TheDane

PlusI believe we have seen the bottom of TSLA. And we are not going below 222 again. TSLA has been through some difficult corrections, which can be read in many different ways. After spending some time studying the 3-waves and 5-waves since the top in November 21, I believe I have a strong case in my reading, and I believe Elon is going to make TSLA a bullish stock...

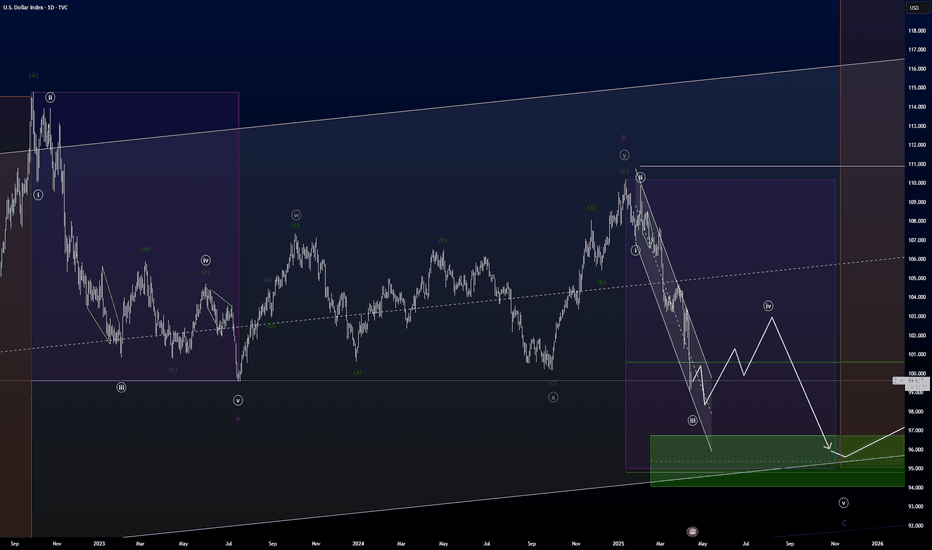

DXY is right now in what I believe to be a 4th wave correction, which has turned into a wxy, and probably also will turn into a WXYXZ. It has plenty of room to develop. Since 4th wave corrections has a tendency to enter the area of the 4th wave of previous impulse, it will most likely go up to the area of the green rectangle above. This will be between 103.2 -...

Previously I posted a reading where I said gold was to go a bit down before is went up. But Gold didn't go down, and went straight up. But it did go up right :D Right now I strongly believe gold is in a wxy correction. And I think will finish the y-wave i the green box area somewhere between 3,147 and 3,077, which is the 100-123% fib-level of the w-wave. The...

BTC is in good rally these days, but my believe is that it is still in a correction. I am not 100% confident in wavecount, but I am confident that BTC is not done correcting until it has gone down to somewhere between 62.500 - 52.500. If the rally BTC is currently in, I believe we are seeing a flat, and I will correct my count accordingly.. But right now I'm...

BNB has been in a correction since the start of December '24. And as time went by, it developed into an combo correction. I believe we are at the end of the purple B-wave of the green (Y) wave. We are right now finithing the white ((c)) wave of purple B wave, so we are going to see a small wave up until around the 630-640 level. And after this the purple C wave...

Gold is right now in a very strong extended 5th wave. It has finished what I believe to be the third wave of that 5th wave, so now we are entering the 4th wave of the 5th wave. I believe it will be a very shallow 4th wave, and considering the speed of things, it will not retrace further than around the 3,000 level. and here on after continue up with the 5th...

Attention: Prices are read on the futures chart, so they might be different if you are reading on cash charts. But directions and realtionships, should be very similar. I believe S&P is in a very volatile correction and it is a bit hard to read. To me it looks like price completed a green (a) of the grey ((y)) wave with a failed 5th and started the green (b)...

I kept the colored rectangels from my weekly analysis, to keep the focus and knowledge where we are on the chart. DXY is doing a long A-B-C before it's is going into the last impulse og the C of Y of x of the larger degree. It's quite a lot of corrections to manage, but if you swipe from the daily to the weekly timeframe, it makes good sense. For me at least...

I decided to give a go at the Dollar Index given the circumstances around the world. And to be honest, I tried to put on the positive glasses. I believe the dollar has been in a complex correction since the mid 80's. Starting out with a large dump in '85 with the a-wave, the correction slowed down and only grew more and more complex. Thought about current wave: ...

I believe XAG has finished the blue ((c)) of green (iv) with an ending diagonal, and now doing the first 1-2 of the green (v) wave of gray ((c)). The price might do a very small retrace to 31.12 before starting a 3rd wave down. I believe the green (v) is going to the green box area at 28.15 - 27.40 area. But I actually have a weekly trendline lower down, which...

This is the read that makes most sense to me. And I have zoomed all the way into 15m, for you to be able to see my thoughts around it all. For that wave down from April 2nd to April 7th to make any sense to me, I have labeled it as W-X-Y to complete (A). At first I had labeled it as a diagonal, but then price should not have retraced as much as it has since April...

I had to correct my reading of AUDUSD, and taking another look at it, it also makes more sense now. It had a little more correction to finish, and I believe it has now finished the correction it has been in since '21, and here finished what I call the Z wave. Now I'm waiting for the pullback into the green box in the area of 0.60588 - 0.60244 where it will finish...

The read I like most now, is we had a Failed 5th on my Elliott Count, and we have now started a new Impulse. Currently we are finishing the 1st wave, so I will wait for price to come back into that green box, and then I will look for buys.