Morning Buddy, Today I hope to see 2 things that I have put on my Journal, 1 : Nas is within a daily FVG which seems weak to hold, but enough to create a manipulative retracement, either into the highlighted zone, which is a weekly bullish candle. 2 : The gap gets slowly taken, increasing FOMO trading and then retraces leaving $ lows, should this happen I expect...

This is what I wanted to talk about today, the gap might really mess with our heads if we are not careful enough. Please don't take the motivation offensive, I am just directing the message to people who are as stuck as I am. Happy Trading.

Plan ahead always, never compromise your plan because of your feelings, use your mind more, build a new channel of dopamine from your disciplined self, we cant be bad at everything, at least let us dominate them here.

Today instead of in depth analysis I am choosing to have you help me, I have drained my mind fuel a lot last week

Is this setup justified, or is it just a seen Gap that SMT default settings had us spot?

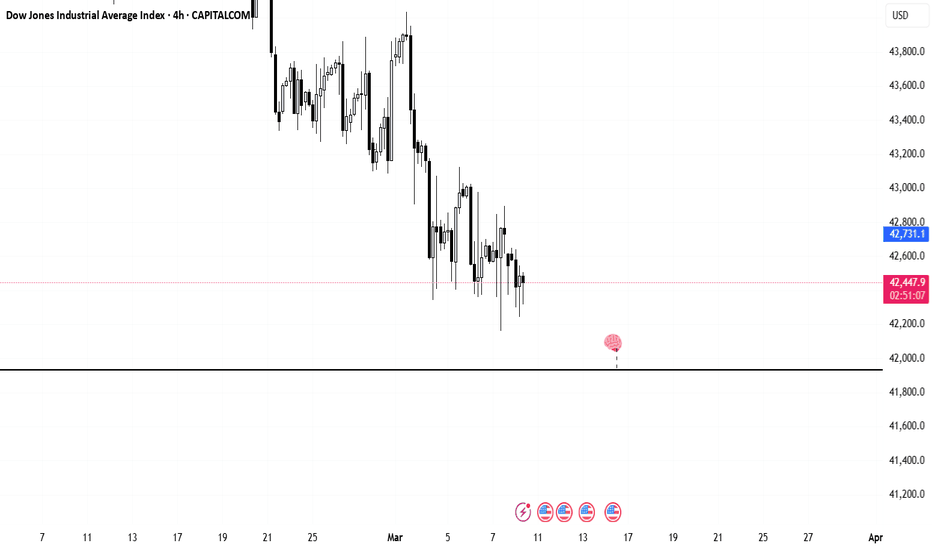

The equal lows from the 4H price action had me thinking. If we look at it from a range perspective, there is still a wide gap left from the 4H change of character, ever since it took the last low of the lower lows, it never gave a single percent to the area's retracement. This might be a daily timeframe FOMO trap. whereby recovery of the market from sells to buys...

Here is a risky scalp, should 15m show sell rejection and 3min show BOS, it is some gambling setup spotted.

After the news hyped Nas100 I am intending to see a manipulative buy that will run back to sell and stay with the narrative, it has been some time since we analyzed for retracements that are to happen in this market. The long sell is not showing some bullish challenge that might end it anytime this week. That is just what I see. In terms of entry, I am using this...

After three weekly bearish candles, there seems to be some dope rejections from this low, price action promises that there will be a stop here or a bit further manipulative sell into the range of the zone, the closing of the week might direct us into understanding if next week carries some weekly retracement buys or if we still will be stuck on the zone

I hold for a swing strategy we are Practicing everyday to trade, or I chicken out and close a 1:30 taking a about 1:4? Terrifying neh

The lines chart at times help me clear out the noise, yes the highs and the lows are important but the close constitutes candle stick communication, so with so much consolidation especially when the spread widens and the market closes, there can be a lot of destruction

In at least a period of 3 Hours I will be dropping a sneak peek into the pairs I am watching today, commentating on what I see, be here with me as we comfort each other through the fear of trading the markets

The displacement that occurred here is beautifully lining up the buy potential after a take of this low, No less than 1 Hour overviews will be considered for this one because the market is still on a respected sell movement

Is this the day that it create a target, {a} A gap that we will return to in a high volume push after tapping on this daily low, should it fail to break it, or when broken, return to it to confirm a further sell? Lets Wait And See...Happy Trading!!!

There is always two sides, a probability and a possibility, supplementing the idea we had mid-day that there might still be some sells on the table, this is how, should a sell pattern occur, we would trade it. Otherwise we would just look at the charts continue high, "Hopelessly"

This is really my thought and i am willing to forward test and wait to see the results unfold. Believe what you see from what you have learnt. Never go against what you always practice if it is positive(especially if it has the probability of making you money)

This is what I see, for now i am not willing to boil down and find some sell, I just want to patiently wait and see if our analysis is correct, rushed sells when we are in the mids, might hurt our ten $ accounts