TheMoney_Association

Essential🚨 Bitcoin bullishness might be more than hype… It could be a signal that investors are protecting assets inside liquidity pools, anticipating an interest rate cut soon. 💰

SP:SPX Update: Rumors of Powell possibly resigning as Fed Chair have created uncertainty among buyers. But if inflation stays low even with tariffs we might see longer holds. If Powell does step down, markets could actually rally on hopes of upcoming rate cuts. 📉📈 Now we wait for the inflation report…

NASDAQ:AMD traders 👀 Buyers stepping in around $137, while sellers target $160. With Q2 earnings coming up, AI data center growth + tariff pressures could drive a surprise. Smart money might be positioning before the numbers drop.

✅ NASDAQ:MSFT trading up to $500/share If investors are willing to pay that, it usually reflects: Strong earnings growth and outlook Confidence in expansion into high-demand sectors (AI, cloud, cybersecurity) The sense that Microsoft has durable “moats” meaning customers and other systems are increasingly dependent on their software and infrastructure

NASDAQ:AMD buyers are stepping in around $150/share As tech continues to expand, investors are leaning toward high-quality plays and NASDAQ:AMD is positioned as a leader in next-gen semiconductors and AI infrastructure. Momentum could build from here if demand holds strong.

NYSE:HIMS is hovering around $45, but demand is drying up. Buyers seem hesitant at these levels after the hype from the Novo Nordisk breakdown faded. Without new momentum or a catalyst, we might see a correction or sideways action until confidence returns.

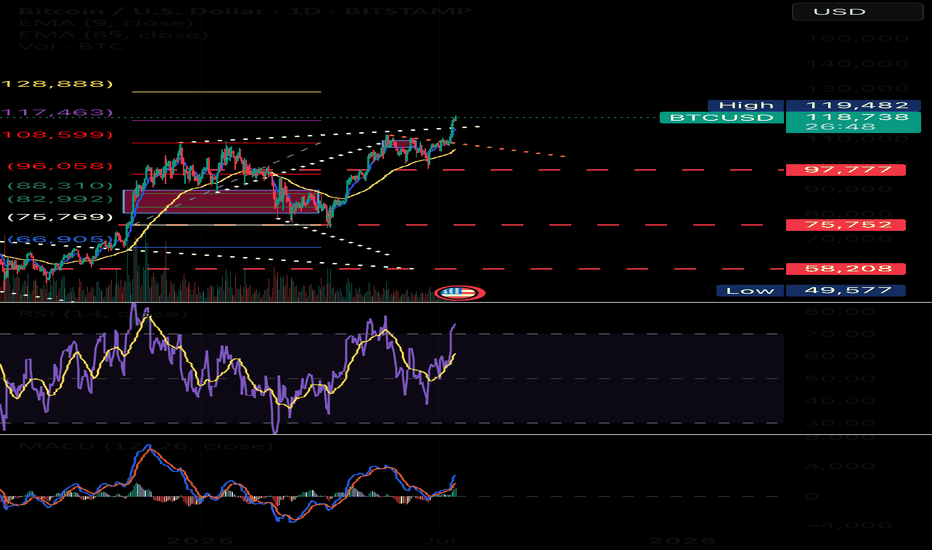

CRYPTOCAP:BTC is showing strength as uncertainty grows. Investors are searching for ways to protect capital and generate yield and crypto liquidity pools are becoming the go-to instrument. With buyers stepping in above $105K, the momentum could push prices to new highs, drawing more capital into the ecosystem.

As uncertainty around war escalates, capital looks for liquid, borderless, and passive alternatives. That’s where CRYPTOCAP:ETH steps in. Liquidity pools offer passive yield, even when traditional markets are shaky. In chaos, Ethereum becomes cashflow tech.

After the Iran strike, don’t be surprised if the dollar surges. Traders want safety. Capital flies back home. TVC:DXY might rally as global money seeks shelter. Safe haven season is back. #Macro #Geopolitics #USD #Iran #DXY #DollarDemand

BBAI is a high-growth, high-risk stock in the AI & defense-tech sector. The company is still unprofitable, with recent earnings showing wider-than-expected losses and cautious guidance. That said, significant volatility and key technical breakouts could present trading opportunities. It may appeal to investors looking for speculative plays tied to defense...

As the Vietnamese Dong weakens against the Dollar, this could benefit $NKE. Cheaper production costs in Vietnam mean stronger margins, giving Nike room to stay competitive and stimulate the market while maintaining profitability. 📉💸👟

As stablecoins gain real-world adoption, CRYPTOCAP:ETH demand might explode. Why? Most stablecoins are backed or run on Ethereum. People can spend stablecoins while keeping ETH locked not sold. This creates real utility for ETH… and tightens its supply. #Ethereum #ETH #Stablecoins #DeFi #Crypto

With wars intensifying Israel vs Iran, Ukraine vs Russia global tension is rising fast. 🌍⚠️ In times like this, high-quality defense equipment becomes a top priority for nations. And guess what? Silver is a key component in military tech from drones and missiles to satellites and radar systems. That’s why silver might be one of the smartest assets to diversify...

As tensions rise in the Middle East, the dollar remains a safe haven. We could see a temporary bullish run on the dollar as capital seeks safety. But for me, Bitcoin was the first signal that smart money is shifting into alternative assets like Gold, Silver, and beyond. Stay alert. The market speaks before the news does.

🛢️ Oil is caught in an unbalanced price zone due to rising global tensions. Prices have spiked and with that, inflation risks are back on the table. Now here's the play I see forming: 📌 The Fed might choose not to cut interest rates as a way to cool inflation without printing more money. 📌 This also puts pressure on China to act since rising oil prices hurt...

📉 Bitcoin price might be showing weakness… but it’s deeper than that. Uncertainty in the global market, including the ongoing Iran-Israel conflict, is creating pressure on risk assets like BTC. Investors are shifting capital, signaling fear and caution. This could also be a clue that interest rates may not be cut soon, keeping financial conditions tight and...

Bitcoin is showing strong momentum to keep moving up. 📊 But for it to truly explode, we need to see inflation spike past 3%. 🔥 Why? Because Bitcoin thrives in high-inflation environments it’s the hedge, the leverage, and the escape route. #Bitcoin #Crypto #InflationHedge #BTC #Macroeconomics #TradingSignals

As global tensions and war intensify, silver becomes more than just a safe-haven asset it’s a strategic resource. 💥 Silver plays a key role in military tech, from drones to advanced weapons systems. 📈 Holding silver isn’t just smart… it’s a hedge against geopolitical instability. #Silver #Geopolitics #DefenseStocks #SafeHavenAssets #MilitaryTech #Commodities