were to open short, $9400-$9500 is the best price to short. Unfortunately the short opportunity was missed but it's fine as we didn't lose any money. You don't need to catch every market move. The above chart is...