Tgore_

The Dow Jones Industrial Average is currently down 55 points (-0.16%) . When price approaches the 33540 level, we will see consolidation between buyers and sellers in the market. If buyers can hold that price, expect to see the DIJA push to 33950 until CPI data is released on Wednesday, May 10th 2023. Earnings Reports and CPI data will inevitably direct...

Disney was down trending on the 4H timeframe from Nov. 1st to Nov. 9th 22. After a pullback to the .618 fib level, price from the stock began to consolidate and price condensed. Dec 6th price broke out of the consolidation and retested on Dec 13th. The Price Action of Disney stock is currently creating a Bearish Pennant . If price can break $92 and reject...

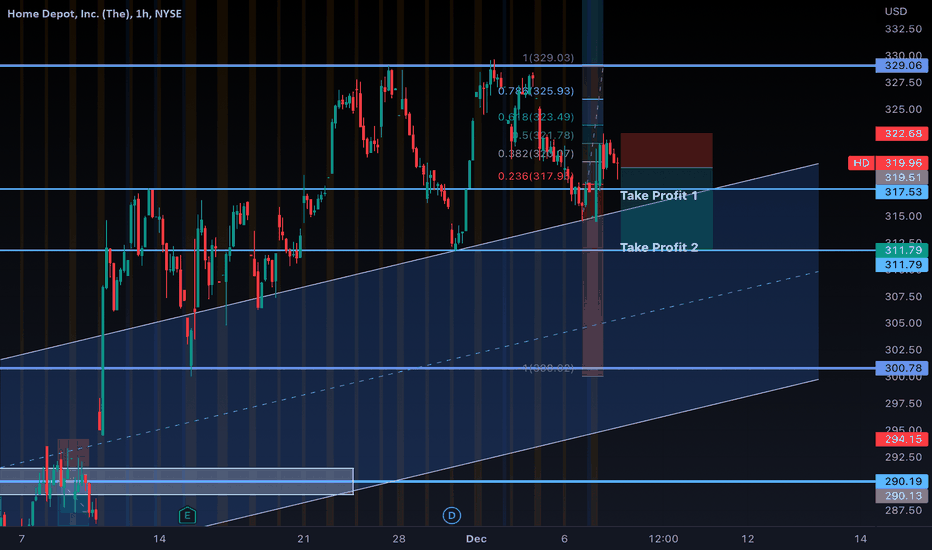

Home Depot is currently sitting at $319.96 $319.50 is the first possible entry point for a short. However, a break of $317 will be a greater confirmation that the stock will push lower.

Uber is currently creating a Bullish Flag Price Action Formation. If Uber exceeds and/or meets expectations, there is a good chance of bullish momentum after the $28.29 price point is broken.

As we all know last week finished pretty terribly for the Dow, S&P500, and overall stock market. Jerome Powell has warned investors of more rising interest rates so investor sentiment is definitely leaning toward the bearish side. With all that being said, I truly believe we’ll head lower going into Monday until we hit that potential price reversal zone. That...

S&P500 4h The large red box located in the middle of the screen contains an Elliott Wave. An Elliott Wave is a price pattern that consists of a rise, fall, and additional rise of price in the market. Earlier this week I called a trade, which was actually the fall of said Elliott Wave. Now that price has reached a higher higher after creating two similar bullish...

The Russia/Ukraine conflict has already begun to short the top U.S. stock market indexes. US30, the Dow, finished negatively for the second week in a row last week and investors continue to be on edge whether the financial markets are a safe place for their investments. Price action for the Dow is indicating this bear market will continue after creating a higher...

USOil is currently creating a Bullish Flag on the 1H and 4H. This is indicating bullish momentum is soon to come. Potential Targets are $96 and $104.

The Dow Jones Industrial Index, as shown in the photo provided, has been creating an Inverted Head & Shoulders Price Action Formation on the 1D Chart since Nov. 8th, 21. Today, Dec. 14, 21 the index made it's second rejection off the neckline of the formation. This means that bullish momentum will soon be flooding the market as the index reaches toward new highs....

The Dow has been extremely bullish this week after the Omicron virus new articles that began to surface last week. Timeline Price first broke out of the bearish trend on Dec. 2nd Retested that same trend on Dec. 3rd Began creating a Bullish Flag on Dec. 8th The Bullish Flag has been completed and price has just rejected the resisting trendline of the...

The Dow Jones Industrial Index has been in a downtrend since the beginning of last week (11/8/21). It has begun this week by rejecting the resisting trendline that has been formed and tested several times. Now, early Monday, until mid-week the index will be backed with bearish momentum causing the index to decline in price.

Bitcoin has been creating a Ascending Triangle Price Action Pattern since it’s peak at 67k on Oct 12th. With the addition of the Taproot update to the Bitcoin Blockchain this weekend, I believe price will not only hit 70k, but will continue to push upward from bullish momentum/investor confidence.

The Dow Jones Index is currently creating a bullish flag price action formation. This is indicating that bullish momentum will enter the market before and after a slight pullback. We should continue to see the index break 35000 again as well as push toward the 35200 price range before the end of the week.

US30 took a steep decline today with bond yields rising. However, the index is significantly overpriced and will pullback regardless of another bear run going into Wednesday morning. In addition, the 4 EMA is crossing the 50 EMA as we speak(indicating bullish momentum

US30 took a very steep fall today. However, if you look back to the week of July 16th, 2021(a week of another steep fall for the Dow), price recovered at a very similar point. The neckline at 34143 of the head and shoulders was a momentary point of rejection back in July and I believe price will push off of 33970 after bulls come back into the market. Pullback @...

A lot of bearish news is beginning to surface this morning. However, the market is still very underpriced/undervalued from the September decline. Price is currently at 34787, but 34739 is a very strong support in the market. It is also a Take Profit point from an idea that was posted yesterday.

The Dow is severely underpriced after the multiple day sell-off that has recently occurred. As we go into midweek, we should see buyers into the market for buying opportunities. TRADE #31- US30 BUY Entry: 34637 TP1: 34645 TP2: 34700 TP3: 34739 TP4: 34830 (Swing) TP5: 34897 (Swing) SL: 34611 Risk/Reward Ratio: 10.08 Enter this trade at your OWN risk! I am not...