The market is in the primary long expansion phase in a H4/H1 countertrend. There was an H1 break above the last breakdown (lower green level), so another wave up triggers a long trade for me. The target zone is the H1 161.8 in line with the daily 123.6 very close to the daily ATR high. A trigger candle I'm looking for is a Marubozu-like candle at the trigger...

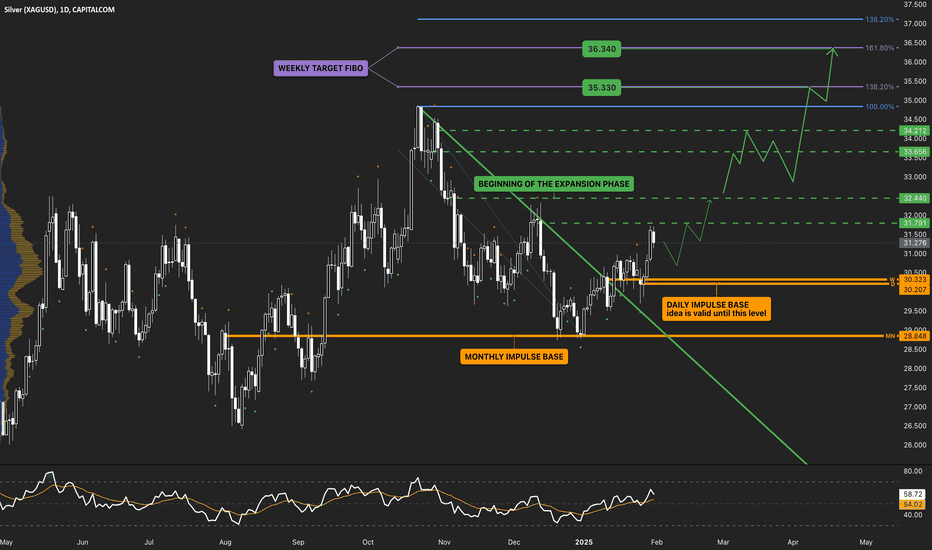

The trend has just become bullish across the monthly, weekly, and daily timeframes, however, the market is still in an accumulation phase. Each dashed level represents an untested breakdown that requires attention from the buyers. If the market transitions into the expansion phase, the Fibonacci target levels on the weekly and daily timeframes become valid...

The weekly trend is bearish, and the daily has broken the long structure. The market is in a minor short trend, that may speed up with a significant break below the lowest clean (not yet tested) daily and H4 breakout zone (red dashed). From there, the H4 and the daily target fibo levels are valid that align well with a daily / H4 breakout zone. Key...

Key Chart (H4) The daily structure was broken 2 days ago, but the buyers immediately took control, and pushed the price back above the daily long impulse base. This correction on H4 created a triangle that gives traders a chance to trade both directions. The dashes levels are clean breakdowns and breakouts (some on lower timeframes) that may stop the price,...

The market is long on every timeframe, and broke the last clean H1 breakdown, so the weekly target fibo 138.2 level is valid again. KEEP IT SIMPLE!🏄🏼♂️ ——— Orange lines represent impulse bases on major timeframes, signaling the direction and validity of the prevailing trend by acting as key levels where significant momentum originated. Level colors: Daily...

Key Chart (H4) The weekly is mixed, but the daily is bullish, and there was only one H4 breakdown that kept the market off from the primary long trend’s expansion phase. Targets are the H4, daily and weekly fibo levels on the chart. Short only below the red level. Key Fundamentals Summary Bitcoin has recently experienced a notable price increase,...

The market is bullish on every timeframe, and there is a countertrend break at the daily target fibo 100 (daily peak). The next targets are the daily target fibo 138.2-161.8 and the weekly target fibo 200. The trigger for this idea is a significant break above the highest CLEAN M15 breakdown. The idea is valid until the Daily impulse base breaks. ——— Orange...

The correction is still valid, and this is a risky bet, but if the price breaks below this M15 breakout significantly, the market my revisit the recent valley. ——— Orange lines represent impulse bases on major timeframes, signaling the direction and validity of the prevailing trend by acting as key levels where significant momentum originated. Level colors:...

The market has reached the daily target fibo 200 and broke the H4 structure by breaking below the H4 impulse base. If H4 makes a new low before making a new high, the countertrend becomes valid. ——— Orange lines represent impulse bases on major timeframes, signaling the direction and validity of the prevailing trend by acting as key levels where significant...

The market is at the countertrend break. There is a clean (not tested) H4 breakdown close to the highest daily peak that needs attention and position management, but above that, the target fibo levels are valid targets. ——— Orange lines represent impulse bases on major timeframes, signaling the direction and validity of the prevailing trend by acting as key...

There are times when it's better to stay out of the market. But we always have to prepare for the next trade. The primary scenario is long, since this is the primary trend, and the daily and the H4 is waving north. The recent H4 breakdown is in line with both countertrend lines (daily and H4) , so upon a significant break above the long trigger (green), the H4...

The countertrend is still valid, and the price is at the countertrend line zone (daily and H4). If the long trigger, that is a H4 breakdown, is crossed up significantly on H4, the target zone is the target fibo levels. ——— Orange lines represent impulse bases on major timeframes, signaling the direction and validity of the prevailing trend by acting as key...

WHAT DO YOU THINK ABOUT BITCOIN? The countertrend of the last corrective impulse is valid until the price closes below H4 impulse base. Within this minor long trend, the market may test the correction fibo 50, but if it's broken, the correction of the primary long trend may go for a test of the correction fibo 50. Of course, the short side offers a much better...

The market is at the countertrend break, daily fibo levels are the targets. KEEP IT SIMPLE! ——— Orange lines represent impulse bases on major timeframes, signaling the direction and validity of the prevailing trend by acting as key levels where significant momentum originated. Level colors: Daily - blue Weekly - purple Monthly - magenta H4 - aqua Long...

The market has managed to stay above the monthly impulse base (orange), and the weekly/daily has turned up. The daily has reached the target fibo 138.2 with an impulse, therefore, I expect a countertrend here on H4/H1, and I want to go long after that countertrend breaks. The target is the monthly breakdown and the daily target fibo 200. ——— EXPLAINING COLORS...

This week's close is below a significant level. First, it crossed below a weekly breakout, second, below the weekly target fibo 61.8. Any up move until the weekly impulse base is just a correction of the last weekly wave down. The next weekly levels are all targets, but 0.91100 is, in my opinion, keeps getting more chance to be reached. WHAT DO YOU...

The market is in a neutral zone. The trend is still long on the weekly, so a break above the long trigger (green), that is the previous daily breakdown, will invite more buyers, and the long expansion phase may kick in. If today it closes significantly below the weekly impulse base, the first targets are the daily and the weekly support levels. In my opinion,...

The trend is long on the weekly, the daily, and the H4, and H4 seems to close above the long trigger line (green), that is the last clean H4 breakdown. If this happens, the daily target fibo 138.2 in line with a daily breakdown is the target. ——— Orange lines represent impulse bases on major timeframes, signaling the direction and validity of the prevailing...