Longing DASH at 129.11, 15 minute break of structure and waiting on retracement now.

Shorted DASH last night, price has crawled higher tapping into 131.83 level and starting to see bearish rejection in this zone. Shorts below 126.90, potential scale in, overall targets 114.45 and 106.67.

Bought Oil, price has pulled back to Daily 50 MA with a strong push from buyers creating a morning star on Daily timeframe, structure has been broken on 4HR timeframe, price is trading above 50MA on Daily, 4HR, and 1HR timeframes. Nice engulfing candle formed on 1HR TF right on the 50 MA acting as a dynamic support level.

Shorting EURCHF again New York open, price pushed up during Asian session and began its decent during London session with a nice 4HR engulfing candle at 50MA on 4HR TF. Price tapped into an imbalance area at 1.0316 and quickly rejected with strong selling pressure from the bears. Momentum looks to be building on sellers side. Price needs to push through support at...

Sold EURCHF, higher timeframe bearish trend with price rejecting the 50MA on Daily TF. Strong impulse down on 1HR with correction and 1HR engulfing candle formed.

Short on NZD/USD, hitting resistance zone, Daily and Weekly Downtrend momentum

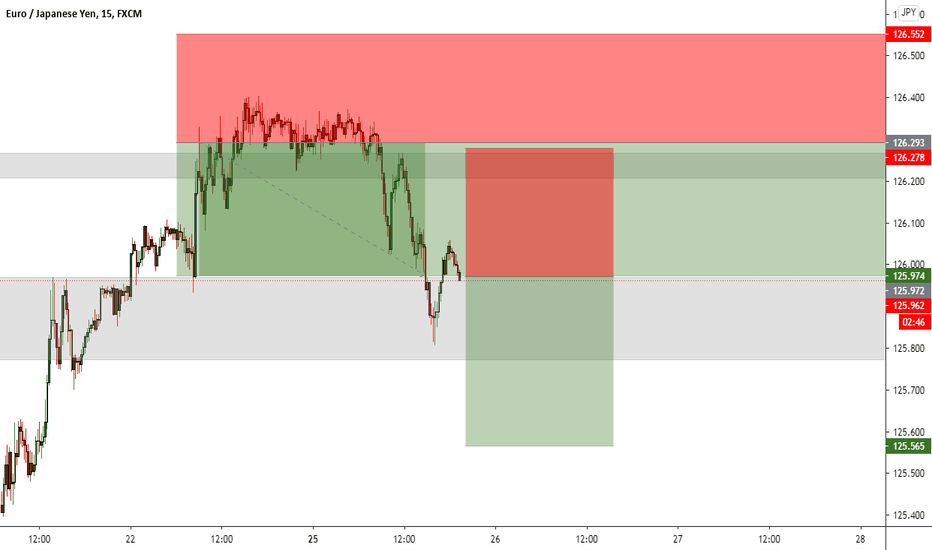

Selling EJ on a pullback with a strong daily/weekly downward momentum

Sell AUD/NZD, small position here and move SL to BE after 25 pips, then let it ride down

Not taking this trade but a nice sell opportunity here.

Nice sell opportunity, we bought the retracement off the 4hr sell, seller momentum still in play. Looking for a rejection here and a sell down to the previous support level and beyond.