Gold came just under the zone which acts as watershed between uptrend and downtrend, defined by down trendline and purple moving average. If it manages to overcome it next week, recent high will most probably be exceeded, question is only by how much

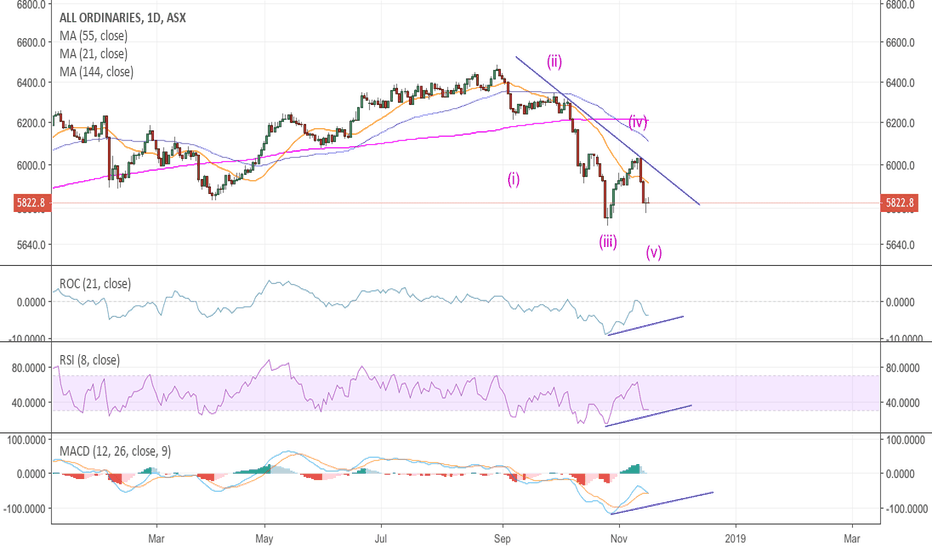

Australian stocks seem do be completing a perfect 5 wave down impulse. It needs to brake 5825 to confirm, watch for momentum divergence when it does.

Prices did not hold the breakout level, could this be just a B wave, with C to come. 1213.70 based on GCdec18 futures is key.

Gold is breaking out of congestion just under 1215. 1240 seems like the minimum target for the move, barring a development of a bull trap, that should be monitored closely.

Gols is banging its head against 1215 level, building a congestion right beneath. If it succeeds to overcome the barrier, could be a sizeable move up.

Impulse - correction in gold, good opportunity to go long

Seems that EURUSD made a 5 wave up move, now being corrected. Nice place to take a shot at the upside.

Gold did move lower after a corrective ABC up, but it seems that an impulse failed to form. Instead we could have a lower degree ABC down right into the up trend line, with more upside potential.

Same pattern, most obvious in CAC. Prices should move to a=c, just above 0.618 retracement.

Same count as DAX, confirming one another. C wave should carry prices towards a=c, and 0.618 retracement.

This is, realistically, the most likely scenario for DAX, in m y opinion at least. b wave, difficult (yet!) to count as an impulse, closed the gap, and prices moved higher.

MDAX seems to have completed an ABC wave up. Momentum is falling, first leg down is probably in. Short next rally on smaller time frame.

It seems like a flat correction in EURAUD, needs to be confirmed, but "early bird..." It should work immediately, or be quickly abandoned. The point is that risk is relatively low at this point, but if the analysis is correct, reward can be huge, as target is 1.64+

Overlapping waves, high volatility and traces of momentum divergence, plus fairly oversold condition of the stock market - could be a nice opportunity to ride the relief rally. I wouldn't bet on new highs though.

After some shuffling, this count emerged as a possibility, but the presumed wave (e) of B circled is not over yet. It seems to me that 1.47 and probably even 1.46 need to be broken before upside, but this is the one to watch, as there is plenty of room to the upside if the count is correct.

NZDUSD is boiling under the trend line, momentun diverging for some time. Note seven waves down, the move is possibly exhausted. I would not call it a sure thing though, as there is no evidence whatsoever that the trend of higher degree is also up. It would also mean that the rally could be weak and short. But still, a pop up seems likely.

On the surface yields and stocks are moving together, but recent carnage in stocks barely produced a yawn in the bond world. In recent history yields would have been plunging together with stocks, but this time there is no true flight to safety whatsoever (same story as gold in a way - but bonds where much more popular safe heaven in recent years then gold). I...

IF (and it is still a big "if") gold has resumed its downtrend, this could be a possible interpretation of the move from the top it made few days ago. It is now showing very tight inverse relationship with SPX, so a relief rally would probably facilitate the decline. Anyway, it WAS a good shorting opportunity at the time of my first post, and from a low risk...